hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Koreans now consider finances, insurances a basic life necessity

In Korea, the traditional saying holds that the essential needs for human existence of “clothing, food, and shelter,” in that order. Now, for the first time ever, “finances/insurance” has been named in place of clothing as one of the three areas of life South Koreans view as most important. Analysts attributed the shift to growing anxieties over the future due to an aging population and low interest rates at a time when rising income levels have more or less resolved more basic needs.

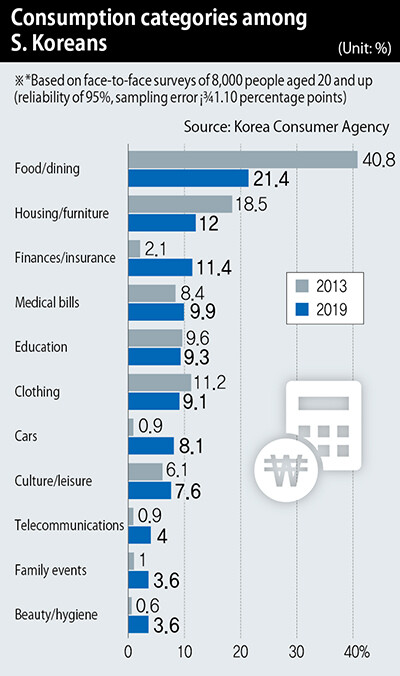

On Nov. 13, the Korea Consumer Agency (KCA) published a report on “2019 South Korean consumer life indicators,” which included findings from a survey of 8,000 adults nationwide on the relative importance of areas of consumer life. For the first time, the rate of importance assigned to “finances/insurance” (11.4%) among the 11 total areas was higher than for “clothing” (9.1%), placing third behind “food” and “housing/family.” Ratings of the importance of finances had steadily risen from 2.1% in 2013 to 7.4% in 2015 and 9.9% in 2017, while trends of decline have been observed for food (40.8% to 21.4% between 2013 and 2019), housing/family (18.5% to 12.0%), and clothing (11.2% to 9.1%).

The change was seen as reflecting growing interest in finances amid low interest ratings and an aging population trend. Interest in finances was particularly high among respondents in their 40s (13.2%) and 50s (13.8%).

“This seems to reflect a growing perception that financial assets need to be managed well to purchase real estate and prepare for post-retirement living,” said Bae Soon-young, head of the KCA’s consumer market research team. In a Bank of Korea (BOK) report from its 2018 household finance and welfare survey, “investment in savings and financial assets” was named as the chief application of surplus funds (45.8%), while the main aims of financial investment were named as “preparing for retirement” (57.2%), “housing-related” (15.5%), and “repayment of debts” (9.6%).

Rising income leads to lower emphasis on food and clothingSome analysts suggested the lower importance placed on food and clothing was a reflection of both rising income standards and diversifying products and services. Seo Yong-gu, professor of business administration at Sookmyung Women’s University, explained, “Clothing has become a low-involvement item with the emergence of a lot of low- and mid-priced products through SPA [combined manufacturing and distribution] and overseas direct purchasing. The difference from the lower interest in clothing has shifted to automobiles (0.9%→8.1%), information/communications (0.9%→4.0%), and culture/leisure (6.1%→7.6%). According to a Shinhan Bank report on the “2019 financial lives of ordinary people,” monthly spending on clothing last year was down by 20,000 won (US$17.08) from 2016 levels, while food spending remained in place and spending on leisure/sports and housekeeping services rose by 9,000 won (US$7.69) and 8,000 won (US$6.83), respectively.

The average rating of satisfaction with consumer life was 69.9 points out of 100, higher than the 63.8 points recorded in 2015 but lower than the 76.6 points for 2017. Ratings were above average for food/dining (71.0) and clothing (70.9) and below average for finances/insurance (67.9) and family events (68.2%).

Deceptive advertising and delivery problems related to foodFood/dining was also an area where consumers frequently experienced issues. At 33.5%, it ranked first among areas for the rate of occurrence of consumer issues. The rate of experiences with problems involving delivery/packaged food and groceries (7.2%) and dining out (7.0%) was higher than for the traditional categories where problems have been encountered, such as clothing/shoes (6.1%) and IT devices (4.4%). Delivery/packaged food also ranked first on the survey (6.3%) for experiences with “false or exaggerated advertising.”

“The growth of delivery services has allowed for more user convenience, but there has also been a rise in complaints of exaggerated advertising,” Bae noted, adding that “response measures are being developed for delivery-related problems.” Among respondents, 64.6% said they had voiced their objections when dissatisfied with a transaction, while 31.1% said they were “satisfied” with the business’s subsequent response, a drop of 18.3 percentage points from 49.4% in 2017.

Differences in consumer life satisfaction were also observed among regions. Daegu had the highest satisfaction level at 76.8 points, while Jeju had the lowest at 62.8. Apart from Sejong City (65.4→71.7 points), South Jeolla Province (65.1→72.0), and Gangwon Province (61.2→65.5), most regions showed declines in satisfaction from 2017 levels.

By Hyun So-eun and Park Su-ji, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

Most viewed articles

- 1[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 260% of young Koreans see no need to have kids after marriage

- 3Months and months of overdue wages are pushing migrant workers in Korea into debt

- 4Bills for Itaewon crush inquiry, special counsel probe into Marine’s death pass National Assembly

- 51 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 6[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 7[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 8[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 9S. Korea discusses participation in defense development with AUKUS alliance

- 10Cracks found in containment building of UAE nuclear power plant built by S. Korean companies