hankyoreh

Links to other country sites 다른 나라 사이트 링크

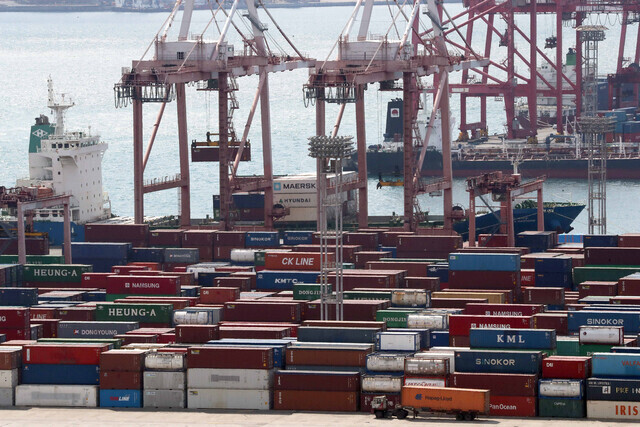

Overreliance on semiconductors drives S. Korea’s economic recovery

While the South Korean economy’s overreliance on semiconductors is a weakness, that has ironically been driving the country’s economic recovery. Some of the main characteristics of the COVID-19 pandemic, including a surge in remote activities and a rash of “revenge” purchases of electronics and automobiles, have proven a boon for the chip industry.

That helps shore up the South Korean economy in the short term, but experts note that balanced growth is needed in a longer timeframe.

“As COVID-19 has driven an increase in global demand for products connected with virtual activities, there’s continuing movement toward a recovery in the South Korean economy, especially in facility investment and IT industry exports,” the Bank of Korea said in an issue note on Thursday titled “Assessing the South Korean Economy’s Dependence on the IT Industry Through a Breakdown of Industrial Dependence Factors.”

In the first quarter (Q1) of 2020, South Korea’s real gross domestic product (GDP) fell by 1.3% from the previous quarter, and that decline continued with a 3.2% drop in Q2. But GDP rebounded by 2.1% in Q3 and 1.2% in Q4.

The manufacturing sector drove that growth. Backed by semiconductors, South Korea’s exports resumed year-on-year growth in November 2020. That growth has been sustained through March 2021.

“Examining the amount of contribution to GDP, we see that semiconductors and the rest of the IT industry helped suppress the GDP decline to 0.3 points last year, while non-IT industry helped drive 0.6 points of growth in the second half of 2020,” the Bank of Korea said.

The shifts in working and spending patterns brought about by COVID-19 have led to a boom in exports in South Korea’s major industries. As more people work, study, and shop from home, there’s been greater demand for laptop commuters, home appliances, mobile phones and televisions. Consumption of durable goods has also fueled a gradual recovery in automobiles and petrochemicals.

Since the US dollar is typically used to buy semiconductors (98.4%) and IT and telecommunications devices (90.1%), more exports of those products have caused the dollar to account for a larger share of export payments. Import and export data for 2020 sorted by payment currency (released by the Bank of Korea on the same day) shows that the US dollar was the payment currency for 83.6% of exports that year, up 0.1 points from the previous year.

As the most commonly used currency for export payments, the dollar’s share stayed close to 85% since 2000. The share slid by 1 point year on year to 83.5% in 2019 amid a slump in the export price of semiconductors.

The Bank of Korea says that the Korean economy’s dependence on the semiconductor industry has increased as local companies competitively responded to structural changes in global trade after 2010.

As of 2019, the semiconductor industry accounted for 17.9% of Korea’s exports passing through customs, the highest of any industry. Semiconductors’ share of total exports has increased more than any other industry, rising by 8.9 points since 2009, while South Korean battery manufacturers’ share of the global market has also been rising briskly.

“These aspects of industrial structure appear to have dovetailed with features of the global pandemic to have a positive impact on the Korean economy during the economic recovery following the outbreak of COVID-19,” the Bank of Korea said.

That said, domination by any single industry leaves an economy vulnerable to risk.

“To acquire a more stable growth engine in the ‘new normal’ of the ‘big blur’ [referring to the weakening boundaries between industries], it’s necessary to strengthen balanced growth between sectors by fostering new technology and new industries and by maximizing integration between industries,” the Bank of Korea said.

“Greater dependence on specific sectors means that unexpected changes in domestic or foreign circumstances can have an even greater shock on the economy as a whole. That’s why we have to keep working to find drivers of future growth.”

By Jun Seul-gi, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0416/8917132552387962.jpg) [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

[Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces![[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0416/8317132536568958.jpg) [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

- [Guest essay] At only 26, I’ve seen 4 wars in my home of Gaza

- [Column] Syngman Rhee’s bloody legacy in Jeju

Most viewed articles

- 1[Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- 2Faith in the power of memory: Why these teens carry yellow ribbons for Sewol

- 3[Guest essay] How Korea turned its trainee doctors into monsters

- 4[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 5Korea ranks among 10 countries going backward on coal power, report shows

- 6Final search of Sewol hull complete, with 5 victims still missing

- 7How Samsung’s promises of cutting-edge tech won US semiconductor grants on par with TSMC

- 8Pres. Park an accomplice in ordering resignation of CJ Group vice chairman

- 9[News analysis] Watershed augmentation of US-Japan alliance to put Korea’s diplomacy to the test

- 10K-pop a major contributor to boom in physical album sales worldwide, says IFPI analyst