hankyoreh

Links to other country sites 다른 나라 사이트 링크

For S. Korean businesses, China patent blitz is a clear and present danger

In 2010, a small South Korean business had just begun selling a touch recognition smartphone glove on the Chinese online shopping mall Alibaba when it unexpectedly started receiving notices of patent infringement.

They had been sent all at once by three to four Chinese businesses and individuals who claimed to hold utility model patent rights to the glove. The business received notice that Alibaba had unilaterally cancelled their sales contract. Realizing only now that it was under attack, the company turned to a corporate legal team to wage a patent battle.

In the end, it had to shut down its glove business. There were simply too many Chinese rivals to fight, and the company opted to give up rather than go through a formal patent dispute that would leave it shouldering huge costs in time and money. The seeds of the disaster lay in its failure to apply for a utility model patent in China first. Now it was too late.

For many South Korean businesses in China, the looming patent risk is becoming a clear and present danger.

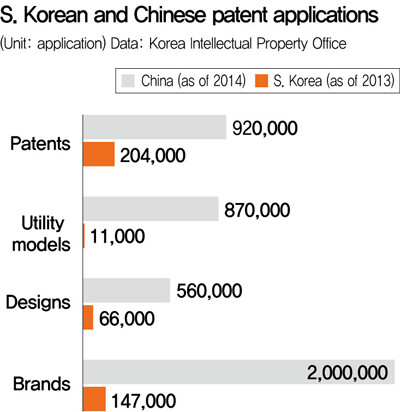

In 2011, China overtook the US to become the world‘s single biggest holder of patent applications. According to the Chinese State Intellectual Property Office (SIPO), the country had a total of around 4.4 million applications for intellectual property rights registered as of last year. The list included 920,000 patents, 870,000 utility models, 560,000 designs, and some two million brands. As of November 2014, it had cumulative totals of over five million patent applications (74% from domestic sources, 26% from international ones) and 1.5 million patents registered.

The numbers clearly signal just how big - and aggressive - China’s patent applications and registrations have become. This is in sharp contrast with South Korea, where the total number of intellectual property right applications (including patents, utility models, designs, and brands) stood at a comparatively tiny 430,000 last year. The Chinese total amounts to 3.91 million patent and utility model applications between 1948 and 2013 - a number that shoots to 7.84 million (with 3.87 million actual registrations) when designs and brands are factored in.

With all the applications and registrations in China, it has become difficult to know exactly who filed an application, or for what kind of protection. Ahead of the technology competition for source patents, the Chinese behemoth is becoming a chilling threat with the sheer weight of the patents it claims.

“In some cases, Chinese businesses and individuals who have the money will buy up patent rights from overseas,” explained Lee Jae-hwan, senior researcher at the Institute for Information and Communication Technology Promotion (IITP).

“The explosive growth of patents in China means that South Korean businesses have to nail down lots of technology patents, or else they could get caught up in a patent battle,” Lee explained.

As the glove example illustrates, the most pressing of the Chinese patent threats has to do with utility models, which cover a product’s shape and structure. The Chinese system accepts patent applications and grants registrations for utility models after the simplest of reviews. It’s a process that goes some way in explaining how the number of utility model applications reached 870,000 last year - compared to 10,000 in South Korea. South Korean businesses applied for just 254 utility model patents in China last year.

“Utility models come with a big patent infringement risk because of the similarities between protects, and there’s a huge potential for the holders of all these utility model rights in China to file suit indiscriminately against foreign businesses in China for patent infringement in order to get money from them,” explained Lee Jong-gi, secretary of the international cooperation division at the Korean Intellectual Property Office (KIPO).

“A lot of smaller South Korean businesses that are facing utility model disputes in China are not reporting it to KIPO because they’re worried about the consequences from their Chinese accounts,” Lee added.

While dominant in terms of sheer numbers, the Chinese source patents still lag behind South Korea, the US, and Japan in the level of technology - as signaled by the fact that just 2.5% of all patent applications in China for 2013 came from overseas sources (i.e., South Korea, the US, and Japan).

But the knowledge is of little comfort to many businesses.

“Imagine not knowing which cloud the rain is going to fall from, or a war where you don’t know when the bombs will drop,” said Song Sang-yeop, director of the IP Licensing and Transaction Center. “That’s what it’s like South Korean businesses when China is holding this gigantic number of patents.”

Besides the source patents, the total number of patents held can also be a major factor in rulings on patent disputes. It’s another reason many are scared of the Chinese patent blitz.

Larger corporations typically having divisions dealing exclusively with Chinese patents. Smaller businesses, in contrast, are almost completely exposed.

“There are around 6,000 patent agents in South Korea, and less than ten of them are China experts who can speak Chinese,” said Yoo Seong-won, chief patent agent for Jeeshim IP & Company.

“Companies are now looking for patent agents who specialize in Chinese patents, but there just aren’t enough to go around,” Yoo added.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 4Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 5Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 6No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 7[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 10Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report