hankyoreh

Links to other country sites 다른 나라 사이트 링크

The conservative nature of S. Korea’s venture capital market is averse to innovation

Behind Silicon Valley’s reputation as the heart of global innovation are the innovative ideas of entrepreneurs and the universities that cultivated them, such as Stanford University’s School of Engineering. No less important has been the power of a robust capital market. It is impossible to reduce the many factors behind the creation of such an ecosystem to just one. In explaining how so much capital came to converge on Silicon Valley, some point to the 2008 Financial Crisis. After the Federal Reserve implemented ultra-low interest rates, so the analysis goes, Wall Street capital, suffering from declining profitability elsewhere, flocked to Silicon Valley, hoping for high returns.

In an ecosystem like this, innovative entrepreneurs seldom have to shut down their businesses due to a lack of money. On the other hand, as the “Theranos incident” has shown, the trickery of entrepreneurs can just as easily bring venture capital to catastrophe. The key competitiveness of the US venture capital market is the virtuous cycle of venture capital lining up at the doors of promising startups, making a name for themselves with good investments, after which funds start flowing to the venture capital company in question,” said an anonymous senior investment officer at a venture capital firm. Lim Jung-wook, managing director of Startup Alliance Korea, said, “The US has a strictly market-oriented venture ecosystem where good startups and good investments stay standing.”

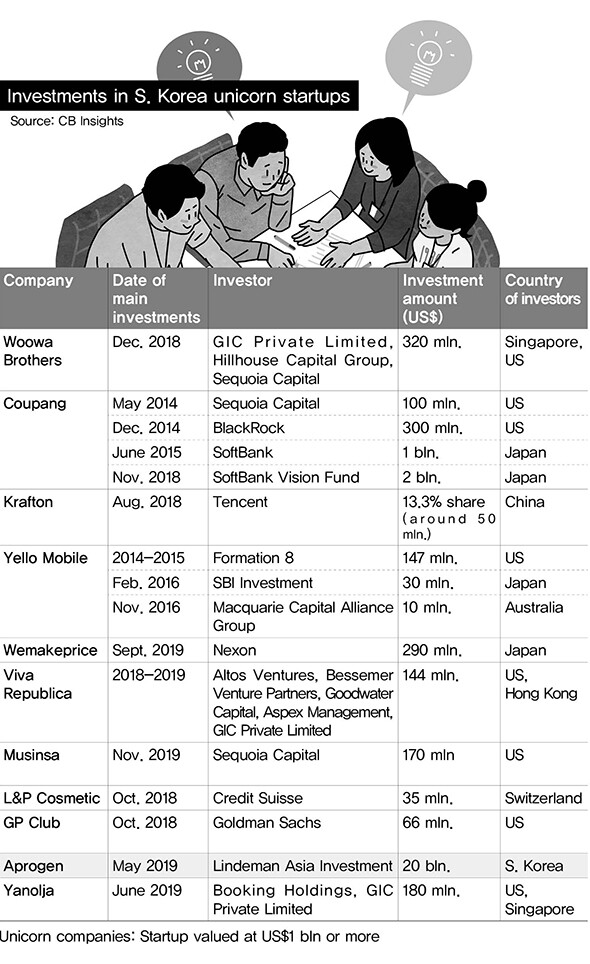

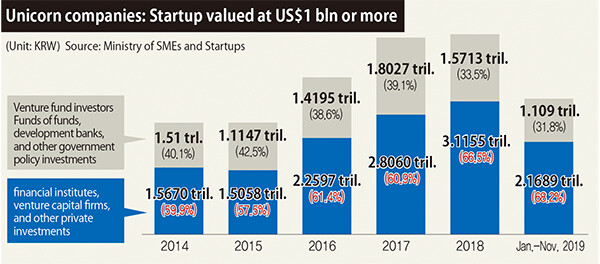

In the South Korean venture capital market, startup financing streams are occupied by bureaucracy, such as the government or state-owned banks. According to data from the Ministry of SMEs and Startups (MSS), public venture funds whose seed money originated from either the government budget or state-owned banks like the Korea Development Bank comprised on average 38.2% of all venture funds (sorted by investor) from 2014 to 2018. Despite the steady increase of civilian investment, such as those from pension funds or mutual aid associations, government capital nonetheless sits at the center of the venture capital market. This outcome can be traced back to the Park Geun-hye administration’s decision that the government ought to be the forerunner of the venture capital market, made under the pretext of its “creative economy” initiative. This decision produced negative side effects, such as the quantitative growth of capital and bureaucratic short-termism.

Experts say that a government-led venture capital market comes with fundamental limitations. Investments of government-led funds would have to undergo audits by both the Board of Audit and Inspection and the National Assembly, which would subject failed investments to the whims of public opinion that label them a “waste of taxpayer money.” “When it comes to government venture capital investment, performance issues such as return on investment will always be subject to scrutiny, so there is the question of how much government funding should be injected [into the venture capital market],” said Lim Chae-un, a professor of business administration at Sogang University. “It is necessary to cautiously reflect on whether we should be increasing the size of government capital.” Requesting anonymity, one private venture capitalist said, “Because government-backed funds prefer stable investments, they tend to concentrate on startups whose worth has already been proven. In this process, some startups get swept up in ‘inflated valuation’ controversies.”

The shortage of skilled investment officers who can recognize startups with growth potential is another weakness of the domestic capital market. Investment officers at venture funds are the arbiters of the investment value of startups, making investment decisions accordingly. While such a role calls for a broader understanding of the market, industry, and technology, most investment officers at domestic venture funds come from strictly finance backgrounds. “Although more investment officers with diverse backgrounds and knowledge are now emerging, in the past, there was resentment in the startup industry against investment officers [who lacked a broader understanding],” said Lim Jung-wook.

An employee at Viva Republica, an established fintech startup operating the mobile payment app Toss, confessed that, “when [the company] was seeking early investment, it was difficult to find investors in South Korea who understood the fintech industry.” One private equity fund manager offered another critique: “Because South Korea’s private financial capital generally revolves around banks, which tend to be stable and conservative in nature, it is unrealistic to hope for adventurous investments from the private financial capital sector.”

By Choi Min-young, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 6Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 7[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 8Why Israel isn’t hitting Iran with immediate retaliation

- 9[Column] Has Korea, too, crossed the Rubicon on China?

- 10All eyes on Xiaomi after it pulls off EV that Apple couldn’t