hankyoreh

Links to other country sites 다른 나라 사이트 링크

LG Chem battles with China’s CATL for top spot in global electric battery industry

A two-way battery race is taking shape between LG Chem and the Chinese company Contemporary Amperex Technology (CATL). With most of its supply chain functioning even amid the COVID-19 pandemic, LG Chem was able to claim the industry’s top spot during the first half of the year -- but the rivalry has been intensifying as CATL wages a full-scale onslaught on the back of the Chinese market. Predictions that the electric vehicle (EV) battery market will be dominated by the two heavyweights for the time being are gaining traction.

The German multinational Daimler AG announced on Aug. 5 that it planned to bolster the strategic partnership between Mercedes-Benz and CATL. Mercedes-Benz plans to not only include CATL batteries in its EQS -- a sedan with a 700km range to be launched next year -- but also partner with CATL on next-generation battery research and development.

“We plan to join our bold partners on R&D to become leaders in battery technology,” said Markus Schaefer, chief operating officer for Mercedes-Benz.

“By partnering with CATL, we can speed up the process of transitioning toward carbon-neutrality,” he added.

For LG Chem, this means the loss of a major account. Previously, it had been supplying batteries for the EQC, another Mercedes model. The EQC was the first purely electric vehicle launched by the automaker, but it has become a source of embarrassment after failing to win subsidies in South Korea due to a failure to meet low-temperature range standards.

“[Mercedes-Benz] appears to have weighed its choice between LG Chem and CATL as long as possible. I guess it finally decided that CATL is more appropriate on a technical level,” a source in the industry said. In short, the scramble for territory between the two companies, which are ranked first and second in the industry, has been heating up in recent months.

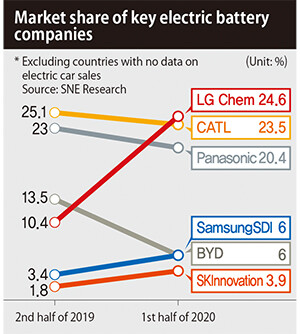

While LG Chem had been stuck at third or fourth last year, it elbowed its way to first during the COVID-19 pandemic this year. But the gap in market share between LG Chem and CATL remains razor thin. A study by SNE Research found that LG Chem held a 24.6% share of the global EV battery market in the first half of the year, while CATL was on its heels at 23.5%. While Panasonic had been touted last year as a potential rival, it’s currently projected to lose ground, leaving LG Chem and CATL at the top of the market.

Another topic of interest is their rivalry for supply contracts with Tesla, and particularly the automaker’s plans for the Model 3, which Tesla started mass producing in China this year. Tesla recently began stocking its Model 3 Standard Range with CATL’s lithium-iron-phosphate (LFP) batteries.

Needless to say, that’s a worrisome move for LG Chem, which had been supplying all batteries for Model 3 vehicles being manufactured in China. While CATL had to close all its factories in China for a while because of COVID-19, moving forward it could put even more pressure on LG Chem as it expands production. Since Tesla has made several announcements of late about cutting costs, it’s uncertain which company will receive more of its business.

But given the lag between inking orders and actually supplying product, it’s likely to take some time before the back-room wheeling and dealing actually shows up in the numbers. Another major variable is the long-term reorganization of the EV market, which is currently dominated by Tesla.

“Given the orders and manufacturing capacity announced thus far, LG Chem and CATL are likely to remain the industry leaders for at least a couple more years,” an industry source predicted.

By Lee Jae-yeon, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US