hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung’s market cap exceeded by that of Taiwan’s TSMC

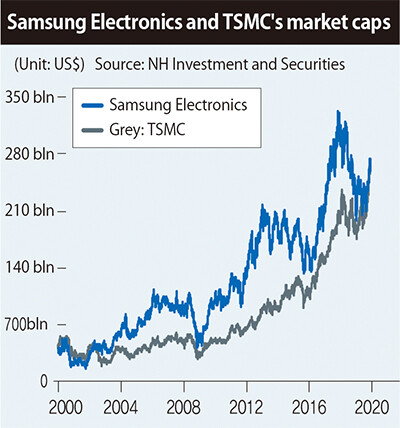

Samsung Electronics’ market capitalization was surpassed for the first time in 17 years by Taiwan’s TSMC. Experts attributed the development to differences in market conditions for memory and non-memory semiconductors.

On Nov. 27, TSMC recorded a market cap of US$279.1 billion on the New York Stock Exchange, putting it ahead of Samsung Electronics’ US$264.7 billion.

“The market caps have switched places since Nov. 20, which is the first time that’s happened since 2002,” said Noh Dong-gil, an analyst at NH Investment and Securities.

TSMC’s share prices have risen by 46% this year, reaching a record high and surpassing Samsung Electronics’ growth rate of 35%. Some observers argue that Samsung Electronics still has the higher market cap when preferred shares (US$29.5 billion) are factored in. But while shares of a different nature, such as voting rights and dividends, add to market capitalization -- as with Google or Berkshire Hathaway -- preferred shares are typically left out.

US-China trade war in Taiwan’s favorIndustry observers attributed the market cap reversal as reflecting global investors’ preference for non-memory shares, where demand has been rising faster than for memory. Benefiting from the rise in non-memory demand as the top-ranked foundry business, TMSC is recording the highest sales since its foundation. US-China trade frictions have also worked in Taiwan’s favor as global businesses have relocated their production bases to Taiwan amid high tariffs on IT products in China. The current situation has been a boon for TSMC, which produces semiconductors by commission.

Share prices for the two companies, which are considered pre-eminent businesses in South Korea and Taiwan respectively, have also influenced the price index. As it happens, the two companies have nearly identical market cap percentages of around 23% on South Korea’s KOSPI index and the Taiwan Capitalization Weighted Stock Index -- one of the reasons the Taiwanese stock market has been relatively robust.

Prediction that situation will return to normal next yearExperts predicted the situation will reverse itself next year as the trade frictions ease up and the memory situation improves, drawing more focus back to Samsung Electronics. Indeed, Samsung Electronics holds an overwhelming lead in terms of overall performance, including memory. Its sales this year are predicted to be 5.6 times greater than TSMC, with operating profits 1.9 times higher.

“On the US stock market, Micron, which focuses on memory, has already been showing more stock price growth momentum than Intel,” noted Kim Young-hwan, a KB Securities analyst.

By Han Gwang-deok, finance correspondent

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

Most viewed articles

- 1New sex-ed guidelines forbid teaching about homosexuality

- 260% of young Koreans see no need to have kids after marriage

- 3[Column] Life on our Trisolaris

- 4OECD upgrades Korea’s growth forecast from 2.2% to 2.6%

- 5Presidential office warns of veto in response to opposition passing special counsel probe act

- 6Months and months of overdue wages are pushing migrant workers in Korea into debt

- 7[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 8Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 9[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 10Japan says it’s not pressuring Naver to sell Line, but Korean insiders say otherwise