hankyoreh

Links to other country sites 다른 나라 사이트 링크

Real estate assets comprise majority of assets of wealthy S. Koreans

The gap between real estate and financial assets among South Korea’s wealthy grew wider last year as apartment prices rose and stock prices fell. With real estate accounting for the three investment areas rated as “most promising,” the wealthy class’ faith in real estate as a sure-fire winner appeared strong.

According to a 2019 report on South Korea’s wealthy published on Sept. 29 by the KB Financial Group’s management institute, the number of wealthy South Koreans – defined as those with financial assets amount to 1 billion won (US$836,050) or more as of late 2018 – amounted to 323,000, an increase of 13,000 (4.4%) from a year earlier. The rate of increase was the lowest in the past five years, which the institute attributed chiefly to poor stock market performance. Late last year, the KOSPI index fell by 17.3% from its 2017 level.

Nearly half of South Korea’s wealthy (145,400 people, or 45%) live in Seoul. Seven out of 10 (224,900, or 69.6%) live in the Greater Seoul area, which also includes Gyeonggi Province and Incheon. Among those living in Seoul, 46.6% reside in the “three Gangnam districts” of Gangnam, Seocho, and Songpa.

Total assets for South Korea’s wealthy fall chiefly into the categories of real estate (53.7%) and financial assets (39.9%). A small proportion is also accounted for my other assets, including membership rights and artwork. The percentage of assets in real estate has remained steady in the range of just above 50%. In contrast, the percentage of financial assets hovered in the 40–45% range for the four years through 2017 before dipping below 40% last year.

“The chief cause [of the disparity] appears to be a decline in financial assets amid a sharp rise in apartment prices in major regions and a drop in stock prices last year,” the institute explained. At the same time, the percentage of financial assets was still around twice as high for wealthy individuals than for ordinary households. According to a 2018 household financial welfare survey by Statistics Korea, total assets for ordinary South Korean households consisted of 76.6% real estate and 18.9% financial assets on average.

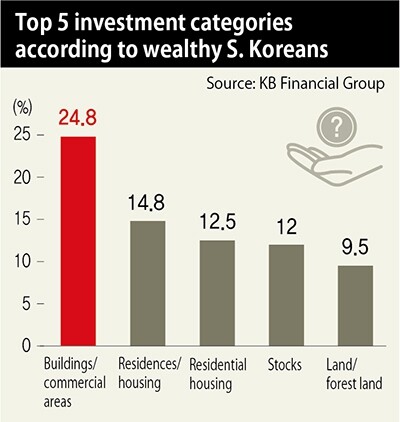

The top-ranked investment area seen by the wealthy as most promising for long-term profitability was buildings/commercial areas, followed by residences/housing (for purposes other than living) and residential housing. Stocks ranked fourth, putting them highest among financial assets. The institute explained, “This appears to be an unchanging investment attitude reflecting acquired investment experience from the past.”

Indeed, an examination of investment losses over the past three years shows the preference for real estate to be a sensible one. An estimated 40.3% of wealthy South Koreans suffered losses from investments over the past three years. While losses were relatively common in highly fluctuating categories such as stocks (55.9%) and funds (24.8%), they were rare for real estate assets such as buildings/commercial areas (3.7%), residences/housing (2.5%), and residential housing (1.2%). The report explained that this “appears to stem from the sustained boom in real estate markets for major areas since 2014.”

Published for a ninth year in 2019, the institute’s report on South Korea’s wealthy was based on the findings of surveys conducted with 400 people owning financial assets of one billion won or more in order to determine the current situation for wealthy South Koreans and their lifestyle and investment patterns.

Please direct Park Su-ji, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

Most viewed articles

- 1[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 2In rejecting statute of limitations defense in massacre case, Korean court faces up to Vietnam War a

- 3Historic court ruling recognizes Korean state culpability for massacre in Vietnam

- 4“Those souls can rest now”: Vietnam massacre survivor reacts to Korean court win

- 5Months and months of overdue wages are pushing migrant workers in Korea into debt

- 6[Editorial] Verdict on Korea’s massacre in Vietnam a first step in atonement

- 71 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 8Ruling on Korean atrocity in Vietnam comes 23 years after Hankyoreh 21’s exposé

- 9[Interview] Continuing the fight for victims of civilian massacres during Vietnam War

- 10Korea’s atrocities in Vietnam, in the words of those who saw and survived them