hankyoreh

Links to other country sites 다른 나라 사이트 링크

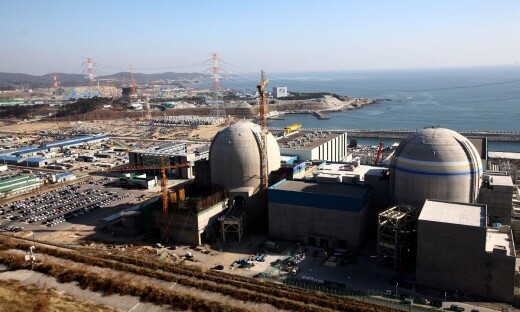

KEPCO consortia UAE nuclear power plant budget examined

The winning bid by a consortium led by the Korea Electric Power Corporation (KEPCO) to build a nuclear power plant in the United Arab Emirates (UAE) has prompted rosy predictions about future power plant exports for South Korea. However, while nuclear power gains prominence as an emergency measure for addressing the energy crisis and climate change, experts are contending that its strengths and weaknesses need to be examined more closely.

A primary area being reviewed is the optical illusion generated by bid announced by the KEPCO consortium, which has projected 40 billion dollars as the projected cost for the UAE order. The issue is linked with the profitability of nuclear power itself. The only definitive figure in the order is the 20 billion dollars required for the plants’ design and construction. The plant’s operation, which accounts for the remaining 20 billion dollars, requires an additional contract with the UAE. An official with the Ministry of Knowledge Economy says this includes the cost for nuclear fuel supplies, plant repairs, maintenance and equipment supplies, and that the announced 20 billion Won figure was an estimate.

A securities company analyst who spoke on the condition of anonymity said, “When you enter into a nuclear power plant project, your profit structure is only secure when nuclear power sales are in tandem with construction, however, this nuclear power plant contract has nothing about nuclear power sales in it.” The analyst added, “KEPCO says it is bringing in profits on management consultation, but we have no idea whether that will be a 1 percent or 10 percent profit margin.” The analyst indicated that it was impossible to know whether KEPCO’s estimate of 20 billion dollars will be borne out.

One KEPCO official says that nuclear power sales could generate a profit or a deficit depending on how the unit cost is set. The official noted, “Due to factors like security issues, there are almost no cases of nuclear power sales being entrusted to a foreign company.”

Analysts say while the nuclear power plant model was competitive, an agreement for a comprehensive economic cooperation relationship established between South Korea and the UAE played a critical part in securing South Korea’s bid. They point out that this assumption of a promise of unstinting support from the South Korean government may become a burden to South Korea in the future when bidding on contracts with other countries that may be looking for a repeat in conditions.

One Ministry of Knowledge Economy official said, “The UAE has a long-term development strategy called ‘Abu Dhabi 2030,’ which at its heart is about finding a way for its citizens to make a living besides petroleum.” The official added, “South Korea has the know-how from achieving development in areas like semiconductors, shipbuilding and aviation quickly within three decades and it looks like the UAE found that attractive.”

Yoon Soon-jin, a professor of energy policy at the Seoul National University Graduate School of Environment Studies, said, “We are hearing predictions about how nuclear plant construction will increase worldwide.” Professor Yoon added, “However, these are just the predictions and expectations of the nuclear power industry, whereas countries within the European Union and Japan have experienced a rough time with nuclear power plant construction due to residents’ objections and conflicts with international environmental policy.”

Yoon cautioned, “While it may look as though nuclear power is encountering a ‘second renaissance,’ the government needs to examine the situation carefully.”

Please direct questions or comments to [englishhani@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 3No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 4Samsung subcontractor worker commits suicide from work stress

- 5[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 6Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 7N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9Flying “new right” flag, Korea’s Yoon Suk-yeol charges toward ideological rule

- 10[Column] Park Geun-hye déjà vu in Yoon Suk-yeol