hankyoreh

Links to other country sites 다른 나라 사이트 링크

Report: wealth now more about inheritance than effort

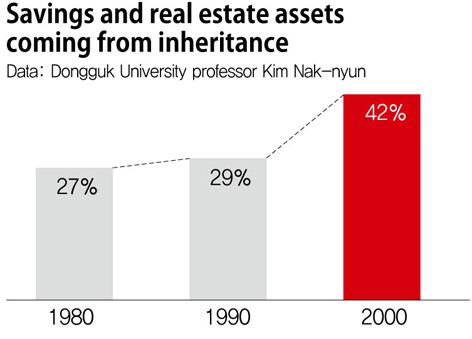

The percentage of personal savings and real estate assets that come to South Koreans from their parents via inheritance or gifts rose sharply from 27% in the 1980s to 42% in the 2000s, a recent report shows.

The numbers suggest that inherited assets are contributing more to wealth than personal efforts or abilities.

The data were published on Nov. 17 in a report titled “Wealth and Inheritance in South Korea, 1970-2013” by Dongguk University economics professor Kim Nak-nyun. Kim used methods proposed by Thomas Piketty - a Paris School of Economics professor who recently helped start up a global discussion on the issue of inequality - to estimate the percentage of South Koreans’ assets that come from inheritances or other gifts (inherited wealth).

Kim’s numbers showed the contribution from inherited wealth among all assets falling from an annual average of 37.3% in the ’70s to 27% in the ’80s and 29% in the ‘90s, before soaring to 42% in the ’00s.

For instance, in the case of an individual with US$100,000 in assets, inherited wealth from his or her parents would have represented US$27,000 of it in the 1980s, but US$42,000 of it twenty years later.

The yearly percentage of inherited wealth against national income has been rising steadily from an average of 5% in the ‘80s to 5.5% in the ’90s, 6.5% in the ‘00s, and 8.2% between 2010 and 2013.

The findings provide empirical support for what many have called the “golden/dirt spoon theory,” where economic status is passed down from parents to their children. They also show it is becoming harder and harder for individuals to overcome unequal opportunities through personal effort.

Kim has also focused on wealth concentration phenomena in his previous research. In a report titled “South Korean Wealth Inequality 2000-2013” that was published in October, Kim observed that the top one percent in terms of income accounted for 25.9% of all assets for those years. The top ten percent accounted for 66% of all assets, or well over half, while the lowest-earning 50% accounted for just two percent.

The problem is that the inheritance of wealth and inequality is poised to increase as the country faces low growth and an aging trend in the population. The reason inherited wealth accounted for such a relatively small percentage of assets in the 1980s and 1990s is low death rates, with South Korean trailing behind Western countries in its aging trend. High growth rates in those decades - annual percentages of 8.8% in the ’80s and 7.1% in the ‘90s - also created opportunities for people to accumulate wealth, resulting a lower inherited wealth contribution that in other countries.

“We are rapidly progressing into a society where transferred wealth through inheritance is becoming more important than savings,” Kim commented.

“When you have a society where inheritance is a far more important means of acquiring wealth than savings, and inequalities in the resulting wealth are large, you can’t really say that it is founded in meritocratic principles,” he added.

By Kim So-youn, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 6Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 7New AI-based translation tools make their way into everyday life in Korea

- 8Thursday to mark start of resignations by senior doctors amid standoff with government

- 9N. Korean hackers breached 10 defense contractors in South for months, police say

- 10Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South