hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Prospects for S. Korean electric vehicle battery industry on the rise

“Tesla’s stock is out of world.” This phrase caused something of a stir when CNN used it early last month while reporting a steep rise in Tesla stock prices. From below US$200 as recently as June of last year, Tesla shares began skyrocketing around late 2019. The stock’s value has more than doubled in this year alone, with shares trading for as high as US$969.

Early last year, Tesla was struggling with a reduction in US government subsidies, with projections putting its share prices at a rock-bottom US$10. What set the stage for its turnaround was last year’s mass production of the entry-level Model 3 at the automaker’s Giga factory in Shanghai. While some have suggested the recent jump in Tesla’s stock value signals a bubble, it also means that expectations are that much higher for Tesla as an industry leader as the “electric vehicle era” is predicted to arrive in earnest in 2020.

Tesla is not the only one smiling. LG Chem shares have also been rising to record highs since early this year after the company finalized its electric vehicle battery supplies, breaking up an exclusive partnership between Tesla and Panasonic last year. Samsung SDI, another battery maker, is in a similar situation. Even SK Innovation has succeeded in securing its share prices despite the double whammy of a slump in the oil refining sector and its recent defeat in a lawsuit with LG Chem for violating trade secrecy related to rechargeable batteries. The three companies are in the driver’s seat of a global battery market that has been called the “heart of electric vehicles.”

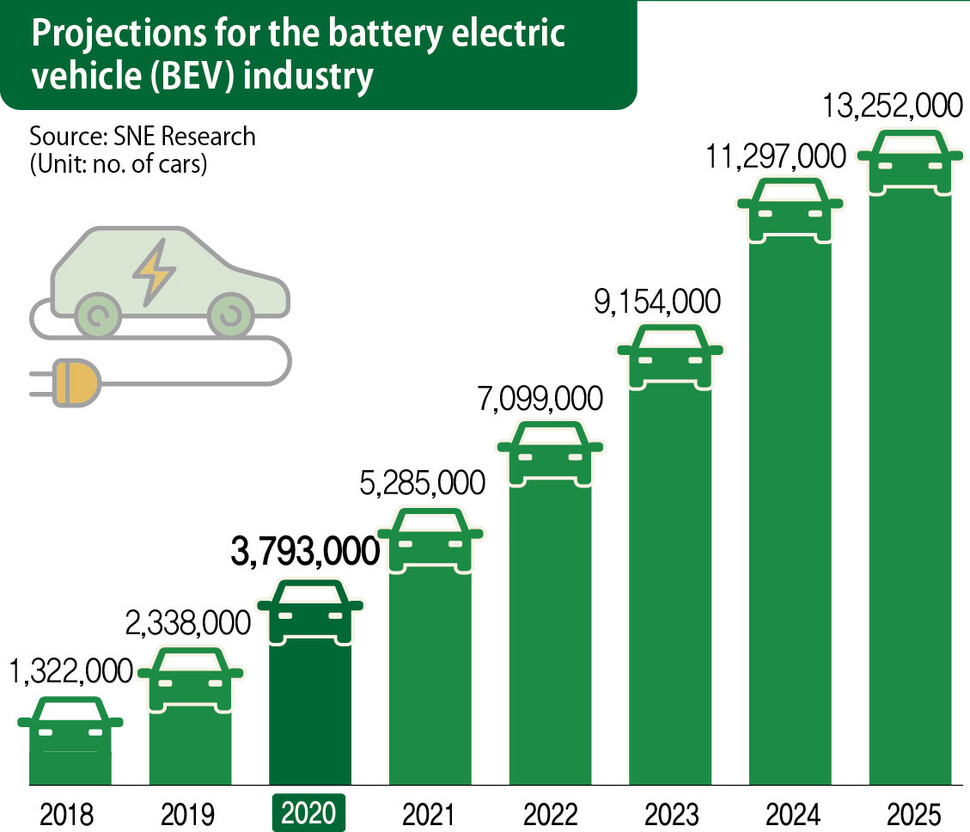

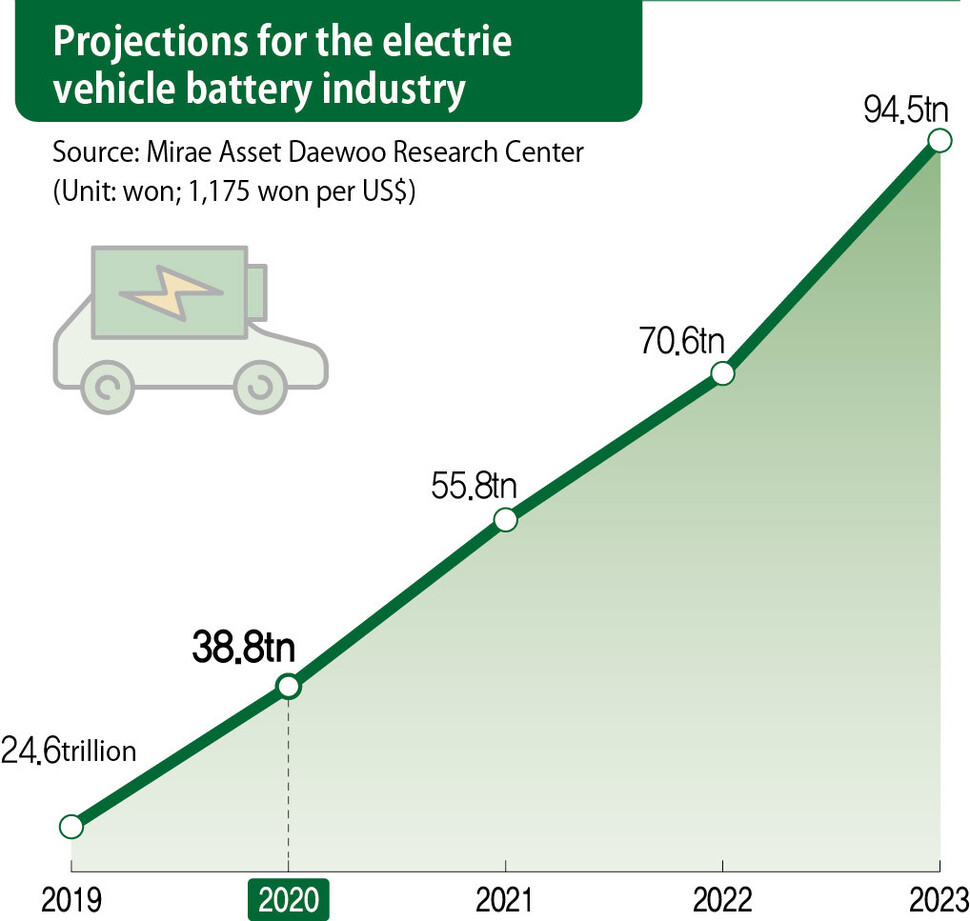

The automobile industry is predicting that electric vehicles will take off this year as global production exceeds 4 million. A report on “global electric vehicle market trends” published last year by the accounting firm Samjong KPMG predicted sales of electric vehicles would increase from 1.98 million in 2018 to over 12 million by 2025. The situation is similar for electric vehicle batteries. In a report published last year, MiraeAsset Daewoo Securities projected a battery market value of 95.8 trillion won (US$78.79 billion) by around 2023, while the overseas market research firm IHS Markit projected 182 trillion won (US$149.7 billion) by 2025, with an estimated average annual growth rate of 25%. This figure is even larger than the 2025 projection for memory semiconductors of 169 trillion won (US$138.98 billion). It is in this context that some are predicting the electric vehicle battery will become “the next semiconductor.” And with demand for electric vehicle batteries exceeding supplies, they’re expecting to become a scarce commodity. SNE Research, a research firm for electric vehicles and batteries, predicted that global demand for electric vehicle batteries would 916GWh by 2023, exceeding the 776GWh in supplies -- which could lead to supply shortages by 2029.

The battery wars among finished car makers are already underway. Germany’s Volkswagen, which declared the “end of the internal combustion vehicle” in November of last year, has announced plans to invest the equivalent of 78 trillion won (US$64.16 billion) in electric vehicle development production over the next five years. Around 2023, Volkswagen plans to collaborate with Northvolt, a Swedish manufacturer specializing in new battery types, to build a battery plant with an annual production of 16GWh. It has also signed battery supply contracts with South Korean companies such as LG Chem, Samsung SDI, and SK Innovation. Toyota, the top-ranked name in the global automobile industry, and Panasonic, which has taken the early lead in the battery industry, established a joint battery venture last year. In South Korea, LG Chem and SK Innovation are pursuing their own joint battery ventures -- with the US automaker GM and China’s Geely Auto in the former’s case and China’s BAIC Group in the latter’s.

Battery companies have also been competing to secure a winning advantage. Today’s battery industry has been compared to the Three Kingdoms period, with China’s CATL in first place followed by Japan’s Panasonic and South Korea’s LG Chem. Rounding out the top five are China’s BYD and Samsung SDI. SK Innovation, a relatively late starter, is building its own name in the seventh to eighth place range. The battery industry involves daunting entry barriers, including massive capital, high-level technology, and complex management tasks. This explains why finished automobile makers -- with the exception of Germany’s BMW -- have opted to acquire existent companies or establish joint ventures rather than independently pursuing production. Indeed, struggles with battery development were a large factor in Dyson’s decision to abandon its plans to independently produce everything from batteries to finished automobiles within a year of its 2018 launch of an electric vehicle project.

South Korean companies are also competing intensely for contracts. With 150 trillion won (US$123.39 billion) in cumulative contracts through last year, LG Chem has plans to exceed 30 trillion won (US$24.67 billion) in battery sales by 2024. This represents a vision of global scale in comparison with industry leader CATL, where growth has been focused chiefly on the Chinese market as the company benefits from the Chinese government’s electric vehicle subsidies. Samsung SDI and SK Innovation are in hot pursuit at 56 trillion won (US$46.04 billion) and 50 trillion won (US$41.1 billion), respectively. Together, the three South Korean companies had a balance of over 200 trillion won (US$164.48 billion) in contracts as of January 2020. This suggests that electric batteries are indeed on the course toward becoming the country’s “second semiconductor industry.” But given the nature of South Korea’s conglomerate-dominated economy, most observers predict the electric battery market will be monopolized by five to six companies, as in the case of semiconductors.

“Going forward, the standard level of battery technology is going to rise, and we’ll need to watch closely for things like changes in Chinese subsidy policies,” said one industry source.

“You’re going to see the competition for a market advantage heating up, as [companies] see themselves as unlikely to survive for long if they don’t place within the top five,” the source predicted.

By Kim Eun-hyoung, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1AI is catching up with humans at a ‘shocking’ rate

- 2After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 3Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 4No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 51 in 5 unwed Korean women want child-free life, study shows

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 8Marriages nosedived 40% over last 10 years in Korea, a factor in low birth rate

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US