hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung, SK Hynix to stop exporting semiconductors to Huawei as of Sept. 15

Tougher sanctions on Chinese telecommunications firm Huawei announced by the US Department of Commerce will take effect on Sept. 15. Since the sanctions prohibit semiconductors made using US technology or software from being supplied to Huawei without US approval, Samsung Electronics and SK Hynix will have to fully halt exports of semiconductors to the Chinese company. In the second quarter of the year, Huawei ranked first in the global smartphone market with a 20% share and first in the global telecommunications equipment market with a 31% share. But can it survive American sanctions?

Huawei’s initial strategy was to acquire as big a stockpile of semiconductors as possible. Taiwanese newspaper the China Times and other media reported that a special cargo plane had landed at Taipei Airport on Sept. 13, chartered by HiSilicon, a semiconductor company owned by Huawei. That offered a glimpse into the urgent logistical operation that Huawei was running until the last possible minute to acquire semiconductors and other parts.

These factors seem to be reflected in data provided by market research firm DRAMeXchange, which said the spot price of DDR4 8Gb DRAM stood at US$2.93 on Sept. 10, 12% higher than early August. The spot price began to rise sharply in September after hovering around US$2.5-$2.6 throughout the previous month. Analysts with DRAMeXchange believe this price movement resulted from Huawei’s urgent drive to stockpile semiconductors. As global IT firms made preemptive purchases of semiconductors for servers as a precaution amid the COVID-19 pandemic, their inventories had exceeded appropriate levels, prompting predictions as late as the end of August that memory semiconductor prices would trend downward in the third and fourth quarters of the year.

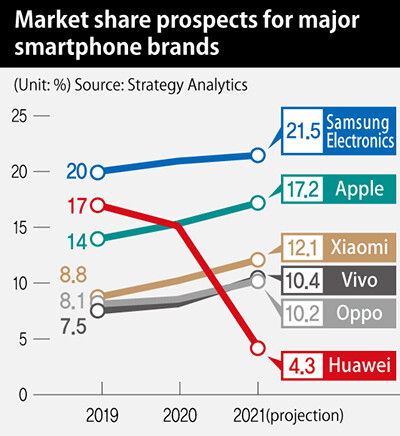

The big question is what happens after Huawei blows through its stockpile. Market analysts haven’t offered hopeful prospects. “Huawei has set aside about six months’ worth of semiconductors, but they’ll run out early next year. As a result, their share of the global smartphone market will drop from 15.1% this year to 4.3% next year,” predicted market research firm Strategy Analytics.

Telecommunications may suffer less losses than smartphonesBut the situation is a little different in the telecommunications equipment field. It’s true that Huawei’s dominant status has come under attack as countries including the US, the UK, and Canada ban the Chinese company from efforts to build 5G mobile networks. Even so, most think that the impact of these measures will be more limited compared to smartphones. Given the need for continuity in both technology and service in the telecommunications equipment market, replacing equipment would entail a huge cost. The upshot is that Huawei’s market share in telecommunications equipment is less likely to fall dramatically. In an interview with the New York Times last year, Huawei founder Ren Zhengfei said that US sanctions wouldn’t have a big impact in that sector, since Huawei could produce 5G equipment using its own technology.

The critical variables are the outcome of the US presidential election in November — especially whether Joe Biden, if elected, would maintain the current sanctions — and the choices that Chinese consumers end up making. If sanctions continue even after the election, Huawei will likely have to seek a new path forward. That would mean complete independence from US technology across the entire IT ecosystem, including not only hardware but also software.

Huawei will also have to transition from Google’s Android to its own smartphone operating system. That explains the company’s plan to create a developer ecosystem for HarmonyOS, the operating system it announced back in August 2019, which it also hopes to distribute to other Chinese smartphone companies such as Oppo, Vivo, and Xiaomi. Currently, HarmonyOS only features about 40,000 apps, just a fraction of the 25 million apps available for Android and the 18 million available for iPhone.

By Koo Bon-kwon, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 3After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 4[Column] Has Korea, too, crossed the Rubicon on China?

- 5US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 6Samsung barricades office as unionized workers strike for better conditions

- 7All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 8[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 975% of younger S. Koreans want to leave country

- 10[Correspondent’s column] The US and the end of Japanese pacifism