hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea’s stock index expected to see rally next year

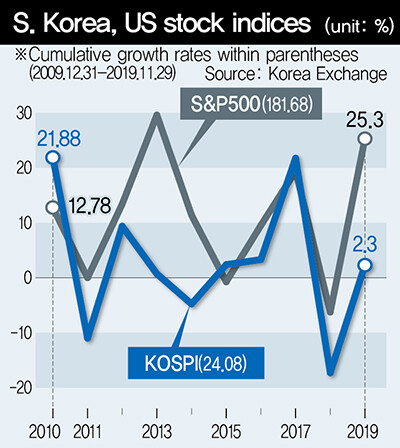

24.1% vs. 181.7%.

These are the cumulative growth rates for South Korea’s KOSPI index and the US’ S&P 500 since 2010. But where valleys are deep, mountains are also high -- and the recent focus on the South Korean stock market by the world’s major investment banks has many watching to see whether the KOSPI can achieve a major turnaround to overtake the US next year.

Securities industry reports available on Dec. 2 included the following analyses. Morgan Stanley predicted that the Korea Composite Stock Price Index (KOSPI) will see a rally next year, with a target level of 2,350. That would be more than a 12.3% increase from its value of 2091.92 on Monday. Morgan Stanley sees KOSPI’s poor performance recently as resulting from unfavorable macroeconomic conditions, such as the US-China trade dispute, and that such conditions are already reflected in the index. Morgan Stanley also upgraded its investment stance on the South Korean stock market from “market weight” to “overweight,” on the grounds that South Korean companies’ profits will rally from a 33% decrease this year to a 25% increase next year.

Goldman Sachs predicted that South Korean companies’ net profits will increase by 22% next year. The investment bank also revised its investment recommendation from “market weight” to “overweight,” arguing that semiconductor exporters will benefit from a cyclical rally in memory semiconductors.

JP Morgan was bullish on the Asian equities market next year, recommending investors to bolster their positions on South Korean stock. “The key South Korean market of IT stocks will see strong performance as product demand recovers,” the company’s Asia manager predicted.

In contrast, projections for the American stock market are tepid. According to the Wall Street Journal, eight major organizations’ average forecast for the S&P 500 level at the end of next year was 3,241, just 3.2% higher than its current level of 3,140.98. The three major indices on the New York Stock Exchange (NYSE) have repeatedly set new records this year, with the S&P rising by 25.3%.

Morgan Stanley and UBS even projected that the S&P would retreat from its current level down to 3,000. Lowered expectations were also evident in a poll of analysts published by Reuters, in which the median projection was 3,260. Morgan Stanley concluded that the US presidential election will create market uncertainty and that comparatively overvalued stock prices will be a risk factor in the American stock market.

Another question is whether the KOSPI will surpass the growth rate of the American stock market, which it has trailed for three years. Over the past decade, the KOSPI has only grown faster than the American stock market in two years: 2010 and 2015. While the KOSPI’s growth rate (21.8%) was slightly higher than the S&P 500 in 2017, it failed to keep up with the Dow Jones index (25.1%).

Investment banks believe that foreign stock acquisition will resume next year with technology stocks driving a rebound in the South Korean stock market. Morgan Stanley said “a strong won next year will help improve foreign cash flow” while describing South Korea as its second favorite emerging market.

Goldman Sachs predicted additional monetary easing because “the South Korean economy’s growth rate will rise from 1.9% this year to 2.1% next year, which is still below the potential growth rate. Higher demand for fifth generation mobile telephony and other factors will have a positive effect on a recovery in performance.”

But other analysts say that, if the American economy and stock market are seriously rattled, the KOSPI is unlikely to emerge unscathed and probably won’t rise on its own.

By Han Gwang-deok, finance correspondent

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 346% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 8Korea sees more deaths than births for 52nd consecutive month in February

- 9“Parental care contracts” increasingly common in South Korea

- 10[Interview] Dear Korean men, It’s OK to admit you’re not always strong