hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean industry sees production decline due to shortage of Chinese parts and materials

As the novel coronavirus continues to spread, the Chinese government has extended its delay for reopening factories past Feb. 9, which is affecting South Korean companies that import Chinese parts to manufacture its exports. This is fueling concerns that the recovery in South Korea’s export and manufacturing sectors that started late last year could be blunted or even reversed.

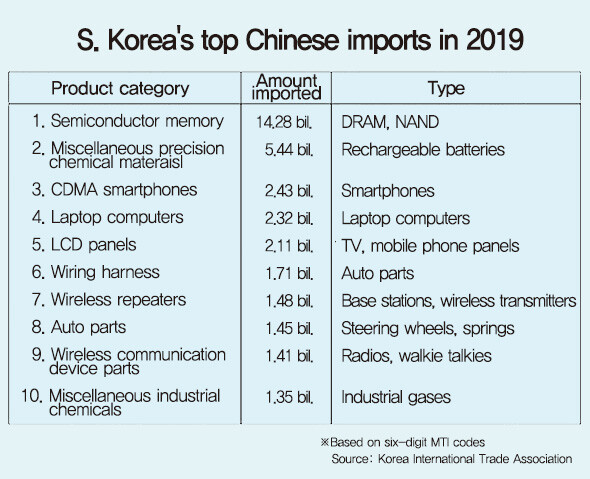

According to trade figures from the Korea International Trade Association (KITA) that the Hankyoreh reviewed on Feb. 4, South Korea’s number one category of import (based on the six-digit MTI codes) from China last year in terms of value was semiconductor memory, including DRAM and NAND flash. This category had a cumulative import value last year of US$14.28 billion. These semiconductors are produced at Chinese factories operated by SK Hynix and Samsung Electronics. The companies do their initial work on the semiconductors (wafer processing) is done in China, taking advantage of the cheap labor costs, and then bring them back to South Korea for the final steps (wafer dicing and packaging) prior to export. The longer these companies have to wait for their Chinese factories to resume operations, the more their exports will be directly affected.

The number two import category was miscellaneous precision chemical materials (amounting to US$5.44 billion), which are also essential for manufacturing South Korea’s leading export goods. These include nitrogen dioxide, hydrogen, and chlorine, which are the basic ingredients of chemical products, and nickel, manganese, and lithium, which are used to make secondary batteries. A shortage of these materials could disrupt production at LG Chem, SK Innovation, and Samsung SDI, which have been spearheading exports of electric car batteries. The fourth and fifth categories of imports from China are laptop computers made by Huawei and Lenova and LCD panels made by display companies BOE Display and CSOT.

The number six import category is wiring harnesses (worth US$1.71 billion), a shortage of which has caused some of the assembly lines at Hyundai Motor Company, Kia Motors, and Ssangyong Motor Company to halt production. South Korean automakers have used China as a source of general-purpose car parts, since labor is cheaper there than at home. General consumer goods — such as tricycles, dolls, and other toys — are also among the top categories of imports from China.

As this indicates, the top categories of South Korea’s imports from China are generally the raw materials and parts used in the manufacture of Korea’s leading export goods. While South Korean companies have stocked up some of those parts and materials, the ones where they’ve kept a minimal inventory — such as wiring harnesses — are causing immediate production difficulties. This means that, the longer Chinese factories are left idle, the greater the chance of major ramifications for South Korea’s leading exporters.

“The government hasn’t been able to figure out exactly how much stock is held by individual companies, since they treat that as a business secret,” a senior official at the economic policy bureau at the Ministry of Economy and Finance told the Hankyoreh in a telephone interview.

By Shin Da-eun and Lee Kyung-mi, staff reporters

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

Most viewed articles

- 1Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 2[Column] The state is back — but is it in business?

- 360% of young Koreans see no need to have kids after marriage

- 4New sex-ed guidelines forbid teaching about homosexuality

- 5[Column] Life on our Trisolaris

- 6Presidential office warns of veto in response to opposition passing special counsel probe act

- 7Trump’s talk of flouting NATO promises sparks apprehension in Seoul

- 8[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 9[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 10Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden