hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean parts and materials industry sandwiched between Japan and China

With the Moon Jae-in administration pushing for South Korea to shed its reliance on Japan for key parts and materials as a fundamental response to Tokyo’s export controls, warnings are sounding that South Korea’s parts and materials industry could end up “sandwiched” between Japan and China at the current rate.

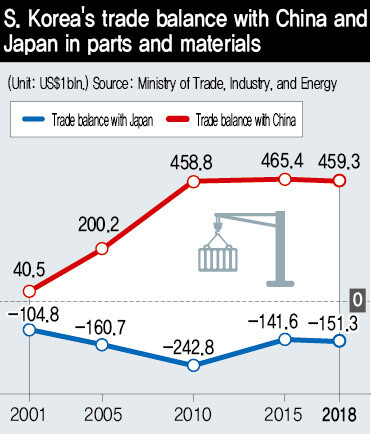

According to the Ministry of Trade, Industry and Energy (MOTIE) on July 15, South Korean exports of parts and materials registered an all-time high of US$316.2 billion last year thanks to the semiconductor boom. The balance of trade in parts and materials also clocked in a high of US$139.1 billion. But the parts and materials trade balance with Japan last year was in the red by US$15.13 billion – accounting for 63% of the US$24.08 billion trade deficit with Japan in 2018. The numbers showed reliance for parts and materials to be the chief factors in the longstanding trade deficit with Japan.

Since the 1990s, the South Korean government has been working steadily to remedy its chronic dependence on Japan for parts and materials. Over a five-year period starting in 1991, it provided technological support through the announcement of around 400 parts and materials targeted for domestic production. In 2001, it launched a 10-year, 1.4 trillion won (US$1.19 billion) support effort for technological development with the enactment of the Act on Special Measures for the Promotion of Specialized Enterprises, etc. for Component and Material. In 2010, it pursued an ambition plan to invest 10 trillion won (US$8.5 billion) – 1 trillion won (US$849.16 million) a year for 10 years – through a project for the domestic production of 10 major types of materials. The amount of support has since dropped due to budgetary issues, but the efforts have led to domestic production of parts and materials for automobiles and displays.

As the Japanese export control situation shows, however, South Korea remains dependent on Japan for key parts and materials in crucial industries including semiconductors and displays. Business community sources agreed that in addition to electronics, the situation is similar for other areas such as automobiles.

“They’re talking about a domestic production rate over 99% for automobile industry parts, but that’s based solely on complete vehicles,” a Hyundai Motor Group senior official said.

“Once you get to the level of the SMEs supplying components, there’s a far greater reliance on Japan for key parts and materials,” the official explained.

An executive from one of South Korea’s top 10 conglomerates said, “We depend on Japan for hundreds of sensors that go into the various control devices in automobiles.”

While disparities with Japan remain in the area of key components and materials, the shrinking lead over China’s pursuit is raising concerns that South Korea could end up “sandwiched.” In 2015, Chinese President Xi Jinping announced “China Manufacturing 2025” as part of an ambitious plan to turn China into a manufacturing power. One of its key goals was an increase in the self-sufficiency rate for manufacturing businesses. China plans to increase the domestic production rate for key technology components and basic materials for 10 core industries to 70% by 2025. Last year, South Korean parts and materials exports to China totaled US$101.1 billion, with a positive trade balance of US$45.93 billion in parts and materials with China. The past situation has been one where South Korea has made money in China and spent it in Japan.

But if China’s competitiveness in parts and materials grows over the intermediate to long term, the situation spells another crisis for South Korea. The German think tank MERICS concluded that South Korea stood to “lose out the most from China Manufacturing 2025.”

Woo Tae-hee, a special appointment professor at Yonsei University and former second vice minister of trade, industry and energy, said the fostering of the component and material industries will require “some time for building.”

“Most of the Japanese and German ‘hidden champions’ with global competitiveness have long histories behind them,” he noted.

Woo also stressed that the “relationship between large corporations and SMEs in South Korea needs to be improved into a model of shared growth and cooperation.” Indeed, cooperation among industries has been cited as one of the secrets behind Japan’s strength in components and materials.

By Kwack Jung-soo, business correspondent

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 6Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 7[Column] The clock is ticking for Korea’s first lady

- 8New AI-based translation tools make their way into everyday life in Korea

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10[Column] Are chaebol firms just pizza pies for families to divvy up as they please?