hankyoreh

Links to other country sites 다른 나라 사이트 링크

Korean electronics makers learn from Japanese behemoths’ collapse

By Kim Jin-chul, staff reporter

Lee Kun-hee, chairman of Samsung Electronics, retuned home on Nov. 3 from his sixth visit to Japan this year. Explaining his frequent visits to the country, Samsung said, “He’s been reflecting on management strategies and business ideas while meeting his Japanese business acquaintances.”

It is impossible to talk about Samsung Electronics without Japan. Since its establishment of 1969, Samsung Electronics had established a foothold through a joint venture with Japan’s Sanyo Electric and Nippon Electric Company, and the full-fledged leap into the semiconductor business was made public through the so-called “Tokyo Declaration,” in 1983, when founder and then-chairman Lee Byung-chull declared Samsung would become a dynamic random access memory (RAM) vendor.

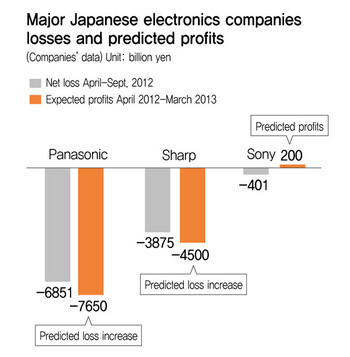

While Samsung Electronics has come into its own as a world-class business, the Japanese electronics sector, which has served as a teacher for the South Korean electronic giant, has “fuses blown” (as a Financial Times Lex column proclaimed on Nov. 2). The big three - Panasonic, Sharp, and Sony - which buoyed Japan as the kingdom of electronics, are now collapsing. Panasonic is expected to record losses of 765 billion yen (US$9.6 billion) between April 2012 and March 2013. Posting huge losses for the second year in a row, the company is in danger of in just two years losing the profits it accumulated over the last 20 years. Panasonic President Kazuhiro Tsuga said, “We’ve failed in our main divisions, including TVs.”

Sharp is expected to record its biggest-ever loss of 450 billion yen (US$5.6 billion) this year. Sony posted a streak of seven quarters in the red, recording losses of 40.1 billion yen (US$514 million) between April and September this year. Sony is holding out for a return to profit of 20 billion yen this year, but the outlook is not so rosy. According to the tally by from S&P Capital IQ, the big three are expected to post 3.7 trillion yen in net losses for over the last five years, a sum equivalent to the profits they had accumulated over the previous 18 years. For this reason, Standard & Poor lowered Panasonic’s credit rating to “BBB” from “A-” on Nov. 2, while Fitch also issued Sharp a six-notch reduction to “B-,” which means investment in the company is not considered safe, from its previous rating of “BBB-”.

The reason for downfall of the Japanese electronics giants, who once led the industry, is cited as the so-called ‘Jalapagos’ phenomenon. This implies the Japanese manufacturing sector has focused on domestic consumption since 1990s and isolated itself from the global market like the Galapagos Islands in the South Pacific. “Jalapagos” is a term coined to indicate that Japanese electronic businesses turned their eyes away from world trends and cut themselves off from the outside, losing their global competitiveness.

Panasonic built the world’s largest plasma display panel (PDP) plant in 2009, seeing PDP as a future flagship in the TV market. As liquid crystal display (LCD) become the trend, however, Panasonic was forced to close the plant. Sharp spent more than 1 trillion yen building the world’s largest LCD plant but is now trying to sell the plant to Taiwan’s Hon Hai (also known as Foxconn). Sony also established a joint venture S-LCD with Samsung Electronics to supply LCD for TV, but pulled out of the partnership at the end of last year. Analysts pointed out it was a misjudgment to make a large-scale investment in the television sector, in which latecomers compete by moving units at low prices.

The Japanese companies and some analysts have maintained that the strong yen had killed the competitiveness in exports. They claim that as one dollar hit 100 yen, showing a weak yen trend against dollar in the mid-2000s, the companies misjudged the “weak yen age” would continue and invested in domestic production facilities, but the value of the yen grew against dollar to the range of 70 yen, causing them to lose their export competitiveness. The “Financial Times,” however, reported that the growth rates of sales by the big three over the last 10 years stopped at a mere 2%, so their troubles actually began when the yen was much weaker than it is now.

Samsung Electronics has snatched the lead in the semiconductor and the smartphone markets and is achieving strong results, but some people pointed out that Samsung should learn a lesson from the Japanese electronic behemoths’ collapse. Faced by the aggressiveness of the Chinese latecomers, Samsung is feeling a growing sense of crisis. It also feels the need to create the market and become a pacesetter rather than trying to catch up with the market as it is. This is why business observers are paying close attention to Lee Kun-hee’s frequent trips to Japan.

LG Electronics is overflowing with a sense of crisis because it fell a step behind in its response to the smartphone market. Chairman Koo Bon-moo repeatedly stressed this year, “To become a frontrunner in the market, we have to strengthen responsible management and integrated capabilities of affiliates while applying for a strict performance-based system.”

An industry insider said, “It’s true that Korean companies are boasting global competitiveness in the TV and smartphone markets, but still they have to catch up with the speed of rapid change in the electronic industrial sector. It is high time for them to blaze their own trail in the market. The collapse of Japanese electronic firms is not just somebody else’s worry.”

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2N. Korean hackers breached 10 defense contractors in South for months, police say

- 3Thursday to mark start of resignations by senior doctors amid standoff with government

- 4[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 5Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7[Editorial] Japan’s rewriting of history with Korea has gone too far

- 8[Cine feature] A new shift in the Korean film investment and distribution market

- 9[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 10[Column] The clock is ticking for Korea’s first lady