hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] The government can’t run from the need to raise direct taxes

By Kim Kyung-rok, staff reporter

Controversy is raging over planned cigarette price, resident tax, and automobile tax increases announced on Sept. 11 and 12.

At root, the issue is the administration’s decision to abandon its promise of “social services without tax increases” - a key pledge in 2012 by then-presidential candidate Park Geun-hye, and a continued focus since her inauguration - without any apology to the public or efforts to build consensus. Another concern is the fact that the first increases are in indirect taxes, which more heavily affect the working class.

Increased taxes for welfare funding are an inescapable reality if South Korea is to boost the level of its social services, which currently stands at around half the OECD average, and prepare for booming social welfare demand from a rapidly aging population. The situation demands that the administration and politicians hold a serious debate on raising direct taxes: the income and corporate taxes that bring in the most revenue and have the strongest redistribution effects.

The basic factor behind the administration’s cigarette price and local tax hikes is its conclusion that Park’s idea of social services without increased taxes is not sustainable. Continued expansions in social services, without the necessary steps to address a low taxation rate, have resulted in local government finances deteriorating to the point of “welfare default,” and a worsening central government deficit - all without achieving an adequate level of social service coverage. Meanwhile, the administration feels constrained from abandoning any more of its social service pledges after so many of the policies promised in the 2012 election have already been heavily watered down.

Experts aren’t arguing with the basic logic of raising taxes.

“From where we stand right now, a tax increase is unavoidable if we are to achieve a welfare state,” said Lee Sang-i, a Jeju National University professor and co-director of the civic group Welfare State Society.

Kim Moo-sung, leader of the ruling Saenuri Party (NFP) and an early contender for the 2017 presidential nomination, echoed the message at a debate on Aug. 20.

“To talk about social services without taxes is to be dishonest with the public,” Kim said at the time. “The time has come for us to talk about higher taxes.”

The message was that the administration needs to frankly acknowledge the difficulties of honoring its social service pledges and begin a serious debate on raising taxes.

The problem is that all of the hikes announced in the administration’s recent plan focus on indirect taxes: cigarettes, local taxes, and automobile taxes. For direct taxes like income and corporate tax, higher rates are applied the larger an individual’s income or a corporation’s earnings, resulting in a heavier burden on high earners and large companies. In contrast, indirect taxes apply equal rates to all consumers of the item in question, which puts a larger burden on low earners. To achieve the aim of income redistribution - the single biggest function of taxes in a modern democratic state - increases focusing on direct taxes are more effective.

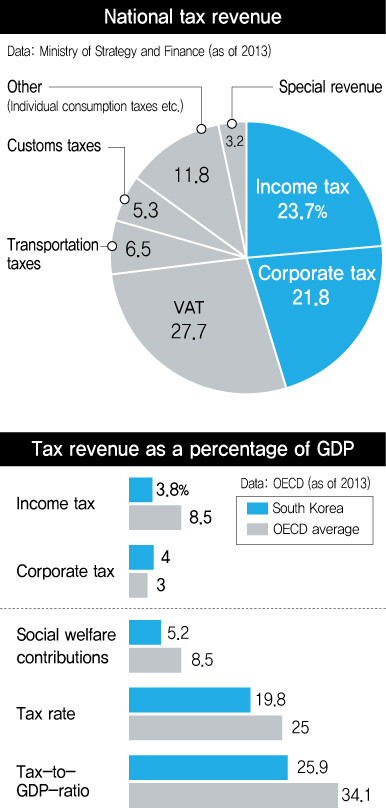

The Paris School of Economics database on the world’s top earners, used by the OECD for its regular announcements of country-by-country income and tax trends, found South Korea’s top income decile to account for 44.87% of all income in late 2012. It was a sign of severe income inequality - the second highest concentration of income among 19 countries examined. The main reason was the small amount of income tax paid as a percentage of gross domestic product (GDP): just 3.8%, or less than half the OECD average of 8.5%.

Another problem with the tax hike plan is its small yields in terms of revenue. Administration estimates put the additional tax revenues for 2015 from the cigarette price and local tax increases at around 4 trillion won (US$3.86 billion) - a long way from covering a more than 8 trillion won (US$7.71 billion) shortfall in central government tax revenues for a second straight year. Income taxes currently account for 23.7% of South Korea’s total national tax revenue; corporate taxes represent another 21.8%. Simply to achieve the necessary social service resources, a hike in direct taxes appears unavoidable.

“We’re never going to have a real debate about higher taxes so long as the government’s explanations are all focused on semantics, talking about how ‘raising the price of cigarettes is not a tax hike’ or about how it’s possible to have social services without raising taxes,” said Hwang Seong-hyeon, an Incheon National University professor and former chief of the Korea Institute of Public Finance.

“We need to seriously talk about raising direct taxes, starting with a rollback of the corporate and income tax cuts by the Lee Myung-bak administration,” Hwang added, referring to Park’s predecessor as president from 2008 to 2013.

Lee Sang-i said politicians on both sides of the aisle are to blame for the lack of a substantive debate.

“The administration is coming out with plans that just fuel people’s hostility to increasing taxes, while the opposition won’t come up with anything specific, but just keeps talking about it’s ‘opposed to raising taxes on the working class,’” he said.

“What we need now is for both sides to come up with good tax increase plans, and focus their energies on building a social consensus,” he continued.

One possible venue for the debate is the “citizen consensus committee” suggested by Park as part of her election campaign pledges. In issuing an apology to public last September after backing away from her basic pension pledges, Park declared plans to “create the citizen consensus committee as I pledged during the election, and hear out the public’s opinions.” The administration, she said, would “share everything with the public in a transparent way” and “work to find the best mixture for what the public wants through a national consensus on the level of taxes and social services.”

For now, the citizen consensus committee has yet to get off the ground.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 346% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 4[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 8[Interview] Dear Korean men, It’s OK to admit you’re not always strong

- 9Korean government’s compromise plan for medical reform swiftly rejected by doctors

- 10[Editorial] Japan’s rewriting of history with Korea has gone too far