hankyoreh

Links to other country sites 다른 나라 사이트 링크

[Column] Could everyone, please, stop sucking up to Samsung?

In Samsung’s case, it makes some sense. After all, it has to do with the leader of their group. But when it comes to the media, this kind of behavior is ridiculous.

It’s nothing new for South Korea’s media to sing the praises of Samsung. But it’s increasingly becoming too painful to watch.

There’s no sign of even the bare minimum of objectivity or balance. It’s like Samsung and the media are now one and the same. And that seems to have less to do with Samsung’s demands as their biggest advertiser — and more to do with them viewing the world through Samsung’s eyes, to begin with.

The generosity certainly is laudable. In addition to the 12 trillion won (US$18.84 billion) in inheritance taxes they are paying, Samsung Vice Chairman Lee Jae-yong and other family members of the late Lee Kun-hee have agreed to contribute another one trillion won (US$903.1 million) for use in responding to infectious diseases and treating children with rare conditions, and to donate 23,000 cultural properties and works of art to the National Museum of Korea and National Museum of Modern and Contemporary Art, Korea.

The donations of cultural properties and art are particularly meaningful, as those personal collection items are being provided as a legacy to the people of South Korea.

But there are two sides to both the 12 trillion won in inheritance taxes and the trillion won in contributions. Yet, for the most part, South Korea’s media haven’t so much as mentioned the issues that surround them.

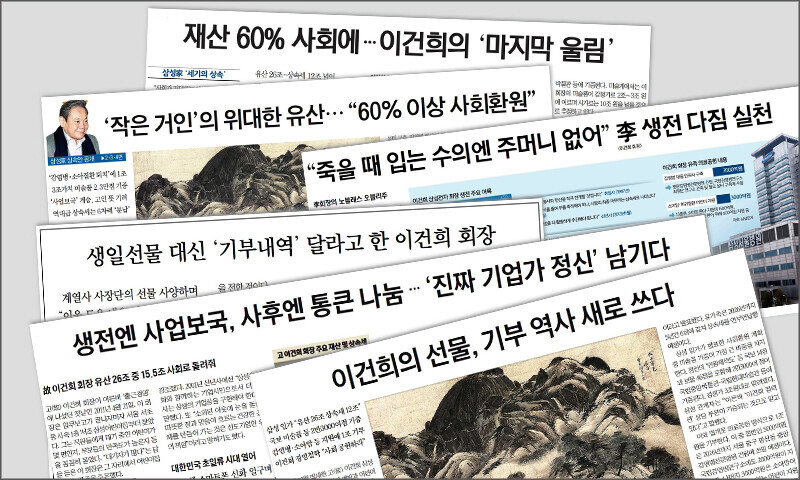

Instead, we hear nothing but praise. “Enriching the country while he was alive, generously sharing after his death,” they write of Lee Kun-hee, lauding the “great legacy of a small giant,” the “final reverberations with 60 percent of his fortune given back to society,” and the “gift that rewrites the history of donations.”

The inheritance tax bill of 12 trillion won is the largest in South Korean history. It’s three to four times the annual total of inheritance taxes in South Korea.

But there is a darker history behind it, with Lee Jae-yong assuming the management reins of the vast Samsung group through more than 20 years of exploiting inheritance loopholes, starting with the allocation of Everland convertible bonds at below-market prices in 1996.

It’s a lot more than 12 trillion won in inheritance taxes could ever make up for — a tax-free transmission of wealth. Lee is currently in prison after being convicted in connection with a government influence-peddling scandal, and he is also being tried on charges related to illegal succession tactics.

Lee Kun-hee’s posthumous donation of one trillion won is also rooted in illegal activities. On April 17, 2008, the Samsung special prosecutor indicted him after discovering that he owned 4.5 trillion won in borrowed-name assets, using 1,021 accounts created in the names of 486 employees.

Five days later, Lee delivered an apology to the South Korean public. In it, he pledged to “pay the missing taxes from the borrowed-named assets, which have been converted to my own name, and use the remainder for ‘beneficial works.’”

In August 2009, Lee received a finalized sentence of three years in prison suspended for five years on charges of tax evasion and breach of trust. Yet the media have been ignoring the darkness and focusing solely on the light.

Remember the good, forget the badConsider an “exclusive” article published by the Dong-A Ilbo on April 20 under the title “Chairman Lee Kun-hee requests ‘lists of donations’ in lieu of birthday gifts.” It relates how in 1991, Lee began asking the presidents of Samsung affiliates to list their donation activities rather than giving him gifts on his birthday.

“Family members and acquaintances describe how he would eagerly await these special ‘birthday gifts’ every year, beaming like a young child whenever he received them,” the article read. Was this a reporter or a hagiographer?

The distortions have been legion as well. For an example, see the Chosun Ilbo editorial on Thursday titled “A country where the commander of the ‘semiconductor war’ receives inheritance tax loan counseling from prison.”

“Most of the advanced economies reduce the tax rate or offer tax deduction benefits when the family members of a major shareholder assume control of a company,” it said. “In Germany, the inheritance tax rate falls to 4.5 percent when these benefits are applied. In Japan, there is a system that defers or waives inheritance taxes for family business inheritance situations.”

This editorial uses the family business inheritance tax deduction system as a basis for arguing that Samsung would have received a major reduction of its taxes had it been a German or Japanese company. This is false.

In Germany, a company with assets of 26 million euros (US$31.29 million) or more must undergo a government review to benefit from family business inheritance deductions. Anything in excess of 90 million euros (US$108.34 million) is ineligible for deductions. In Japan, the system applies exclusively to small businesses that are not listed.

South Korea also has a family business inheritance tax deduction system: taxes are reduced for small to medium-sized businesses with annual sales of 300 billion won (US$267.58 million) or less. As of 2000, the Samsung Group possessed assets of 425 trillion won (US$3.79 billion), with sales of nearly 400 trillion won (US$3.56 billion). It’s a bogus argument.

Pointing at the 12 trillion won in inheritance taxes, one South Korean news outlet howled Thursday about the need to “do something about our anachronistic inheritance tax system.” That same day, US President Joe Biden announced plans to raise taxes for his country’s wealthy.

“It’s time for corporate America and the wealthiest 1 percent of Americans to just begin to pay their fair share,” he declared.

With the aims of ensuring enough finances to overcome the pandemic and easing the economic inequalities exacerbated by it, he announced plans to raise the maximum corporate and capital gains tax rates. It’s not just the US: the UK, Germany, and other major countries of Europe have also moved to raise taxes for the rich. South Korea’s media need to open their eyes and ears.

It’s clear what direction these paeans are all pointing. They want to make a case for pardoning Lee Jae-yong.

In the past, these same news outlets pointed to the “semiconductor crisis” as they insisted that Lee be given the “opportunity to contribute to the national economy.” Since the inheritance tax announcement, they’ve begun simply demanding a pardon as “the right thing for the state to do to show its magnanimity toward a businessman who did his best.”

They’re even claiming that Lee Jae-yong is a “political scapegoat” and that it’s “bizarre for him to be in prison in the first place.” Samsung has not broached the topic of a pardon, at least officially. Perhaps it’s because the media have gone above and beyond their expectations in voicing their position for them.

Let’s look at another piece, this time a Thursday column in the JoongAng Ilbo titled “The politics of the Lee Jae-yong pardon question.”

“With a single decision, a great leader leaves his mark on the hearts of the public,” it said. “This may be President Moon Jae-in’s last chance. Hopefully, he can transcend partisanship and save the country.”

The claim is that pardoning Lee Jae-yong represents Moon’s last chance to save South Korea. Is Lee supposed to be Admiral Yi Sun-sin now?

In the 2015 movie “Veteran,” there is a line spoken by the main character Seo Do-cheol to a fellow detective defending the illegal activities of a third-generation chaebol family member.

“We may be broke, but we have pride. Don’t do something that’ll make you look like a fool when you’re walking around in handcuffs,” he says.

Doesn’t it bother them? They should be ashamed of themselves. Let’s keep things reasonable.

By Ahn Jae-seung, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0517/8117159322045222.jpg) [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later

[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence- [Editorial] Yoon must stop abusing authority to shield himself from investigation

- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

Most viewed articles

- 1[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- 2[Exclusive] Unearthed memo suggests Gwangju Uprising missing may have been cremated

- 3[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 4Xi, Putin ‘oppose acts of military intimidation’ against N. Korea by US in joint statement

- 5[Column] When ‘fairness’ means hate and violence

- 6[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner t

- 7Spotlight turns to Hyundai Group Chairwoman’s visit to North Korea

- 8China, Russia put foot down on US moves in Asia, ratchet up solidarity with N. Korea

- 9‘Shot, stabbed, piled on a truck’: Mystery of missing dead at Gwangju Prison

- 10Records show how America stood back and watched as Gwangju was martyred for Korean democracy