hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea to launches amnesty for voluntarily reporting assets and income hidden overseas

Between Oct. 1 of this year and Mar. 31 of the next, South Koreans who voluntarily report assets and income they have hidden overseas and pay the taxes they owe will be exempted from prosecution and from late fees. This is the first time that the South Korean government has offered benefits for voluntary reporting of assets and income concealed overseas.

If individuals who fail to report such assets during the specified time are caught later, they will be subject to a tax audit and criminal investigation.

The government announced the plan on Sep. 1 at the Central Government Complex in Seoul in a statement jointly signed by Finance Minister Choi Kyoung-hwan and Justice Minister Kim Hyeon-ung.

“By 2017, agreements with other countries for automatic exchange of tax information will enable us to start acquiring financial information from overseas. Before this happens, we‘re giving people one chance to make things right. There will be no more tolerance in the future,” Choi said.

Citizens of South Korea must report both their overseas income and domestic income, and they are also required to report overseas financial accounts that are worth more than 1 billion won (US$848,540). The voluntary reporting exemption applies to residents of South Korea and to corporations registered in the country.

This is a chance for individuals and companies to report income earned in other countries or international transactions and overseas assets (including inheritance and gifts) that they had failed to report, either in whole or in part, by the legally mandated deadline. Individuals who are currently being audited or investigated by the prosecutors are not eligible for voluntary reporting, however.

There are a number of benefits for individuals who voluntary report their overseas assets and income. Along with being exempted from fees and penalties for late reporting, they will not be prosecuted and their names will not be added to a list of tax evaders.

For example, a South Korean corporation that failed to report 1 billion won in overseas income would normally have to pay more than 500 million won in taxes, fees and penalties. Furthermore, if found guilty of tax evasion, they could be sentenced to up to two years in prison and could be fined as much as twice the amount they failed to report.

But if that same corporation were to take advantage of the voluntary reporting period, it would only have to pay 290 million won in taxes, it would be exempted from penalties and part of the fees, and there would be no prosecution.

In cases that involve not merely the simple failure to report income but other more serious crimes such as embezzlement and breach of trust, suspects can still be prosecuted.

The reason the government is implementing the voluntary reporting system is to provide a way out for relatively honest taxpayers who initially missed the deadline for reporting their taxes but still want to pay them.

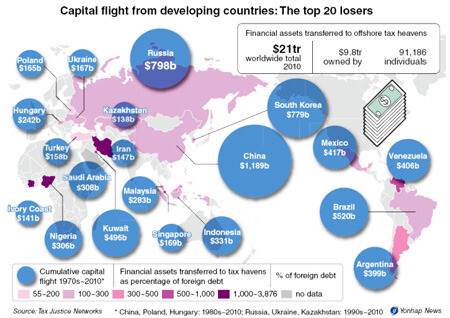

It also reflects the fact that offshore tax evasion continues to increase each year, but the tax authorities are limited in their ability to track this. In 2010, the government collected 501.9 billion won in additional fines on overseas tax evasion, but by last year this had jumped to 1.22 trillion won.

Starting in 2017, a large amount of financial and tax information will be swapped with around 50 countries with which South Korea has signed automatic information exchange agreements. The voluntary reporting system is also intended to create a window of time in which people can correct their records before these agreements take effect.

The 50 countries that are party to the automatic information exchange agreements include such well-known tax shelters as the British Virgin Islands and the Cayman Islands.

“Since 2002, 15 countries including the US, the UK, Germany, France, and Australia have created voluntary reporting systems and have enjoyed considerable results,” said Mun Chang-yong, chief of tax policy for the Ministry of Strategy and Finance.

“Australia, which has a similarly sized economy to South Korea’s, has been running a voluntary reporting system since 2014 and has collected around 500 billion won in additional tax revenues. This means that the system brought around 4 trillion won of unreported income to light,” Mun said.

The government announced that, beginning this month, it would be operating a voluntary reporting planning team with staff from the Ministry of Strategy and Finance, the Justice Ministry, the National Tax Service, and the Korea Customs Service.

By Kim So-youn, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 6Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 7[Column] The clock is ticking for Korea’s first lady

- 8New AI-based translation tools make their way into everyday life in Korea

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10[Column] Are chaebol firms just pizza pies for families to divvy up as they please?