hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea officially decides to pursue “corresponding measures” against Japan

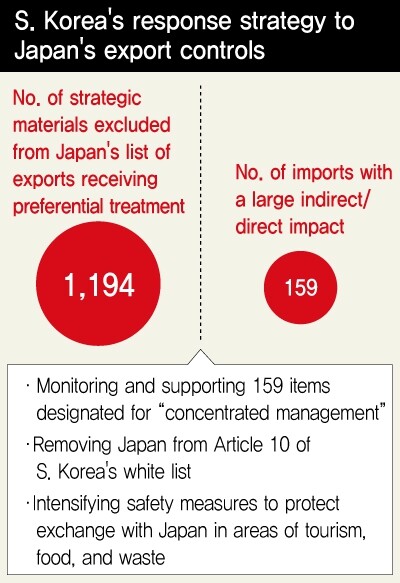

The South Korean government’s official decision on Aug. 3 to pursue “corresponding economic measures” against Japan, including its removal from South Korea’s “white list” of countries receiving expedited export reviews, has observers watching to see what specific response plan emerges. While Seoul is currently weighing response measures that extend beyond strategic items into areas such as tourism, food, and waste, analysts are calling for a practical and carefully calibrated approach to avoid a potential boomerang effect on the South Korean government and businesses.

To begin with, the white list removal measure signals that South Korea will begin implementing tougher export reviews for Japan in the area of strategic items. South Korea currently has an “A” region of 29 countries that are parties to four international control regimes on strategic items, including the Wassenaar Arrangement, with simplified export review procedures for South Korean businesses exporting strategic items to this region. All countries outside of the “A” region fall into the “B” region, where companies exporting to these countries must receive individual permits rather than three-year bulk permits from the government. While exports to the “A” region require only the submission of an approval application and strategic item determination document, exports to the “B” region require additional paperwork such as contracts and oaths.

S. Korean government considering creating new “Category C” for Japan

Exports to the “B” region also include more stringent “catch-all” regulations, which apply to goods that are not considered strategic items but could be diverted into weapons production and development: a situation permit must be applied for even in cases of “suspected” intentions to divert an item. The South Korean government is weighing whether to amend Article 10 of the current Public Notice on Trade of Strategic Items to create a new “C” region for Japan. Its aim is seen as being to apply regulations on Japan that are similar to or even more stringent than those for the “B” region.

Considering non-tariff barriers for tourism, food, and waste

In addition to the area of strategic items, Seoul is further considering the possibility of imposing non-tariff barriers. On Aug. 3, Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki announced plans to “strengthen security measures [against Japan] for areas related to the public’s safety, beginning with areas including tourism, food, and waste.” While he did not provide specifics on the plans, the industry sees intensified regulations on Japanese food items and waste product imports as a particularly strong possibility – meaning that Seoul may expand its restrictions on seafood imports from the Fukushima region to other Japanese agricultural and seafood products or intensify customs procedures such as quarantining and safety inspections. Tougher regulations on Japanese thermoelectric power plant waste products imported by South Korean cement companies are also being mentioned.

The question is how much of a practical blow these export and import controls could actually inflict on Japan. Industry insiders are pointing to areas where South Korea holds a competitive edge – including semiconductors, 5G technology, and displays – as potential items for retaliation, but controls on such leading exports stand to increase the costs and losses for South Korean companies that export to Japan. The situation is an asymmetrical one in which South Korean companies face greater damage from exportation and importation setbacks than their Japanese counterparts.

Concerns are also being raised about a potential boomerang effect from Japan and the international community if the legal and institutional bases and situational logic for such controls are murky. The question is whether the claims of intensifying export controls for the sake of “the public’s safety” will provide a clearer basis and more convincing argument than Japan’s claims of “national security” concerns.

“Japan’s toughening of export controls despite there being no particular issues with its security could have the effect of undermining the South Korean government’s own basis for claiming a violation of the free trade order,” said one industry official.

“The key question is likely to be whether we can devise a carefully constructed system that has a substantial impact on Japan while minimizing the damage to companies,” the official suggested.

By Choi Ha-yan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 2Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 3Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 4Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 5[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 6[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 7[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 8‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 9Korea sees more deaths than births for 52nd consecutive month in February

- 10Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?