hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea’s prosperous startups mainly funded by foreign capital

Woowa Brothers, the company that operates the food delivery app Baemin, signed a deal to sell the company to a German firm at a value of close to 5 trillion won (US$4.25 billion) in December last year. Since then, interest has been growing in “unicorns,” a term which refers to startups with a value of at least 1 trillion won (US$849.5 million). South Korean President Moon jae-in announced a plan to promote unicorn companies in his New Year’s address on Jan. 7. Soon afterward, the Democratic Party announced on Jan. 20 that its second main campaign pledge for the general election would be fostering 30 unicorn companies and investing 1 trillion won in a fund of funds by 2022. However, some have pointed out that the focus on quantitative growth in unicorns and venture capital has caused qualitative vulnerabilities in the Korean venture ecosystem to be overlooked, such as a heavy reliance on foreign capital.

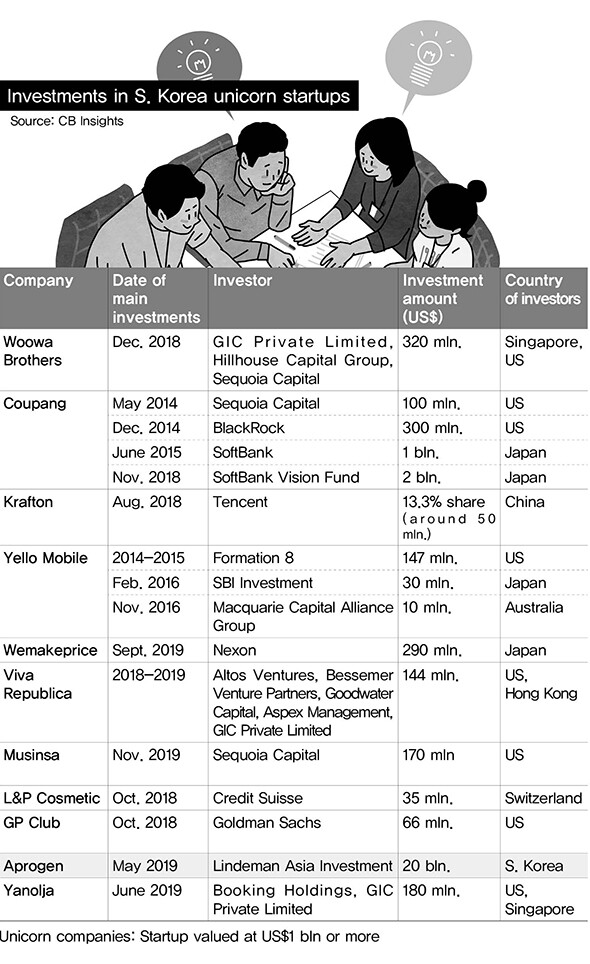

Upon examining the growth history of the 11 Korean companies that have achieved unicorn status, including Woowa Brothers, the Hankyoreh found that 10 of them relied on foreign rather than domestic capital during their growth into unicorns. Woowa Brothers transferred all of its stock to German firm Delivery Hero in December last year, with major investment from CEO Kim Bong-jin as well as GIC, a Singaporean sovereign wealth fund, Chinese venture capital firms Hillhouse Capital and Sequoia Capital China, the US-based Altos Ventures and global investment bank Goldman Sachs. These investors obtained a stake in Woowa Brothers, which was founded with 30 million won (US$25,488) in capital, via several rounds of recapitalization.

With the sale of the company, they have earned combined proceeds of several trillion won. In a phone interview with the Hankyoreh, Woowa Brothers stated there was a dearth of Korean investors willing to bet on the company’s survival and future profitability at the time. “We did not give any particular consideration to nationality when selecting investors,” the company said. “At the time we needed investment, the company was in the red so it was difficult to find local investors who would fund us.”

This story is the same for other Korean unicorns. With the exception of Aprogen, a manufacturer of immunotherapy drugs, the list of investors in the other 10 unicorns contains mainly overseas venture capital or private equity funds. Coupang LLC is the parent company that owns a 100% stake in Coupang, the largest Korean unicorn with a valuation of US$9 billion. Coupang LLC received more than 3 trillion won (US$2.55 billion) in investment from Softbank Vision Fund, the American firm Sequoia Capital, and BlackRock, the world’s largest asset management company. The firm with the second highest valuation is game developer Krafton, which received more than 500 billion won (US$424.84 million) from Image Frame Investment, an affiliate of the Chinese tech giant Tencent. Image Frame Investment is the second largest shareholder with a stake of 13.3%.

The majority shareholder in Yello Mobile, the third largest Korean unicorn, is the American venture capital firm Formation 8, which invested around US$ 100 million. A representative from Viva Republica, another Korean unicorn that operates the simple payment app Toss, stated, “We solicited an early investment [seed money] of US$1 million from overseas investors, and since our initial investment came from abroad it was only natural that we continued to mainly use foreign investors from that point on.”

Other Korean startups which have not yet attained unicorn status but are experiencing rapid growth also rely heavily on foreign investors. One example is Kurly Inc, a firm that has blown open the doors of the early morning delivery market in Korea. This company’s main source of funding is Chinese capital from Sequoia Capital China and Hillhouse Capital, the same firms that invested in Woowa Brothers. Some of the investors supplying funds have limited their involvement to simple financial investment, while strategic investment such as sending outside directors has taken place in other cases. Under this structure, it appears that the business strategies of Korean entrepreneurs could be easily swayed by the influence of overseas investors.

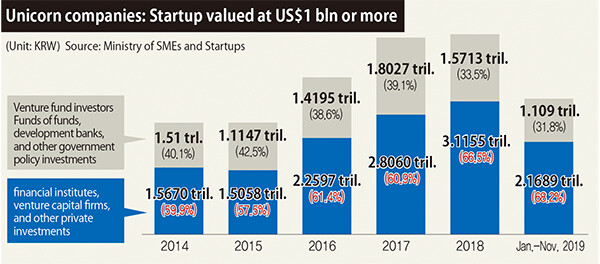

Domestic startups that are rich in creativity and innovative ideas but lacking in capital require support in order to grow and become profitable, but this is evidence that the Korean private capital market is too weak to provide such support. This is why concerns have been raised that if the government’s policy to promote unicorn companies remains focused solely on increasing their number, the spoils of success may become concentrated in the hands of foreign private capital.

“Since the Korean capital market is not mature, there aren’t any local investors who can afford to inject a level of funding commensurate with the growing value of startups” says Choi Seong-jin, CEO of the Korea Startup Forum. “Private equity funds that have received government policy capital struggle to make large investments in startups due to operating guidelines that set deadlines for investment returns.”

By Choi Min-young, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent