hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korean companies suffering heavy losses due to THAAD retaliation

Chinese economic retaliation for the THAAD deployment is driving South Korean companies in China to the brink, with many now moving to sell off or restructure their business ventures. Companies that previously sought to make inroads into the vast Chinese market are seeing their efforts potentially go up in smoke amid a wholesale crisis of THAAD retaliation and anti-South Korean sentiment. Experts are calling for Seoul to set up a dialogue channel with Beijing to search for a resolution.

According to accounts from industry insiders on Sept. 18, the area hardest hit by the retaliatory measures are retail, automobiles, and confectionaries, all of which involve direct dealings with local customers. Lotte, which provided the site for the THAAD deployment, has taken a direct hit. Snowballing losses have led Lotte Mart to move to sell off its 112 stores in China. Other Lotte affiliates are also weighing restructuring of their Chinese ventures. A Lotte source said the group “isn’t considering a pullout for anything but Lotte Mart,” but reported that it is “considering restructuring measures such as local staff cuts.” Some are predicting local corporations for Lotte Confectionery and Lotte Chilsung Beverage Company could end up for sale.

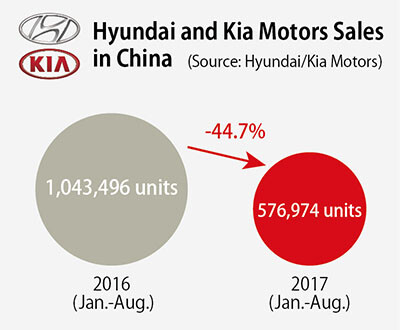

Hyundai and Kia Motor’s Chinese sales have also plummeted by nearly half, sparking fears they could end up as a “second Lotte Mart.” Cumulative sales between January and August (576,974 vehicles) were down 44.7% from the same period in 2016. The Chinese Communist Party newspaper People’s Daily and its sister publication Global Times reported on Sept. 6 that the BAIC Motor, Hyundai’s Chinese partner, was even considering ending its relationship with the Beijing Hyundai joint venture. The Beijing Hyundai partnership currently consists half-and-half of investment by Hyundai and BAIC.

A Hyundai Motor source said the reports “appear to be the Chinese state-run media’s way of pressuring South Korean businesses,” adding that the automaker has “no plans whatsoever” to end the venture.

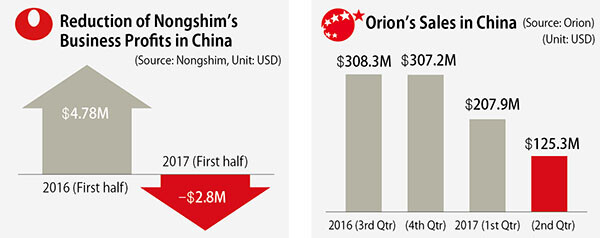

Food and cosmetics companies are facing a similarly tough situation. Orion’s sales in China plunged from 348.4 billion won (US$308.3 million) in the third quarter of 2016 to 141.5 billion won (US$125.3 million) in the second quarter of this year, prompting it to cut around 20% of its 13,000 local positions. Amorepacific’s second quarter operating profits dropped to 130.4 billion won (US$115.5 million) amid the THAAD retaliation measures, or less than half their level for the same period last year. LG Chem and other electric car battery makers are also taking a hit from being denied eligibility for Chinese government subsidies. An industry source said their operation rate was “at around half,” adding that they “can’t afford to give up on the huge Chinese market” and are “holding out.”

Experts are calling on Seoul to take proactive steps to fix the situation.“Uncertainties stemming from the ‘THAAD risk’ continue to grow, and there isn’t any solution from the standpoint of private businesses,” said Hyundai Research Institute senior fellow Han Jae-jin.

“They need to hurry up and set up a channel for senior-level dialogue between South Korean and Chinese trade and diplomatic authorities, which is currently pretty much out of commission,” Han urged.

“We’ve been putting a lot of effort into the China market for a long time with things like the South Korea-China FTA, and the losses there could grow in the future as more and more businesses give up on the market like Lotte Mart,” he worried.

Korea Institute for Industrial Economics & Trade (KIET) senior research fellow Cho Chul predicted, “If the two sides are seen cooperating on a senior trade channel, it could send the signal to Chinese consumers that it wouldn’t be a problem for them to start buying South Korean again.”

The South Korean government has yet to come up with any effective response since giving up on the idea of taking the THAAD economic retaliation issue to the World Trade Organization (WTO). Beijing is currently focused on the Communist Party of China National Congress on Oct. 18, complicating efforts to set the stage for dialogue.

“China’s political system is a lot different from ours. It isn’t going to move readily in response to our calls for dialogue on THAAD,” said a trade official.

The current plan is to wait for the political climate in China to change following the Congress, after which Seoul will begin full-scale negotiations on service market openness, using that as an opportunity to seek a way out of the situation. But with China’s political calendar packed with important events through next March, things could end up dragging out without any opportunities for dialogue.

In the absence of any silver bullet solutions, Seoul has been focusing on providing support to companies working in China, including discounted overseas project financing insurance premiums for those that relocate their production bases from China to a third country. It is also pushing supply chain diversification policies aimed at finding and supporting alternative markets in North America and India for South Korean automobile parts companies currently in China.

By Kim So-youn and Cho Kye-wan, staff reporters

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 3[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 4Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 5Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 6No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 7S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 8The dream K-drama boyfriend stealing hearts and screens in Japan

- 9[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 10Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?