hankyoreh

Links to other country sites 다른 나라 사이트 링크

Public left with the burden of digging out of Lee MB administration’s financial hole

The Park Geun-hye administration has come out with major plans for public institution reforms nearly every year since taking office in 2013. The plans include ideas for reducing debt, merging and eliminating redundant or similar public tasks, and instituting performance-based pay and wage peak systems. The stated goal has been to correct decades of disorder in the public sector and increase efficiency - but a more immediate reason has been an attempt to recover costs incurred due to Park’s predecessor Lee Myung-bak (2008-13).

Indeed, state corporations are still suffering the hangover from being dragged into economic stimulus measures, the Four Major Rivers Project, and overseas resource development under the Lee administration. The results have included underperforming projects, lost investment assets, and a resulting blow to fiscal soundness. A “functional adjustment” plan for institutions in the energy sector announced by the Park administration on June 14 has the aim of improving conditions for public energy enterprises left with deep-seated problems after the Lee administration‘s overseas resource development push.

While Lee was president, the Korea National Oil Corporation (KNOC), Korea Resources Corporation (KORES), Korea Electric Power Company (KEPCO), and Korea Gas Corporation (KOGAS) all scrambled to be part of the development plan. Now they have found every part of their operation on the operating table, from staffing to organization and projects. The KNOC’s organization is to be reduced from its current six headquarters to four. Around 23% of its department units are closing down, while staffing is to drop by around 10% from its current level by 2020. With 1,585 employees as of late March, that means over 160 of them will have to pack up in the next four years. The liquidation of overseas KNOC affiliates would bring the total adjustment to over 1,200.

The KRC is pulling out of resource development altogether, which means it plans to focus exclusively on mineral reserves and mineral industry support. Its overseas offices are to be reduced from eleven to three next year. Beyond that “slimming,” as many as 118 jobs - roughly one-fifth of the corporation‘s 607 employees as of late March - are expected to be cut. KEPCO, for its part, is pulling out of overseas development projects involving bituminous coal and other fuels. Projects under way in Indonesia and three other countries are all to be put up for sale to affiliates and Korea Hydro & Nuclear Power (KHNP).

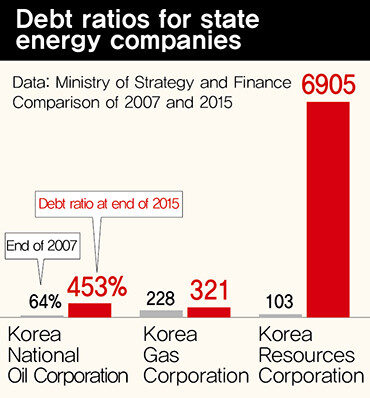

This large-scale restructuring was made inevitable by worsening financial conditions at the corporations. The KNOC’s debt ratio stood at 64% in 2007, the year before Lee took office. By late 2015, it was all the way up to 453%. Over the same period, KOGAS’s ratio climbed from 228% to 321%, and KORES’s from 103% to fully 6905% - levels that would leave most private businesses facing bankruptcy procedures. Intensive restructuring represents the only way to rein in the debt ratios without requiring taxpayer money.

Eight of KEPCO‘s affiliates, including five power companies, KDN, KHNP, and the Korea Gas Technology Corporation, are to be listed on the market one by one as of next year. The stated reason has been to ensure transparent management and boost market monitoring and oversight - but the real goal is to attract private capital and shore up financial soundness. Other plans are meant to address longstanding energy area issues, including an exit for the Korea Coal Corporation - currently facing a cumulative deficit of over one trillion won (US$849 million) - and gradual opening of the power retail sales market once monopolized by KEPCO to the private sector.

All of the plans appear to be measures by the state corporations themselves to recover from losses brought on by the Lee administration. But a closer look shows that the burden ultimately falls on the general public. The KNOC and others are almost certain to face losses in selling off their overseas assets. If their financial situation deteriorates any more, an infusion of taxpayer money will become unavoidable. The amount of overseas asset losses - and the resulting financial burden - could vary substantially according to the sales price, making even a rough estimate difficult for now. For that reason, the administration is merely saying the functional adjustment in overseas resource development projects will result in improved financial stability, without specifying exactly how much. It is also more likely now that the administration could attempt a hike in electricity charges or other public fees, citing the tough financial situation facing the energy institutions.

But while measures to shed Lee-era losses have become unavoidable, it remains unclear whether the plans will even go ahead as written. A great many interests are at play: a stepwise reduction in Korea Coal Corporation efforts would inevitably lead to mass unemployment in certain regions, which could flare up into a national issue. Conscious of the possibility of local objections, the administration avoided including even a schedule for reductions in its final plan. Meanwhile, the listing of public energy enterprises and opening of electricity retail sales to the private sector could lead to cries that the administration is paving the way for privatization or granting preferential treatment to specific companies. The fear is that with the government stake’s decreasing in the listing process, additional future sales could leave management authority in the hands of private investors. The administration, for its part, maintains that it is not considering a privatization approach in which management authority is given to the private sector.

Sales of overseas state energy corporation assets could also provoke charges of dumping. And while Park declared at a workshop for public institution heads on June 14 that she was going “all the way with public sector reforms,” she has less than two years left in her term - while the time horizon for the plan extends to 2025.

By Kim Kyung-rok, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent