hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean companies steadily boost market share in EV battery industry

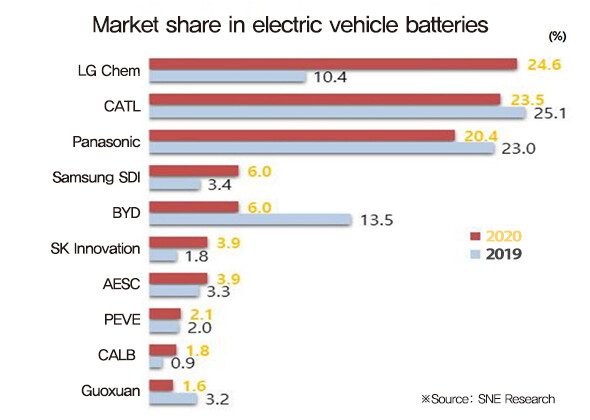

South Korean companies producing electric vehicle (EV) batteries have enjoyed a rapidly increasing market share over the past few years. But with EV battery technology undergoing swift changes and a fierce competition underway between established finished automobile makers and emerging companies, market uncertainty remains high.

According to report published on Aug. 17 by the Korea International Trade Association (KITA) under the title “Korea, China, and Japan: The Three Kingdoms of Batteries,” the three countries accounted for a combined 93.8% share of the EV battery market (by shipments) during the first half of 2020. South Korean batteries in particular have enjoyed rapid growth, with their market share growing nearly fourfold from 9.5% in 2016 to 34.5% this year. China also increased its market share from 24.7% in 2016 to 42.7% as of last year, but saw it decline to 32.9% during 2020. Japan had the highest market share as of 2016 with 37.0%, but it has since shown a clear trend of decline, reaching 28.9% in 2018 and 26.4% in 2020.

The chief purchasers or South Korean batteries are Germany and China. As of the first half of this year, Germany imported the most South Korean batteries with US$481 million in purchases. It was followed by China (US$299 million), Poland (US$243 million), the US (US$216 million), Vietnam (US$165 million), Hong Kong (US$139 million), and Japan (US$119 million).

But it remains unclear whether this trend will remain stable. With solid-state batteries and other next-generation battery technologies emerging at a rapid rate, countries that fail to drive or keep up with technology development stand to sacrifice their market dominance. One factor behind the annual amount of South Korean battery exports to China declining by nearly half from US$1.15 billion in 2014 to US$570 million last year was the growth of local China companies such as CATL.

CATL is now reportedly at work developing batteries that do not use nickel, an expensive product. With a battery’s energy density varying proportionally with the percentage of nickel, the metal plays a key role in increasing EV range. CATL’s “nickel-free” announcement is being seen as an attempt to drive down battery costs even further in the wake of this year’s mass-production of cobalt-free lithium ferrophosphate (LFP) batteries. Tesla also announced plans to unveil a “million-mile” battery during a Battery Day event scheduled for next month.

By Cho Kye-wan and Lee Jae-yeon, staff reporters

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 3After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 4[Column] Has Korea, too, crossed the Rubicon on China?

- 5[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 6US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 7Samsung barricades office as unionized workers strike for better conditions

- 8All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 9More South Koreans, particularly the young, are leaving their religions

- 10John Linton, descendant of US missionaries and naturalized Korean citizen, to lead PPP’s reform effo