hankyoreh

Links to other country sites 다른 나라 사이트 링크

Are we seeing the end of the deflation era?

The US Federal Reserve Board’s decision to introduce an average inflation target is focusing growing attention on prices. The arrival of an era of inflation is expected to result not only in limits to growth arising due to debt, but also in major changes to the distribution of individual financial assets.

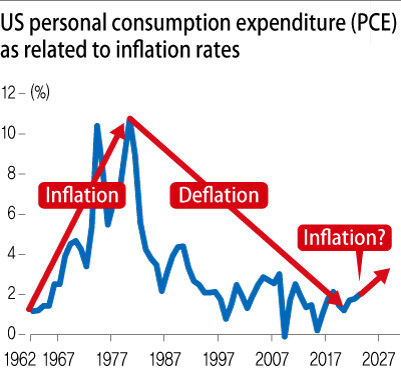

The Fed’s monetary policy goals involve maximizing employment and keeping prices stable. Since 2012, it has been pursuing monetary policy with a target growth rate of 2% in personal consumption expenditure (PCE) prices. But between then and July 2020, the rate of inflation amounted to just 1.4%. The rate of increase in core prices -- not including energy and food/beverages, where prices trend to fluctuate heavily -- also falls below the 2% mark at 1.6%.

How do we explain prices remaining so stable despite close to US$6 trillion in funds being freed up in the process of responding to the financial crisis of 2008 and the economic crisis caused by the COVID-19 this year? In demand terms, the US economy’s growth has fallen below its capabilities. Actual gross domestic product (GDP) for the US between 2012 and 2019 has averaged 1.6% lower than the provisional GDP estimated by Congress. This means that the corresponding demand has been lacking. In supply terms, another factor behind price stability has been China’s production and supply of products to the US based on low wages and production costs since joining the World Trade Organization in 2001.

But the situation has been changing since the pandemic erupted. US policy authorities have been responding with unprecedented fiscal and monetary policy measures. This year, the government has spent US$2.2343 on support to households and businesses -- a total amounting to 47.5% of the US federal government’s annual budget. In March, the Fed held two emergency Federal Open Market Commission (FOMC) meetings, where the benchmark interest rate was lowered to 0-0.25%. The Fed’s assets also increased by nearly US$3 trillion between March and June -- meaning that an equivalent amount was supplied to the market. Demand has been gradually recovering as a result of the policies. Under the current trend, inflation could arise around 2022 as actual GDP approaches its potential level.

Changes have also been occurring in supply terms since the pandemic began. In the past, products were made wherever they could be produced most cheaply and supplied to the rest of the world through trade -- a system encapsulated in the term “global value chain.” But amid an intensifying wave of protectionism in the US and elsewhere, many are adopting the mindset that items in the corresponding areas should be produced at home or in neighboring regions. Rising wages in China mean that it can no longer provide products to the world as inexpensively as before.

Inflation is unlikely to be a reality in the immediate future. But an examination of supply and demand factors suggests the “disinflation era” that has continued since 1980 could come to an end in the next two to three years, with an era of inflection arriving in its place. With the Fed declaring its inflation target system, it is likely to refrain from raising interest rates in the early stages. But a central bank’s most important target is price stability -- which means that the Fed will end up becoming an inflation fighter. The result of the bold fiscal and monetary policies adopted to overcome the global financial crisis of 2008 has been a large increase in liabilities for the different economic actors. If interest rates increase, debt could erupt as an issue. Bond prices could drop sharply as market interest rates rise. This is not something that it is about to happen right now -- but it is something we need to respond to ahead of time.

By Kim Young-ik, adjunct professor of economics at Sogang University

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

Most viewed articles

- 1Months and months of overdue wages are pushing migrant workers in Korea into debt

- 2Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 3At heart of West’s handwringing over Chinese ‘overcapacity,’ a battle to lead key future industries

- 4[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 5Fruitless Yoon-Lee summit inflames partisan tensions in Korea

- 61 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 7Dermatology, plastic surgery drove record medical tourism to Korea in 2023

- 8AI is catching up with humans at a ‘shocking’ rate

- 9First meeting between Yoon, Lee in 2 years ends without compromise or agreement

- 10Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report