hankyoreh

Links to other country sites 다른 나라 사이트 링크

Telecommunications firms gradually moving away from communications services

Telecommunications companies have been hastening their efforts to branch away from communications. After relying in the past on stable profits generated from necessary communication services based on wired and wireless networks, the companies are now undergoing transformations with achievements as “general ICT businesses.” Competitive practices focused on “poaching” subscribers, which continued even after the emergence of smartphones, have also been changing. With the COVID-19 pandemic drawing attention to the untact (non-face-to-face) economy, the “post-communications” efforts by communications companies are starting to include efforts to resolve societal issues.

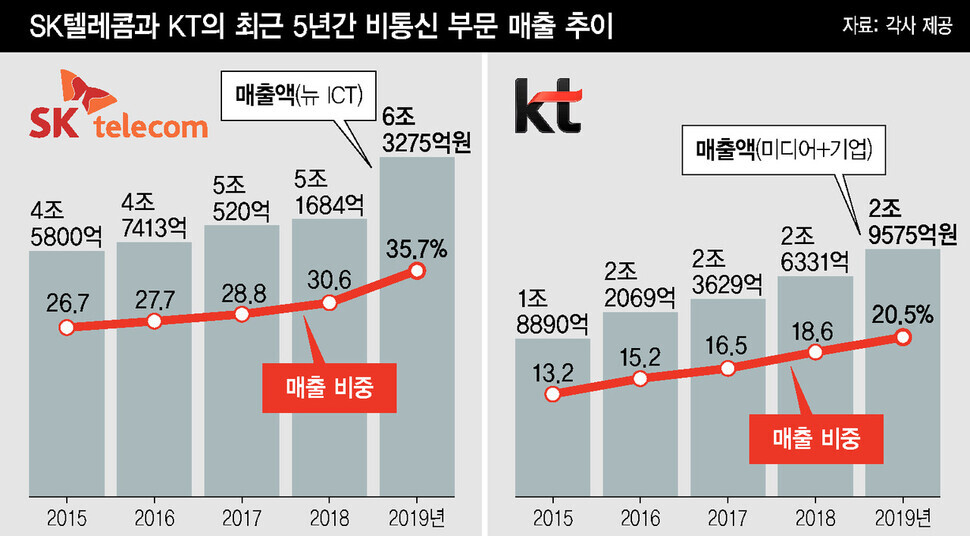

On July 8, the Hankyoreh analyzed sales trends over the past five years (2015-2019) for South Korea’s three major telecoms. The results showed that companies saw a steadily rising volume and percentage of sales in non-communications sectors. In 2015, SK Telecom’s sales in non-communications sectors totaled 4.58 trillion won (US$3.83 billion) or 26.7% of its total sales of 17.14 trillion won (US$14.34 billion). Sales numbers rose annually over the next four years to reach 6.33 trillion won (US$5.29 billion) as of 2019, or 35.7% of the company’s 17.74 trillion won (US$14.84 billion) in total sales.

While sales in the communications sector have dropped sharply, total sales have remained over 17 trillion won (US$14.2 billion) as non-communications sales have risen to fill the gap. KT’s non-communication sales totaled 1.48 trillion won (US$1.24 billion) in 2014, or 10.2% of all sales. Five years later in 2019, the respective numbers were 2.96 trillion won (US$2.48 billion) and 20.5% -- meaning that the volume and percentage of sales both doubled in the space of five years. Total sales remained more or less unchanged over the same period at over 14 trillion won (US$11.7 billion). In the case of LG U+, however, non-communications sales (the company sector) showed little change, creeping up from 1.82 trillion won (US$1.52 billion) in 2014 to 1.98 trillion won (US$1.67 billion) in 2019.

While both SG Telecom and KT experienced large rises in their volume and percentage of non-communications sales, they differed considerably in the details. KT’s non-communication sales come from media as wired and wireless network-based services (paid broadcasters such as SkyLife) and the company sector (data centers and cloud computing). A KT official explained, “With media services like IPTV, value added is high and sales have continued to rise with things like advertising, video on demand, and home shopping in addition to monthly fees, and we’ve experienced a growth trend thanks to the scale effects as the top-ranked operator in this sector.”

In contrast, SK Telecom has designated non-communications sales as a “new project” and future company growth driver. Its new projects fall into the three sectors of media (SK Broadband, Wavve), security (ADT Caps, SK Infosec), and commercial transactions (11st, SK Store), and the company is also broadening into the areas of artificial intelligence and healthcare. Rather than being a response to declining communications sales, SK Telecom’s post-communications strategy is oriented to strategically fostering new business sectors to increase future value for the company.

AI a key component of “post-communications” projectsBoth SK Telecom and KT have drawn attention with their respective leaders taking the initiative in transforming their communications businesses with ideas for AI and post-communications activities. SK Telecom CEO Park Jung-ho has consistently stressed the need for his business to transform from a “telecom” to a “general ICT company” since taking over the reins in 2017. In an online seminar for all employees early last month, he said, “We need to break away from the attitude of calculating mobile communications competitiveness in terms of average revenue per user (ARPU) or user numbers and looking at market share as a battle to capture higher ground.”

“The only way for us to gain new opportunities is to attempt a change by applying AI and the cloud to all new industries, even if it means losses in the short term,” he stressed.

KT CEO Ku Hyeon-mo launched the industry-academia-research consortium AI One Team early this year in conjunction with Hyundai Heavy Industries and LG Electronics. In a speech early this month at the GTI Summit, an online meeting for communications industry leaders around the world, Ku said, “Where mobile communications to date have been focused on business-to-consumer (B2C) transactions, the focus for 5G will shift to business-to-business (B2B).”

“5G communications are not simply a network, but a platform with explosive potential thanks to the combination of AI, big data, and cloud computing. KT will drive innovation in other industries through 5G,” he predicted.

Amid the coronavirus pandemic, the two telecoms have also been similar in their efforts to transform not simply into post-communications companies but into ICT-based “solvers of societal issues.” Last month, SK Telecom held SKT Happy Insight, a competition for the public to propose ICT-based solutions to societal issues. The company has also been sharing stories of caregiving for senior citizens with dementia and other vulnerable population segments. KT announced on July 6 that it was forming a “Korean New Deal cooperation strategy task force” to actively support implementation of the “Korean Digital New Deal” -- a strategic project by the South Korean government -- and working to devise ICT-based means of project cooperation.

By Koo Bon-kwon, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 11 in 5 unwed Korean women want child-free life, study shows

- 2AI is catching up with humans at a ‘shocking’ rate

- 3[Column] Has Korea, too, crossed the Rubicon on China?

- 4[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 5Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 6[Photo] More Sewol paintings by Hong Sung-dam

- 7Court dismisses comfort women’s suit against government for signing 2015 agreement with Japan

- 8[Editorial] Seoul’s callous response to disability rights protests

- 9Netflix imperialism: Are Korea’s days as the platform’s favorite content creator numbered?

- 10Marriages nosedived 40% over last 10 years in Korea, a factor in low birth rate