hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea has produced no new firms among top global companies in past 10 years

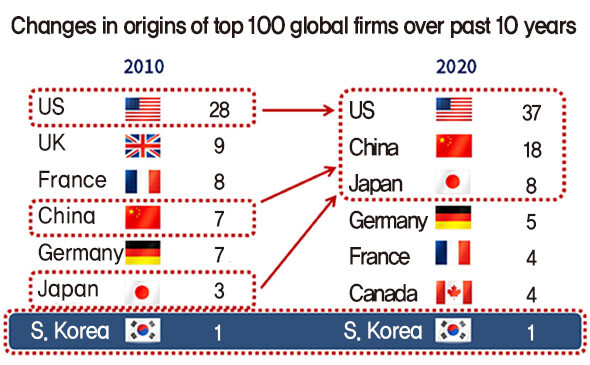

Nine companies from the US, 11 from China, and five from Japan have entered the list of the world’s top 100 companies over the past decade, but no companies from South Korea have managed to do so. Analysts point to an invisible glass ceiling in the circulation of wealth in Korea’s corporate world and argue that its corporate metabolism is congested.

A report titled “The Metabolism of South Korean Companies Seen Through the Lens of an International Comparison,” published by the Korean Chamber of Commerce and Industry on Dec. 13, analyzed the status of Korean companies using global rankings of self-made entrepreneurs and companies including Forbes’ Global 2000, Fortune’s Global 500, and The World’s Billionaires by Forbes.

As of this year, Samsung Electronics is the only South Korean company among the world’s top 100 companies, a list calculated according to sales, assets, market capitalization, and net profit for companies on Forbes’ Global 2000. Korea was far behind the US (37), China (18), and Japan (eight) on this indicator.

Significantly, no South Korean companies have joined the list over the past 10 years (2010-2020), in comparison with nine companies from the US, 11 from China, and five from Japan.

A similar observation can be made about revisions to lists of the top 10 Korean firms and the top 10 US firms, derived from Fortune’s Global 500 (in terms of sales). Over the past decade, seven of the top 10 US firms have changed, but only three of the top 10 Korean firms (Kia Motors, Hyundai Mobis, and the KB Financial Group have joined the list).

While the new American firms on the list have hailed from new industries such as IT and healthcare, replacing firms from legacy industries like energy and manufacturing, Korea hasn’t managed to produce any global leaders in these emerging industries.

Korea is also far below the global average in terms of the percentage of billionaires who are self-made, an indicator that signifies circulation of wealth. An analysis of The World’s Billionaires by Forbes shows that 16 of 28 (57.1%) of Korean billionaires are self-made entrepreneurs. That fell far short of the figure in major countries such as the US (70%), Japan (81%), the UK (87%) and China (98%). The global average is 69.7%.

“The percentage by which the private sector contributes to the growth of GDP has fallen from 3.6% (2011) to 0.4% (2019) over the past 10 years. Tracking the fundamental reason for that decrease shows that a key factor has been companies’ sluggish metabolism,” the report said.

“Startups in new industries in the US and China often seize new opportunities to create success stories. But in Korea, corporate growth is limited by barriers designed to protect vested interests. There’s an invisible glass ceiling on the circulation of wealth through entrepreneurship,” the Korean Chamber of Commerce and Industry said.

Problems with Korea’s culture of entrepreneurshipThe report identifies numerous problems with Korea’s entrepreneurship culture, which represents the initial stage of corporate metabolism. Only 14.4% of new companies launched in the first half of 2020 were tech-based opportunity startups. Many of the other new companies (85.6%) were necessity-based startups, designed to provide a livelihood. Opportunity startups have accounted for roughly the same share of new companies over the past four years, with only minor variations, since hitting 16.5% in the first half of 2016.

According to statistics provided by the Organisation for Economic Cooperation and Development (OECD), necessity entrepreneurship accounted for 63% of new companies in Korea in 2014, much higher than major countries such as the US (26%), while opportunity entrepreneurship was lower in South Korea (21%) than in the US (54%).

“More opportunity entrepreneurship and more self-made entrepreneurs are needed for rules across our economy and society to change more quickly and for investment and innovation to be promoted. There’s a critical need for sweeping reform of our outdated legal system, which only allows companies to operate within preset categories. That fundamentally limits opportunities for innovation by new industries and startups, which by definition are supposed to create totally new categories,” said Kim Mun-tae, head of the economic policy team at the Korean Chamber of Commerce and Industry.

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3N. Korean hackers breached 10 defense contractors in South for months, police say

- 4[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 5Up-and-coming Indonesian group StarBe spills what it learned during K-pop training in Seoul

- 6[Editorial] Japan’s rewriting of history with Korea has gone too far

- 7Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 8Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 9Thursday to mark start of resignations by senior doctors amid standoff with government

- 10Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan