hankyoreh

Links to other country sites 다른 나라 사이트 링크

ASEAN provides investment conditions equal to or more favorable than China’s, study finds

The investment conditions in five ASEAN countries -- Vietnam, Indonesia, Malaysia, Thailand, and the Philippines -- have improved to equal China’s in terms of various economic, policy-based, and societal indicators, a study shows. The ASEAN region has been emerging as a stable production base and alternative investment and production base amid an accelerating shift away from China by companies around the world due to its rising production factor costs and trade conflict with the US.

On July 12, the Korea International Trade Association (KITA) published a report titled “Examining the ASEAN Investment Environment for Global Supply Chain Diversification in the Post-Coronavirus Era.” The report assessed the investment environments of five ASEAN countries (Malaysia, Vietnam, Indonesia, Thailand, and the Philippines) and China in terms of 25 indicators (including growth rate, per capita purchasing power, national credit rating, productivity relative to wages, policy reliability, tariff rates, productive population rate, and road infrastructure) to determine their relative advantages.

For the assessment’s indicators, average values calculated for the past five years by major South Korean and overseas economic institutions were applied, with each assigned a rating from 1 to 6 and totaled up to determine the areas of relative advantage for each country. Singapore, an ASEAN member dominated by the financial industry, was omitted from the analysis.

The results showed Vietnam and Indonesia to be close to China in terms of the economic assessment, which considered market appeal and stability and production efficiency (with indicators including growth rate, market scale, per capita purchasing power, national credit rating, manufacturing industry wages, and productivity relative to wages). While China still rates highly in terms of market scale and purchasing power, its production cost competitiveness has been waning amid a steep rise in wages. Vietnam rated highest among the five ASEAN countries in production efficiency, receiving the highest marks for industry production rate of increase in manufacturing industry wage levels.

Most ASEAN countries have more stable environments than ChinaIn terms of policy (as measured by indicators including policy reliability, tax rate relative to operating profits, protectionist trade measures, and weighted average tariff rates), the assessment focused on government policy and investment/trade systems. Most ASEAN countries were found to have an advantage over China due to their more stable environments. Malaysia in particular received strong ratings in all assessment categories, including total tax rate relative to operating profits, weighted average tariff rates, and protectionist trade measures. In terms of social indicators such as the productive population rate, road infrastructure, internet usage rates, and power supplies, Malaysia and Thailand were found to be on par with China in terms of their category totals, boasting advantages in the areas of industry infrastructure and start-up environments in contrast with China’s advantage in outstanding human capital.

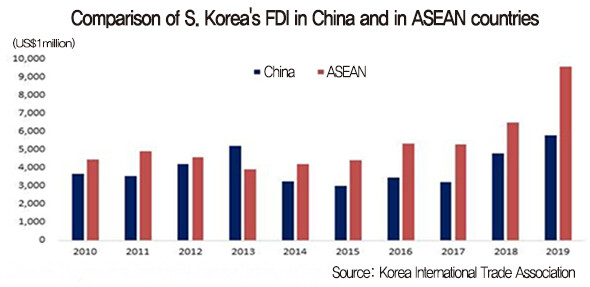

China has recently found itself being passed by as South Korean companies have rapidly begun focusing their foreign direct investment (FDI) on the ASEAN region. The scale of South Korean investment in the ASEAN region has increased more sharply than investment in China, rising by an annual average of 8.9% between 2010 and 2019 compared with 5.2% in the case of China. As of 2019, South Korean FDI to ASEAN countries totaled US$9.55 billion, compared to the US$5.8 billion in FDI to China. The three countries of Vietnam, Singapore, and Indonesia accounted for 88.6% of South Korean companies’ FDI in the ASEAN region last year, indicating an intensifying concentration of investment in those countries compared with the 50.1% recorded in 2010.

According to Export-Import Bank of Korea figures, while the local investment rate of return for South Korea companies in the ASEAN region amounted to just 8.5% as of 2014 -- far below the 24.6% rate for China -- the positions were reversed as of 2018, with rates of 12.4% for ASEAN and 9.4% for China. In 2018, the investment rates of return were highest for Singapore (39.7%), Vietnam (22.2%), and Thailand (14.4%). Additionally, the average operating profit ratio for local branches of South Korean businesses in the ASEAN region rose from 2.0% in 2014 to 3.4% in 2018, while the ratio for local branches in China slid from 4.6% to 3.2% over the same period amid the effects of rising wages and land, water, and electricity prices and production costs in China.

The largest increase in operating profit ratio among ASEAN countries was observed in Indonesia, which experienced a 7.7-percentage point rise over the past four years. In contrast, the Philippines registered large declines in both operating profit ratio (5.7% in 2014 to -3.6% in 2018) and investment rate of return (11.0% in 2014 to -64.2% in 2018).

FDI rate globally declining but rising in ASEANDespite a global trend of decline in FDI -- with a -4.3% rate of increase between 2010 and 2018 -- foreign investment in the ASEAN region recorded a 9.2% average annual rate of increase from 2015 to 2018. The rate of increase in foreign investment in China amounted to just 0.8% over the same period. The percentage of direct investment in ASEAN from Japan among all countries rose from 10.3% in 2014 to 13.7% in 2018. Its increase vastly outstripped the changes observed over the same period for other major economies, including China (6.5% in 2019, a 1.3-percentage point rise from 2014), South Korea (3.9%, -0.1 percentage points), and the US (5.3%, -11.0 percentage points).

“With the shift away from China intensifying amid rising wages in China and the US-China trade conflict, there has been growing interest in establishing stable supply chains due to the coronavirus pandemic, and as global economic volatility increases, individual global businesses have been reducing their concentration of investment in China and diversifying their production networks,” the report observed.

“Companies expanding overseas in pursuit of low wages will need to move away from their exclusive focus on China in their overseas production strategies and start focusing on the ASEAN region,” it advised.

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 3Samsung barricades office as unionized workers strike for better conditions

- 4[Column] Has Korea, too, crossed the Rubicon on China?

- 5All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 6[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 7US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 8Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 9[Photo] Smile ambassador, you’re on camera

- 10[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes