hankyoreh

Links to other country sites 다른 나라 사이트 링크

Semiconductor industry insiders calls for less dependence on Japanese imports

The Japanese government’s announcement that it will impose export controls on three materials used by South Korean semiconductor and display manufacturers has prompted calls to reduce the dependence on imports of Japanese materials and to increase the competitiveness of the domestic materials industry, which has been regarded as a weak point of the South Korean economy.

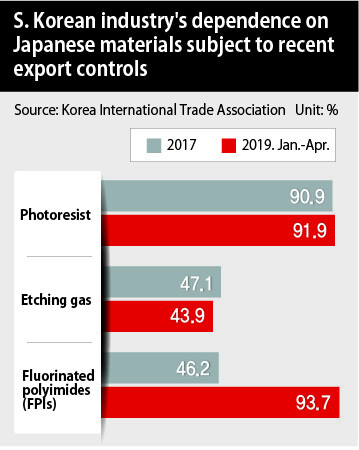

According to figures released by the Korea International Trade Association on July 2, South Korean companies imported US$112.66 million worth of photoresist, an essential material in semiconductors, through May of this year, with 91.9% of those imports coming from Japan. These companies also imported US$12.96 million worth of fluorinated polyimides (FPIs), used in the production of smartphone displays, with 93.7% of those imports from Japan. The dependence on Japan for FPIs fell to 46.2% in 2017 before shooting up again more recently.

These companies have managed to achieve some degree of import diversification in the case of etching gas (high-purity hydrogen fluoride), which will be subjected to import controls along with the other two materials. During the first five months of this year, Japan accounted for 43.9% of etching gas imports (valued at US$64.78 million), followed by China at 46.3% and Taiwan at 9.7%. South Korean companies had been highly depended on Japan for this material, which is used in the semiconductor production process, with 72.2% of imports sourced there in 2010. Over the past five years, however, the dependency rate has dropped below 50%.

Industry sources argue that this crisis should be viewed as an opportunity to focus efforts on strengthening the competitiveness of the domestic materials industry and to build a semiconductor ecosystem in which smaller and mid-sized companies work together with larger conglomerates. Semiconductors and displays are some of South Korea’s flagship industries, ranking first and fourth in export volume last year, at US$126.7 billion and US$24.9 billion, respectively. Growth has been led by major companies such as Samsung Electronics, SK Hynix, Samsung Display, and LG Display.

While observers have continued to argue that the domestic materials industry needs to be strengthened because of the high dependence on imports, little progress has been made toward that goal. A special law was even passed in 2001 to assist companies specializing in parts and materials as part of a scheme to reorient trade on that industry, but that’s now regarded as an empty slogan. “There’s a reason why Japan is so dominant in the global chemical market, including semiconductor materials. Some South Korean companies are engaged in the market, but they haven’t been able to catch up to Japan’s technological prowess yet,” said a source in the semiconductor industry.

Analysts call for an overhaul of the industrial structure, and especially its focus on short-term profit, and for a push to set up domestic production of major parts and materials. “Materials research takes time and money. Given the vertical integration of domestic industry and its orientation on the chaebols, it hasn’t been easy for smaller enterprises to invest in developing their own technology and move into production, as Japanese companies have done. Since semiconductor firms have been importing the materials they need, the fact is that the chemical-oriented conglomerates have been looking to other areas as a source of profits. Considering that the industrial structure’s focus on short-term profits under the fast follower strategy has reduced interest in innovation and increased our dependence on other countries for key parts and materials, we need to take this as an opportunity to spur domestic production of semiconductor materials and revamp the industrial structure,” said Lee Hang-gu, a senior analyst at the Korea Institute for Industrial Economics and Trade.

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 3[Column] Has Korea, too, crossed the Rubicon on China?

- 4[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 5Samsung barricades office as unionized workers strike for better conditions

- 6All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 7US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 8Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 9[Photo] Smile ambassador, you’re on camera

- 10[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes