hankyoreh

Links to other country sites 다른 나라 사이트 링크

Memory semiconductor prices rebound in wake of export controls

There are signs of a rebound in the price of memory semiconductors, such as DRAM and NAND flash, which have been in a downward spiral. This appears to reflect market insecurity about growing concerns that the Japanese government will retain its export controls on semiconductor components and impose additional controls as well.

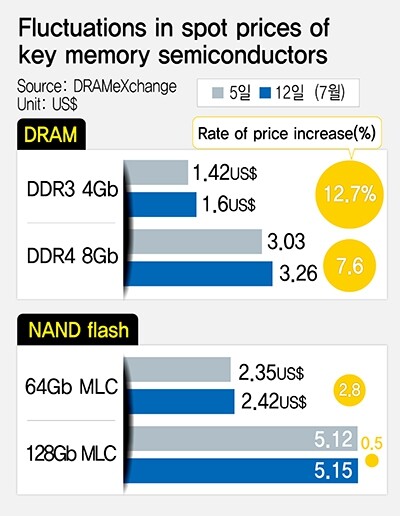

According to data provided by semiconductor market research organization DRAMeXchange on July 15, DDR 8Gb DRAM, a memory semiconductor generally used in computers, finished trading last week at a spot price of US$3.26, an increase of 7.6% from the previous week. The spot price for DDR3 4Gb also posted a 12.7% weekly increase, reaching US$1.60 on July 12.

The spot prices of NAND flash semiconductors are on the rise as well. Although most of the memory semiconductors at Samsung Electronics and SK Hynix are traded for fixed prices that are set for a limited period of time, it’s possible to ascertain trends to a certain extent by tracking daily spot prices.

These changes are thought to result from action taken by the Japanese government on July 4 to tighten customs regulations on the exports of materials that are necessary for the manufacture of semiconductors, including high-purity hydrogen fluoride and photoresist, triggering a purchasing mentality. Samsung Electronics and SK Hynix maintain that they’ve “avoided the worst-case scenario” by securing an alternative supply of high-purity hydrogen fluoride that can tide them over during the delay caused by Japan’s tougher screening of exports. The companies also said that the restrictions on photoresist won’t cause immediate problems, since the specific type being restricted (photoresist with a wavelength of less than 193 nanometers) isn’t even being used in South Korea’s production of memory semiconductors. But the extreme ultraviolet lithography photoresist that’s included in the first round of restrictions is used in making non-memory semiconductors, which could impact Samsung Electronics’ future operations.

Even so, fears that Japan will impose further regulations on exports to South Korea, such as by removing it from its “white list” of countries that receive preferential treatment, are impacting the price of memory semiconductors. While analysts had been pushing back the timing of the expected rebound in memory semiconductor prices to the third or fourth quarter of this year or the first half of next year, this crisis seems likely to serve as an opportunity to reduce inventory and raise prices. While there are also predictions in the market that Samsung Electronics and SKY Hynix will cut production of memory semiconductors, the two companies have officially issued denials. Other analysts think that dealers in the spot market are exploiting Japan’s export controls to artificially manipulate the asking price.

“If people start to think that the export control issue will become protracted, potentially causing a disruption to the production of DRAM or an adjustment of capacity utilization, buyers will want to stockpile semiconductors before prices go up,” said Yu Jong-woo, an analyst with Korea Investment and Securities.

“My forecast is that the NAND flash industry will embark on a gradual recovery. Samsung Electronics and SK Hynix are expected to see better performance in NAND flash beginning in the third quarter of this year,” said Choi Do-yeon, an analyst with Shinhan Investment Corporation.

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 2Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 360% of young Koreans see no need to have kids after marriage

- 4[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 5After 2 years in office, Yoon’s promises of fairness, common sense ring hollow

- 6S. Korean first lady likely to face questioning by prosecutors over Dior handbag scandal

- 7AI is catching up with humans at a ‘shocking’ rate

- 8[Column] The state is back — but is it in business?

- 9[Column] Why Korea’s hard right is fated to lose

- 10‘Weddingflation’ breaks the bank for Korean couples-to-be