hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] The imbalance between chaebols and independents in S. Korea’s semiconductor industry

South Korean Minister of Trade, Industry and Energy Sung Yun-mo boarded an airplane bound for the US on Jan. 6 to visit the global chemical company DuPont. This was in response to DuPont sharing its plan to produce extreme ultraviolet (EUV) photoresists at a factory in Cheonan, South Chungcheong Province. The reason Sung hurried over to visit DuPont was because the photoresists the company intends to produce are essential for the production of semiconductors, South Korea’s top export. A As photoresists are one of the three items targeted for intensified export controls by Japan in July of last year, securing a new supply line is urgent.

The world semiconductor industry is dominated by South Korean companies such as Samsung Electronics and SK Hynix. But the substructure underneath this dominance is quite vulnerable, as the photoresist situation illustrates. South Korean makers of semiconductor materials, components, and equipment produce limited ranges of items and are weaker in core technology competitiveness compared to their overseas counterparts. With Japan’s recent export controls coming amid an increasing wake of protectionism worldwide, establishing a self-reliant material, component, and equipment ecosystem is becoming a focus of pan-governmental attention.

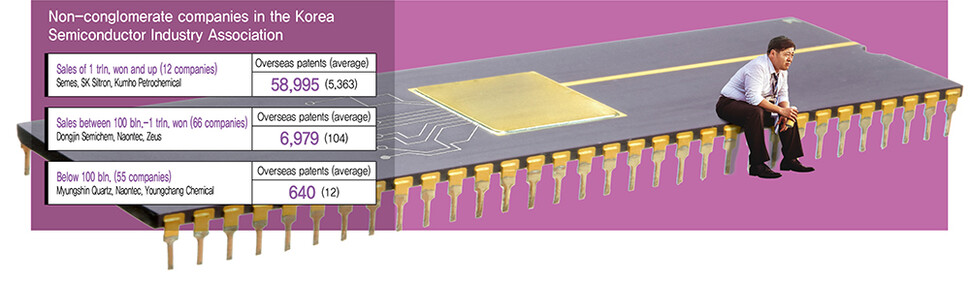

On Jan. 14, the Hankyoreh carried out an analysis of the current situation for 136 producers of semiconductor materials, components, and equipment that are registered with the Korea Semiconductor Industry Association. The data used in the analysis came from the companies’ 2018 project and audit reports. The results showed all but one of the companies that generate annual sales of more than 1 trillion won (US$861.68 billion) were either chaebol group affiliates or South Korean arms of global businesses. “Independent” companies not affiliated with chaebol groups had sales clustered predominantly in the 100-200 billion won (US$86.16-172.32 million) range -- outward evidence of a severe disparity. An analysis of overseas patent activities by the companies similarly revealed weak links in the semiconductor ecosystem. While a single chaebol group affiliate in the “1 trillion club” for sales might have over 30,000 patent applications overseas, 38 of the independent companies had zero.

The reason for this has to do with the vertically integrated ecosystem with chaebol corporations like Samsung and LG at its apex -- one that situates the independents in what amounts to a subordinate status to the chaebols. It’s a framework where the semiconductor industry’s “backbone” is unable to establish the ability to stand alone. An emergency sounded by Samsung Electronics or SK Hynix sends shock waves throughout the domestic semiconductor industry.

Park Dae-young, a research fellow with the Semiconductor Industry Structure Advancement Research Association, explained, “In many cases, South Korean memory semiconductor and display client companies sign two-year or longer monopoly contracts for core technology or are blocked from exportation outright due to leak concerns.”

“Since establishing a customer base is such an immediate priority, they agree to these kinds of subordinate transaction conditions, but as the contracts are renewed, the prospects of overseas expansion grow more distant and they end up dependent on their client company,” he continued.

The 136 companies analyzed are members of the Korea Semiconductor Industry Association. In terms of area, 27 of them focus on materials, 28 on components, and 81 on equipment. For its analysis, the Hankyoreh divided them into three groups according to the sales listed in their 2018 project and audit reports. The reason for this had to do with large differences in the characteristics of semiconductor material, component, and equipment companies depending on their sales figures A total of 12 companies (Group 1) had annual sales of over 1 trillion won; another 66 (Group 2) had sales between 100 billion and one trillion won, while 55 (group 3) had sales of less than 100 billion. The remaining three did not provide any performance data to make a determination with. While the sheer number of companies suggests a strong semiconductor industry backbone, the reality is a different story.

Non-chaebol “independents” see significantly lower sales

The companies in Group 1 consisted of chaebol group affiliates and South Korean arms of global companies like DuPont. The only “independent” not affiliated with a chaebol group was SFA, which spun off from Samsung Techwin in 1998. Group 1 included Toray Advanced Materials and Dongwoo Fine-Chem (materials) -- both South Korean branches of Japanese companies -- as well as chaebol groups and affiliates such as Hanwha (materials), Semes (equipment/materials), Samsung SDI (materials), LG Chem (materials), OCI (materials), KCC (materials), Hyosung Chemical (materials), SK Sitron (materials), Kumho Petrochemical (materials), and SFA (equipment).

Even the strongest performing independents did not pass the 1 trillion won mark for sales; most fell in either Group 2 or 3, with only seven of them recording annual sales of more than 500 billion won (US$431 billion): SoulBrain (963 billion won, or US$830.1 million ), TOP Engineering (917 billion won, or US$790.43 million), Dongjin Semichem (820 billion won, or US$706.82 million), AP Systems (714 billion won, or US$615.45 million), Wonik IPS (649 billion won, US$559.42 million), KC (526 billion won, or US$453.4 million), and Mujin Electronics (501.2 billion won, US$432.02 million).

Rounding out the top 15 independent companies in terms of sales were Zeus (453 billion won, or US$390.41 million), ENF Technology (425 billion won, or US$366.28 million), KC Tech (357 billion won, or US$306.67 million), PSK Holdings (328 billion won, or US$282.62 million), DMS (298 billion won, or US$256.77 million), EO Technics (294 billion won, or US$253.32 million), TES (287 billion won, or US$247.31 million), and STI (286 billion won, or US$246.44 million). The remaining 51 companies had sales clustered within the 100-200 billion won range -- meaning that nearly half of South Korea’s “competitive” semiconductor material, component, and equipment companies are pulling in less than 300 billion won (US$258.51 million) in annual sales. This stood in sharp contrast with the overwhelming representation of chaebol group affiliates among companies with over one trillion won in sales. Also in Group 1 were the South Korean arms of overseas companies, including Edwards Korea (788 billion won, or US$679.02 million) and ULVAC Korea (324 billion won, or US$279.21 million).

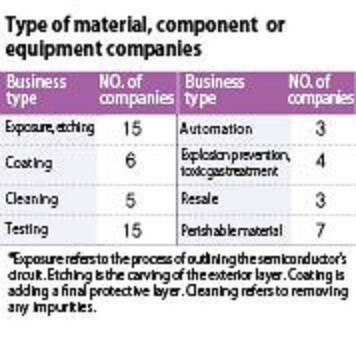

Focus on all-purpose items, strong dependence on chaebol groupsMany of the independent companies focus on producing replaceable all-purpose items. This inevitably leaves them vulnerable to bargaining or pressure to lower unit prices from commissioning companies using “cost competitiveness” as their weapon. The category of all-purpose items includes components for switching equipment on and off, along with nondurable goods such as semiconductor protection packets and silicon rings. Some of the companies simply purchase used semiconductor equipment at a low price for resale. The list also included 21 companies involved in the key semiconductor manufacturing processes of exposure, etching, and coating; 20 involved in cleaning and testing equipment; 16 involved in display panel-related equipment, and seven involved in selling toxic gas treatment, distribution automation, and explosion prevention equipment.

Independent companies showed a severe dependence on the chaebol groups for sales. Samsung Electronics, SK Hynix, Samsung Display, and LG Display accounted for a majority of their accounts. In the case of the equipment company TES, 93% of sales were to Samsung Electronics and SK Hynix. The phenomenon is particularly striking when sales are separated into exports and domestic demand. Among the 36 companies for which information could be obtained, exports exceeded domestic demand for just 11 of them. Only nine companies -- including IO Technics, LIS, and Semisysco -- reported supplies to overseas companies such as China’s BOE and UTEC. Even those cases were limited to components and equipment related to semiconductors and flat panel displays.

Many non-chaebol companies with zero overseas patent applicationsThe reliance on domestic corporations was evident in patent numbers. The Hankyoreh asked the Korea Patent Attorneys Association (KPAA) to examine the current status of domestic and overseas patent applications by South Korean semiconductor-related businesses according to the patent statistics system. The results showed four of the top five companies with over 1,000 overseas patent applications to be either South Korean branches of overseas companies (Dongwoo Fine Chem and an affiliate of Japan’s Sumitomo Chemical) or affiliates of the Samsung Group (Semes and Samsung SDI) or LG Group (LG Chem).

Among independents, only Dongjin Semichem had applied for over 1,000 overseas patents. Fully 30 of the independent material, component, and equipment companies had applied for no overseas patents at all -- representing 28% of all companies analyzed. While low overseas patent application numbers for independents is partially due to lagging technological capabilities, the dominance of domestic chaebol corporations among their customer base also suggests they have little motivation to seek overseas patents.

“In a patent market where the principle of territoriality prevails, the lack of overseas patents signifies either that they have essential no intention of expanding overseas or lack any source technology that needs to be protected,” said Cho Woo-je, the KPAA patent attorney who performed the analysis.

By Shin Da-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence![[Editorial] Yoon must stop abusing authority to shield himself from investigation [Editorial] Yoon must stop abusing authority to shield himself from investigation](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/4417158464854198.jpg) [Editorial] Yoon must stop abusing authority to shield himself from investigation

[Editorial] Yoon must stop abusing authority to shield himself from investigation- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

- [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

Most viewed articles

- 1China calls US tariffs ‘madness,’ warns of full-on trade conflict

- 2[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 3[Editorial] Yoon must stop abusing authority to shield himself from investigation

- 4[Column] When ‘fairness’ means hate and violence

- 5[Column] How to win back readers who’ve turned to YouTube for news

- 6US has always pulled troops from Korea unilaterally — is Yoon prepared for it to happen again?

- 7[Book review] Who said Asians can’t make some good trouble?

- 8Naver’s union calls for action from government over possible Japanese buyout of Line

- 9Could Korea’s Naver lose control of Line to Japan?

- 10[Editorial] Korea must respond firmly to Japan’s attempt to usurp Line