hankyoreh

Links to other country sites 다른 나라 사이트 링크

[Editorial] Data show 10% of South Korea with 90% of the wealth

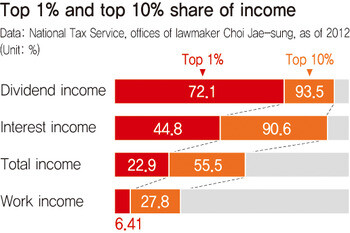

Newly released data provide a first-ever picture of just how badly stratified financial assets and the income from them are in South Korea. For one thing, they show the top 10% of earners making over 90% of dividend and interest earnings in a year. As bad as the imbalances in earned income and business income are, the gap for financial income is far worse.

The 2012 National Tax Service percentile data on dividend and interest earnings were released on Oct. 7 by New Politics Alliance for Democracy lawmaker and National Assembly Strategy and Finance Committee member Choi Jae-sung, and they are shocking. Of the 11.3 trillion won (US$10.6 billion) total earned in stock dividend income, the top one percent of earners accounted for 72.1%. For the top 10%, that share rises to 93.5%. The top one percent also made 44.8% of the 24.9 trillion won (US$23.4 billion) in total interest earnings; the top ten percent took 90.6%. The source of both kinds of earnings lies in financial assets like stocks and deposits. With so many financial assets confined to the top 10% of earners, it makes complete sense for them to dominate so much of the resulting income.

In the past, the issue of inequality in the South Korean economy has been characterized more by divisions of opinion than by anything in the way of productive debate. Earned income is relatively transparent, but accurate information on asset income has been difficult to come by. What Rep. Choi unveiled this week has strong implications: it gives hard numbers to confirm the income imbalance arising from non-real estate financial assets. It’s very likely that the household incomes reported in Statistics Korea surveys are underreported the higher we go up the income ladder. National Tax Service figures on interest and divided earnings are much more accurate gauges.

As valuable as these data are, we also need to understand the causes and figure out an appropriate response. Imbalances in financial assets are as severe as many researchers have feared. In his book “Capital in the Twenty-First Century,” the French economic Thomas Piketty warns that once the ratio of asset (capital) income to national income grows past a certain point, income equality races out of control and saps economic vitality. Even if things don’t go exactly as his theory predicts, the image of an economy where money earns money at a faster rate than working does is enough to frighten anybody.

If we really want to correct this imbalance in the overall income distribution structure, the answer is clear: make the tax system as a whole more progressive, and increase taxes on financial earnings. The South Korean government, for its part, needs to abandon the plan for increasing dividend income that it recently submitted to the National Assembly. It would just be another tax break for the rich at a time when the dividend earning imbalance is already beyond the pale.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 4Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 5Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 6No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 7[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 10Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report