hankyoreh

Links to other country sites 다른 나라 사이트 링크

Chinese companies aggressively targeting South Korean businesses for M&As

Chinese companies are snapping up South Korean businesses at a rapid rate -- part of a bid to boost their own competitiveness by absorbing the latter’s state-of-the-art technical ability and acquired knowledge.

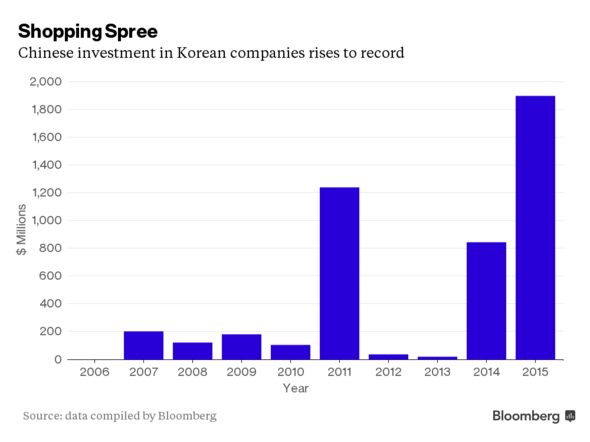

“Chinese investments in Korean companies soared 119% this year to US$1.9 billion [2.23 trillion won],” noted Bloomberg on Dec. 22.

The news site also described the “acquisition spree” as setting a “record pace.” Indeed, the amount spent this year on M&As and investment is the highest yet since South Korea and China established formal diplomatic relations in 1992.

Areas where Chinese companies have been making acquisitions and investments have chiefly included finance, advanced technology, healthcare, cosmetics, and entertainment. China’s Anbang Insurance Group spent US$934 million (1.13 trillion won) in February to acquire Tongyang Life Insurance, one of South Korea’s top life insurance companies; in May, the cosmetics shopping mall Jumei invested US$125 million in the South Korean cosmetics maker It’s Skin. June saw Champ Investments Ltd. spending US$35 million on shares in Jeju Semiconductor, which holds the top market share for low-power semiconductors, and Tigermade spending US$23 million on the contract research organization (CRO) DreamCIS.

The Chinese hunt for South Korean businesses is being seen as part of a “fast follower” strategy -- an attempt to narrow the gap with the companies quickly by acquiring their technological ability and efficiency directly.

“South Korea’s spending on research, patents and post-secondary education made the country No. 1 on the Bloomberg Innovation Index in 2015, versus China’s global ranking of 22,” noted Bloomberg.

“Listed Chinese companies . . . are taking advantage of Korean know-how to serve a domestic consumer market that now accounts for more than half of the country’s economic expansion,” the report explained.

“The proximity and the high level of technology available in Korean companies make them more attractive to China,” the article quoted Bernard Aw, an investment strategist at IG Asia Pte. in Singapore, as saying. “Chinese companies are snapping up acquisitions because they are sitting on a good cash hoard.”

In 2012, the Chinese game developer and mobile messaging service Tencent invested 72 billion won (US$61.5 million) to acquire a 13.3% share of the South Korean messaging service Kakao. The latter’s value at the time Tencent took over from chairman Kim Beom-su as second biggest shareholder was estimated at 500 billion won (US$427 million). The Kakao success story has continued since then with a merger with the portal site Daum and subsequent listening on the KOSDAQ index. Tencent’s share of Kakao is currently 9.3%, but with Kakao’s market capitalization standing at 6.7 trillion won (US$5.7 billion) as of Dec. 22, the Chinese company hit the jackpot with a return of close to ten times its investment in just over three years.

Tencent’s investment in Kakao - which created buzz back then, too - is paradigmatic of how Chinese capital is making inroads in the South Korean market. Investors buy up shares of IT companies and media producers with good prospects and wait for their investment to yield rich dividends.

After striking it rich with its investment in Kakao, Tencent invested US$500 million in the first half of 2014 in Netmarble Games, a company affiliated with CJ that’s best known for the games Monster Taming and Everybody’s Marble. Tencent has poured tens of millions of dollars into other game companies as well.

In August of last year, Chinese online portal Sohu used its affiliate Fox Video to invest 15 billion won (US$12.81 million) in Keyeast, the talent agency that manages Bae Yong-joon and Kim Soo-hyun, taking the second largest share in the company after Bae.

In September, Agabang, South Korea’s first children’s clothing company, was acquired by the Lancy Group, a Chinese producer of women’s clothing.

In October, the Huace Media Group, a Chinese producer and distributor of movies and television programs, bought 56.6 billion won worth of shares in South Korean movie company Next Entertainment World (NEW), becoming the company’s second largest shareholder. NEW was the company that funded and distributed the blockbusters “Miracle in Cell No. 7” and “The Attorney,” both of which sold more than 10 million tickets.

These cases illustrate how Chinese investment in South Korea has rapidly increased and diversified since last year. A string of buyouts this year - including the insurer Tongyang Life Insurance, the cosmetics company It’s Skin, the manufacturer Jeju Semiconductor and the healthcare provider DreamCIS - has led analysts to conclude that Chinese investment in South Korea is undergoing a qualitative shift.

Chinese companies are expanding their investment beyond the IT and media industries into finance, healthcare and manufacturing, while their type of investment is gradually shifting from simple stock purchases to growing participation in management.

Investment bankers often compare these Chinese investors to the American bullfrog, a nod to the prodigious appetite of this invasive predator, which was introduced into South Korea not long ago.

The most troubling scenario would be hostile M&As becoming a reality. This would be a situation in which South Korean managers are forced out and the technological skill and expertise that they have acquired with such difficulty are leaked to other countries.

Some even suspect that, if Kakao faces a performance slump, Tencent might ultimately take steps to buy the company outright.

The problem is that, aside from industries in which foreign investment is restricted by law, there is no way to discriminate against Chinese investors.

“Chinese investment in South Korea should be understood as an obvious effort to acquire advanced technology, so there is no reason to view it in a negative light. Another way of seeing M&As is as investment in South Korean companies. While we need to take protective measures for strategic industries, we also need the wisdom to turn these investments to our advantage,” said Lee Chi-hun, chief China analyst for the Korea Center for International Finance.

To be sure, Chinese corporate raiders are not only active in South Korea. In an effort to catch up with Samsung and SK Hynix in the area of semiconductor memory, Tsinghua Unigroup spent US$19 billion in October of this year to buy SanDisk, the world’s fourth strongest company in NAND flash memory. Meanwhile, Tencent steadily increased its share in Riot Games - the American game company that developed the global smash hit League of Legends - until, on Dec. 17, it bought the last of the company’s stock, turning it into a complete subsidiary.

Some think that, since Chinese corporate raiding is a worldwide phenomenon, South Koreans ought to accept reality and implement strategies for profiting from this.

“Previously, the model for foreign investment in South Korea was to build factories and create jobs, but the fact that Chinese investors only want to acquire companies is giving rise to a clash in expectations. If the investors hold the key, we need the wisdom to take advantage of this,” said Ji Man-su, an analyst at the Korea Institute of Finance.

Since there is no way to prevent Chinese investors from acquiring South Korean companies, Ji says, those companies need to learn how to sell themselves for a fair price. This will require companies to increase their market value through commercialization and require South Korea as a society and economy to develop its capital market and the mergers and acquisitions this entails.

By Seong Yeon-cheol, Beijing correspondent; Lee Soon-hyuk, staff reporter; and Kwack Jung-soo, Business correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4‘Weddingflation’ breaks the bank for Korean couples-to-be

- 5[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Korea sees more deaths than births for 52nd consecutive month in February

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father