hankyoreh

Links to other country sites 다른 나라 사이트 링크

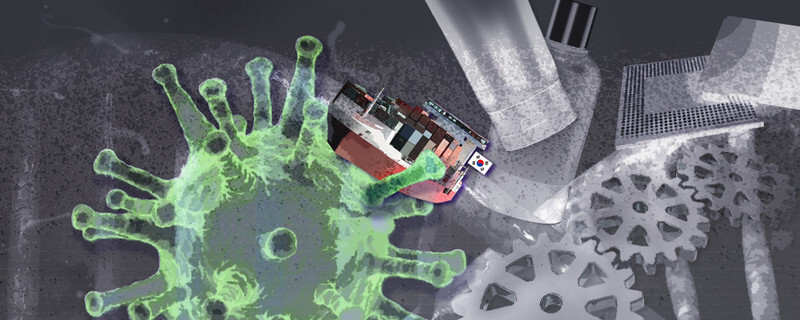

Small manufacturers bear worst of novel coronavirus’ economic impact

The owner of a company in Gyeonggi Province that makes packing machinery had plenty to gripe about during a telephone call with the Hankyoreh on Feb. 26. “We need to sell our machinery, but the brokers aren’t coming to Korea or meeting us. We’ve already paid the registration fee and sent the machines to an export convention in Vietnam, and now they’re saying the Vietnamese government might ban Koreans from entering the country. Our factories on the ground in China aren’t running properly, and parts aren’t being shipped to South Korea. Our losses are probably going to run into the hundreds of millions of won,” the frustrated business owner said.

The owner’s company is a small one, with less than 10 billion won (US$8.32 million) in annual sales and a short list of clients. But the outbreak of the novel coronavirus has put it under just as much stress as bigger companies. Such small machinery manufacturers account for a large share of South Korean small and medium-sized enterprises (SMEs)’ total exports to China. Last year, US$970 million worth of industrial machinery (including packaging machines and mixers) was exported to China, which ranked fourth among SME exports to China (using six-digit MTI codes).

At the request of the Hankyoreh, the Ministry of SMEs and Startups (MSS) calculated the top categories of SME exports to China last year by value. The top 15 categories included cosmetics, parts and equipment for semiconductors and displays, automobile parts, miscellaneous precision chemical materials, and industrial machinery. The business model for a substantial number of the SMEs making these products is to reprocess raw and subsidiary materials imported from China and then export them back to China for sale. This means that the novel coronavirus (COVID-19) outbreak comes as a double whammy.

Companies connected with basic cosmetics and makeup products (US$1.53 billion, ranked first on the list of SME export products) and companies connected with cosmetic face masks and shaving and bath deodorants (US$340 million, ranked eighth) are having trouble sourcing parts and securing clients. “A number of the export conventions that serve as our channel for finding clients throughout the year have been cancelled. Consumer demand has contracted in China, and SMEs have fewer outlets for sales,” said Lee Dong-gi, a member of the board at the Korea Cosmetics Export Association (KCEA).

“Since a number of South Korean companies import cosmetics containers from China, the disruption of Chinese imports is also having an impact on South Korea. That’s why South Korean cosmetics SMEs are temporarily switching production to masks and hand sanitizer,” Lee said.

“We get the majority of our cosmetics containers from China, but it’s become extremely difficult to find pump and spray containers for disinfectants. Since distribution in China is focused on hygiene products for the home market, delivery is taking 50% longer than normal,” said a source at a cosmetics manufacturer in Hwasong, Gyeonggi Province. This company said that both OEM (original equipment manufacturer) and ODM (original design manufacturer) products were being delayed by more than two weeks.

Companies that export products to China through brokers rather than directly are also in trouble. For example, some of the companies that ship diesel oil to China (US$260 million, ranked 13th) are smaller firms. “The four bigger refiners have their own branches that handle shipping, but smaller shippers and buyers sometimes rely on brokers. When it’s hard to get in touch with Chinese clients, as it is right now, these shipping companies have trouble finding work,” said a source in the oil refining industry.

In the automobile part sector (US$380 million, ranked seventh) and the semiconductor and display part and equipment sector (US$1.21 billion, ranked 3rd), where firms have been around longer and have a more stable supply chain, interrupted imports are a bigger problem than exports. The primary export products of South Korean automobile parts manufacturers are steering wheels, chassis components, and gearboxes.

“There are some suspension parts that have to be sourced from China, so we have one month’s supply of those. We’re managing our inventory through communication with the [automaker’s] purchasing team, and we just hope sales go well,” said the CEO of a prime contractor for one of South Korea’s automakers.

“While purchasing demand will no doubt recover in the long term, customs is taking several days longer than expected, and the distribution network isn’t functioning properly. The result is that product sales are markedly slower than last year,” said the CEO of a South Korean manufacturer of semiconductor equipment.

“We have enough stock to last through March, and we’re riding out the current situation. If [the coronavirus situation] drags on, we’ll be forced to set up a substitute supply chain,” said the executive of a company that makes semiconductor materials, sourcing its chief raw materials in China.

A large number of those companies are concentrated around Daegu and North Gyeongsang Province. “The major plants of South Korea’s automobile part manufacturers are in Daegu and North Gyeongsang Province. [Parts manufacturers] are terrified that some of their production line workers will get infected, forcing them to suspend factory operations,” said Kim San, head of planning and research for the Korea Auto Industries Cooperative Association.

By Shin Da-eun and Kim Yoon-ju, staff reporters

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3‘Weddingflation’ breaks the bank for Korean couples-to-be

- 4Korea sees more deaths than births for 52nd consecutive month in February

- 546% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 8Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 9[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 10[Column] Yoon’s first 100 days should open our eyes to pitfalls of presidential system