hankyoreh

Links to other country sites 다른 나라 사이트 링크

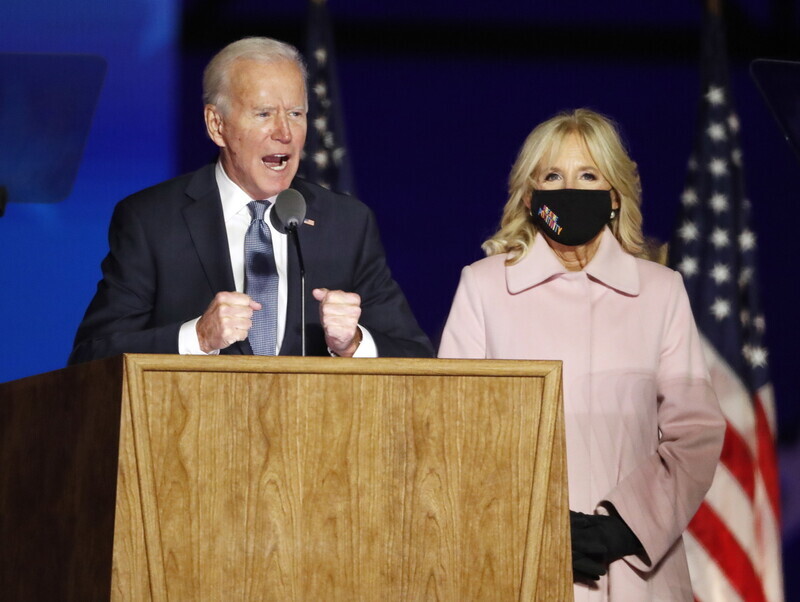

[News analysis] A mixed bag of risks and opportunity for S. Korean economy in Biden’s America

The election of Joseph Biden as US president is expected to present both opportunities and risks for the South Korean economy. While some observers are concerned that his continuation of the “American products first approach” of current President Donald Trump could shrink Korea’s industrial base, others are foreseeing a potential increase in opportunities for South Korean businesses to enter and participate in the US market amid accelerated investment in green energy. This would be coupled with a shift away from China in high-tech industries fueled by a rise in sanctions and curbs against Chinese businesses. With both opportunity and risk factors present, the question of how China actually responds to the curbs and the shift away from its industries that are being predicted at a muted level is already becoming a subject of intense interest.

Batteries, semiconductors could become “double-edged sword”To begin with, South Korean industries could face both an opportunity and challenge in high-tech manufacturing and new technology areas such as semiconductors, batteries, and energy. Biden has shared plans for expanding clean energy (including self-driving vehicles, batteries, and renewable energy sources) and channeling large-scale investment of US$2 billion into green infrastructure. In particular, he is pursuing the restoration of a stable semiconductor supply chain in the US, viewing semiconductors as not simply an industry but an essential element for national security. Observers are watching to see whether Samsung Electronics and SK Hynix devise strategies involving increased local investment in the US.

But Biden’s message of “manufacturing in America by Americans” even when it comes to semiconductors and batteries could pose a challenge to South Korean semiconductor businesses. Biden also plans to expand infrastructure support for domestic production in the battery sector, which is closely tied to green energy. In particular, he has called for a domestic restoration of industry from batteries to electric vehicle production under the banner of using next-generation battery technology manufactured by US workers. US companies are expected to pose an even stiffer challenge to South Korean ones, which currently rank first in the world for batteries.

“Responding with balanced industry policy”With Biden’s industrial policies premised on proactive fiscal outlays, some are looking ahead to a rise in investment and exports in the US market by South Korean companies. Biden plans to increase purchases of steel, cement, concrete, building material, and equipment through US$400 billion in public procurement by the government, and to invest US$300 billion in AI, quantum and high-performance computing, 5G and 6G technology, new materials, semiconductors, and biotechnology.

But large uncertainties remain in terms of carrying Biden’s policies out. The feasibility of such large fiscal expenditures may decrease as finances worsen amid the COVID-19 response and long-term recession, and priorities may end up reshuffled. In the case of government purchasing, the benefits for South Korean businesses are likely to be limited in light of the Buy American Act, which mandates the use of over 50% US-produced parts, and the Berry Amendment, which states that certain military items must be 100% produced within the US.

“South Korean businesses will need to respond to the Biden era not just at the individual company level, but through wide-ranging and balanced industry policy that integrates the enterprise, trade, and technology sectors,” the Korea Institute for Industrial Economics and Trade (KIET) advised. This suggests that South Korean businesses and industries may find themselves having to develop more complex and multilayered strategies than during the Trump era.

Growing pressure for US offshoringWith demand for US-produced items expected to continue growing from the Trump era, South Korean businesses may need to give serious thought to offshoring in the US. This in turn could lead to a hollowing effect for domestic industry. Biden is carrying on from Trump in calling for a US-centered reorganization of the value chain through curbs against Chinese high-tech industries, an accelerated push away from China, and favoring US-produced items. But amid the constraints of the US decoupling away from China in emerging industries and high-tech due to security issues, the economic and industry conflict between the US and China is expected to continue in softened form. In the case of high tech, South Korea may see expanding opportunities for value chain investment as a US ally.

Increased cooperation on technology and production is also being predicted in key new technology areas such as semiconductors. But given the reality of South Korea’s high dependence on China for trade, it is very likely to find itself facing more difficult situations owing to the US-China conflict in the Biden era as well. KIET stressed that South Korean businesses “must carefully grasp and respond to the initial industry policy priorities that Biden will be announcing in the near future” adding in particular that “Growing uncertainty resulting from China’s response measures to Biden’s trade and industry policies will be inevitable.”

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Up-and-coming Indonesian group StarBe spills what it learned during K-pop training in Seoul

- 4[News analysis] Using lure of fame, K-entertainment agency bigwigs sexually prey on young trainees

- 5[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 6Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 7Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 8S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10Report reveals toxic pollution at numerous USFK bases