hankyoreh

Links to other country sites 다른 나라 사이트 링크

Reports from national energy and resource corporations criticized for “half-hearted reflection”

The Korea National Oil Corporation (KNOC), Korea Resources Corporation (KORES), and Korea Gas Corporation (KOGAS) submitted reports from a months-long review last year of overseas resource development efforts. But with the reports omitting reference to the reasons or responsibility behind the opaque decision-making process, critics are accusing the three corporations of engaging in “half-hearted reflection.”

Meanwhile, a task force on overseas resource development reforms operating in conjunction with the Ministry of Trade, Industry and Energy (MOTIE) is focusing its efforts on restructuring of development projects – a far cry from investigating the reasons for failures with past projects. The situation stands in sharp contrast with the revelations coming from the National Intelligence Service (NIS), Ministry of Unification, Ministry of Foreign Affairs, and others on illegal special activity fees or behind-the-scenes contracts involving negotiations on the comfort women issue.

In August of last year, MOTIE and the three corporations set up a review team to analyze contracts and economic feasibility assessment data for overseas resource development projects since 2008. The corporations subsequently drew up a report titled “Overseas Resource Development: Status, Reflections, and Tasks” for submission to the reform task force. A copy of the report obtained by the Hankyoreh on Jan. 2 included an independent analysis on the reasons for the resource development failures.

In the report, the three corporations named external factors as the chief reason for the development failures, including falling oil prices and geopolitical issues. More specifically, the KNOC cited issues with inadequate oil price risk management efforts, overdependence on borrowing, lack of project management capabilities due to accelerated short-term growth, inadequate controls on affiliates, and the lack of a rational investment decision-making process.

In its reflection, the corporation said the decline in oil prices was unforeseen, while investment projects and affiliates were inadequately controlled due to a lack of corporation capabilities. While it admitted to a failure to make rational investment decisions, it offered no explanation as to the reason.

An example was the case of Canada’s Harvest Energy, where just US$4 million (around 4.2 billion won) has been recovered to date from an investment of US$4.08 billion (4.3 trillion won) – a roughly 0.1% rate of return. The KNOC attributed the failure to sharp oil price fluctuations, a lack of control efforts by the headquarters, and inadequate scrutiny of the acquisition risks.

Reports contained omissions of relevant factors

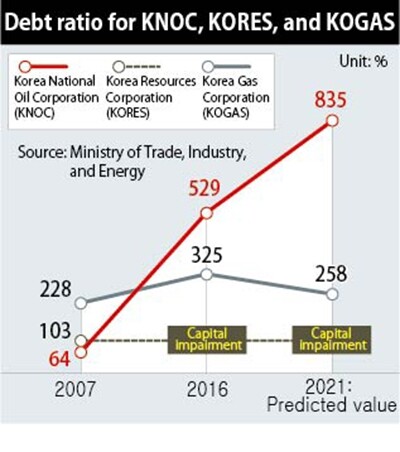

Omitted from this was an explanation on the real factors – namely why and how the project went ahead even after the Korea Institute of Geoscience and Mineral Resources (KIGAM) warned that it was “risky” when commissioned to conduct an economic feasibility assessment by the Ministry of Knowledge Economy (MOTIE’s predecessor). The KNOC suffered a serious blow to its financial soundness, with its debt ratio soaring from 64% in 2007 to 529% as of 2016. Since 2011, it has recorded annual deficits ranging between 200 billion and 4.5 trillion won (US$188 million–4.2 billion).

The “reflections” from KOGAS and KORES were similarly lacking. In 2014, the Board of Audit and Inspection accused KOGAS of inflating the economic feasibility of a package project involving Canada’s Horn River and West Cutbank regions when it calculated a combined 12.3% rate for both sites after the internal rate of return (IRR) for the West Cutbank was estimated at an investment-unsuitable 9.2%.

Yet KOGAS offered no explanation at all for the decision-making error. Similarly, KORES cited a lack of technological and legal scrutiny and failure to conduct adequate reviews due to an imminent management rights acquisition as reasons for the failure of the Boleo copper mine project in Mexico, which recovered only US$177 million from a US$1.45 billion investment.

Three corporations have liabilities of nearly US$50 billion

Together, the three corporations are shouldering 53 trillion won (US$49.8 billion) in liabilities after suffering 13.3 trillion won (US$12.5 billion) in losses on 33.8 trillion won (US$31.8 billion) in investments since 2008. KORES in particular has been in a state of total capital depletion since 2016 and is relying on one trillion won (US$940 million) from the government to stay afloat.

“It seems like the three corporations’ goal is to admit to a few errors and ignore the larger of issue of failure,” said Kim Gyeong-yul, an accountant who heads the executive committee for the group People’s Solidarity for Participatory Democracy (PSPD).

“We need to look closely into the decision-making process for each project, whether economic feasibility was inflated before projects were launched, and who was responsible for any inflations, and the people responsible should be punished if necessary,” Kim said.

With the reform task force scheduled to operate through the first half of next year, it remains uncertain how close it will be able to get to the truth. Once findings are released from KIGAM’s re-assessment of economic feasibility for 81 projects, MOTIE plans to ask task force members to issue recommendations during the first half of the year on the handling of each project, rating them as “blue chip” or in need of management or adjustment.

Once the recommendations are issued and the three corporations develop and report restructuring plans, the task force is scheduled to conclude its activities. Concerns are now being raised that an investigation into the facts of the overseas resource development efforts will become more difficult once the task force’s efforts finish – and that the three corporations and the individuals responsible could end up being let off the hook.

By Choi Ha-yan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Korea must respond firmly to Japan’s attempt to usurp Line [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0514/2317156736305813.jpg) [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

[Editorial] Korea must respond firmly to Japan’s attempt to usurp Line![[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0514/7917156741888668.jpg) [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

- [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

- [Editorial] Yoon’s gesture at communication only highlights his reluctance to change

- [Editorial] Perilous stakes of Trump’s rhetoric around US troop pullout from Korea

- [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- [Column] The state is back — but is it in business?

- [Column] Life on our Trisolaris

Most viewed articles

- 1Ado over Line stokes anti-Japanese sentiment in Korea, discontent among Naver employees

- 2[Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

- 3Korean opposition decries Line affair as price of Yoon’s ‘degrading’ diplomacy toward Japan

- 4US has always pulled troops from Korea unilaterally — is Yoon prepared for it to happen again?

- 5Korean auto industry on edge after US hints at ban on Chinese tech in connected cars

- 6[Editorial] Yoon’s gesture at communication only highlights his reluctance to change

- 7[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

- 8[Column] Will Seoul’s ties with Moscow really recover on their own?

- 9[Photo] Korean students protest US complicity in Israel’s war outside US Embassy

- 101 in 3 S. Korean security experts support nuclear armament, CSIS finds