hankyoreh

Links to other country sites 다른 나라 사이트 링크

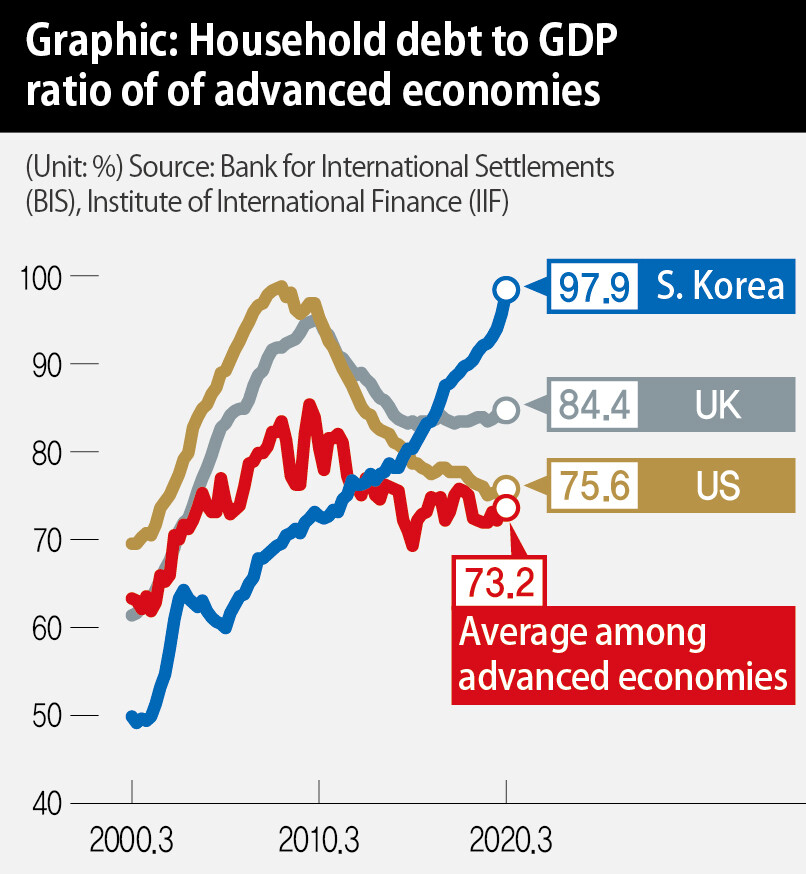

S. Korea’s ratio of household debt to GDP at 97.9%, higher than most advanced economies

Over the past five years, household debt in South Korea has risen to a level higher than most of the world’s major economies, including the US and the UK, and nearly reached the limits of what the economy can bear, a recent report finds.

When the Bank for International Settlements and the Institute of International Finance analyzed the ratio of household debt to gross domestic product (GDP) in 44 countries, South Korea had a ratio of 97.9% in the first quarter of 2020, ranking sixth among the countries in the survey. The only countries that ranked higher than South Korea were Canada and Switzerland, as well as the three countries of Northern Europe, which are difficult to compare directly because of their massive pension programs and unique housing finance systems. Several major economies had a much lower household debt-GDP ratio than South Korea, including the UK (84.4%), the US (75.6%), China (58.8%), and Japan (57.2%).

The level of household debt in South Korea outstripped the US and the UK in 2015 and 2016, after home mortgage regulations were eased by the Park Geun-hye administration, and that level has continued to rise under the current Moon Jae-in administration. This is the result of South Korea relaxing mortgage regulations while the US and the UK were moving to deleverage their banks after the financial crisis brought on by the collapse of the housing bubble in 2007-2008. Since South Korea will probably see negative economic growth this year as household debt continues to soar, the ratio is expected to soon exceed 100%.

Analysts with the Bank for International Settlements believe that the level of household debt that a given economy can endure is about 85% of GDP. That estimate is based on a survey of economic conditions in 18 advanced economies between 1980 and 2010. In the short term, household debt increases consumption, which has a positive effect on economic growth. But above a certain level, debt has a negative impact on the economy, analysts say.

“We’ve nearly reached our limit for household debt. The heavier the burden, the greater the consequences we’ll face down the road,” warned Park Chang-gyun, a senior analyst with the Korea Capital Market Institute.

The financial authorities believe that some household loans are flowing into capital markets such as real estate and equities, driving a spike in asset prices, and they’re working on countermeasures.

“We’ve eased some regulations for the sake of small business owners who are suffering because of COVID-19. But if banks use their excess credit to make loans to other people, we intend to make selective adjustments,” a senior financial regulator said.

By Park Hyun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1AI is catching up with humans at a ‘shocking’ rate

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 4Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 5The dream K-drama boyfriend stealing hearts and screens in Japan

- 6Korea sees more deaths than births for 52nd consecutive month in February

- 7[Column] Action on climate change isn’t driving inflation – fossil fuels are

- 8Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 9[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 10Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?