hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Doosan Heavy’s financial decline and its failure to read the global power generation industry

The Korea Development Bank (KDB), the Export-Import Bank of Korea (Eximbank), and other government-run banks plan to supply 1 trillion won (US$808.66 million) in policy funds to Doosan Heavy Industries & Construction, which is struggling with a liquidity crisis. But the business prospects remain bleak. How did Doosan Heavy arrive at this point when it once ranked first in the world in the power generation industry? Assessments on the reason for the crisis remain mixed. Some have attributed it to the current administration’s policies promoting a shift away from nuclear power, while others attribute the deteriorating financial situation to a complex mixture of factors, including going against the global move away from coal and the excessive financial burdens the company shouldered as it assumed responsibility for affiliate underperformance.

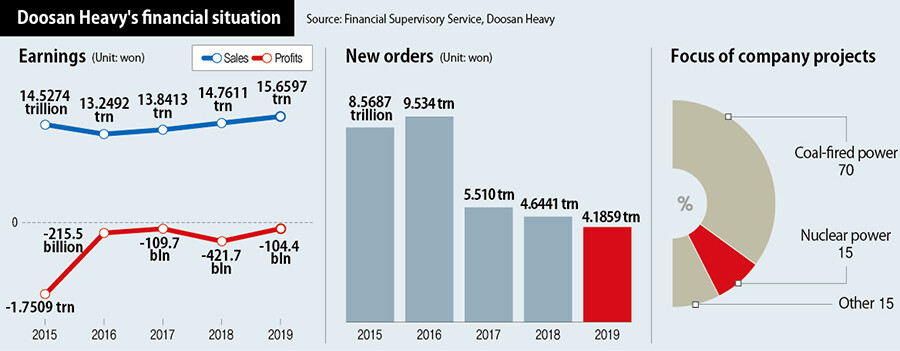

A crisis several years in the makingDoosan Heavy’s financial performance began its turn for the worse in 2015, the year before the Moon Jae-in administration took office. According to a Doosan Heavy business report on Mar. 31, the company has not registered a net profit for any term on its consolidated financial statements since 2015. Its cumulative net losses by term over the past five years (2015-2019) exceeded 2.6 trillion won (US$2.1 billion). New orders fell by more than half from 8.6 trillion won (US$6.95 billion) in 2015 to 4.2 trillion last year (US$3.4 billion).

Excessive support to underperforming affiliates played some part in Doosan Heavy’s decline. As of last year, Doosan Engineering & Construction (Doosan E&C) had recorded cumulative net losses of 2.8 trillion won (US$2.26 billion). Doosan Heavy has poured some 2 trillion won (US$1.62 billion) into Doosan E&C by means of recapitalization and investment in kind. Unable to carry on amid its losses, Doosan E&C was finally delisted this year, with Doosan Heavy acquiring it as a full subsidiary as it absorbed a 100% stake.

As its performance continued to slide amid a steep drop in orders and other financial burdens, Doosan Heavy resorted to personnel cuts and other restructuring in addition to project reshuffling. Its workforce has fallen from around 8,400 employees in 2013 to 7,600 in 2017, 7,300 in 2018, and 6,700 last year -- a drop of nearly 1,000 workers in the space of just two years. Its labor union has insisted that the company is “dodging responsibility for a management failure,” but the company has maintained that its “personnel restructuring has become unavoidable amid the sustained slump in the global power generation market over the past few years.”

What role has the South Korean government’s policy shift away from nuclear power played in Doosan Heavy’s management struggles? Nuclear power accounts for just 15% of Doosan Heavy’s project structure. In contrast, coal-fired power generation represents 70-80%. Globally, the coal-fired power generation industry entered a decline after the Paris Agreement was signed in late 2015; that year marked the beginning of a steep slide in Doosan Heavy’s order balance. Sales shrank from the 5.1 trillion won (US$4.12 billion) range (individual) in 2015 to just over 3.7 trillion won (US$2.99 billion) last year. The drop in overall project orders occurred amid a decline in coal-fired power generation volume. This suggests it may not be fair to attribute Doosan Heavy’s struggles simply to the administration’s policies to promote a shift from nuclear power.

A bigger factor in its management woes may be the fact that the global power generation industry has entered a recession, with a decline in orders for coal-fired power. While plans to build nuclear power plants in South Korea have indeed been suspended or reduced amid the administration’s post-nuclear power policies -- including third and fourth reactors at Shin-Hanul Nuclear Power Plant -- the resulting decline in profits is not the main variable accounting for current performance. Doosan Heavy supplies nuclear power generation equipment and other key devices to Korea Hydro & Nuclear Power (KHNP), but an examination of recent KHNP statistics showed that amid the energy policy shift since 2017, the amount it paid to Doosan Heavy in connection with nuclear power dropped from 655.9 billion won (US$530.4 million) in 2016 to 587.7 billion won (US$475.25 million) in 2017, but actually rose afterwards to 763.6 billion won (US$617.5 million) in 2018 and then to 892.2 billion won (US$721.5 million) last year.

Crisis stemming from resistance against global shift away from coalThe prevailing view among market observers is that while the 1 trillion won (US$808.66 million) bailout may be enough for Doosan Heavy to put out its most urgent fires, it is a long way from completely resolving its liquidity issues. As of late March, the company had borrowed 7 trillion won (US$5.66 billion; consolidated) from financial institutions stood at. Of that amount, 4.28 trillion won (US$3.46 billion) needs to be repaid within the year.

“The 600 billion won [US$485.2 million] in foreign-denominated public offering bonds coming due in April are to be resolved by a loan conversion with Eximbank, which stood surety for payment, while the 400 billion won (US$323.5 million) in bonds with warrant (BW) that comes due in May is to be repaid with independent reserves of assets and cash,” a company official said.

“The 2.3 trillion won [US$1.86 billion] in bank loans can be rolled over, while another 570 billion won [US$460.94 million] in corporate bills and other liabilities that come due in the first half of the year are to be repaid with these borrowings from government-run banks,” the official added.

But it remains unclear whether Doosan Heavy can normalize its management situation even with the support of the government and creditors. Beyond the growing fears of a global economic recession due to the novel coronavirus pandemic, the prospects for orders are by no means clear. Doosan Heavy plans to develop intensive self-rescue measures to discuss with its creditors. The market is already speculating about a possible Doosan E&C selloff, but the company has said that “nothing has been decided.”

The Doosan Group is reportedly weighing additional means of securing liquidity besides selling off Doosan E&C, including recapitalization. The group previously used the controlling family’s shares in Doosan and major affiliates as collateral for 1 trillion won in loans.

“The question of whether to provide additional funding support will be decided after observing Doosan Heavy’s self-rescue efforts,” said Choi Dae-hyeon, vice president of KDB’s corporation and financing sector.

Energy industry observers said the cause of Doosan Heavy’s crisis lies in failed project determinations by managers unable to read market trends. Melissa Brown, a director at the US-based Institute for Energy Economics and Financial Analysis (IEEFA), recently published a column in the South Korean press in which she claimed that Doosan Heavy had “lost much of its domestic and overseas growth potential by misreading the direction of the power generation market over the past three years.”

“Even though the energy shift is an unavoidable trend, [Doosan Heavy] maintains a project portfolio centering on fossil fuels such as coal and gas,” she noted.

“Doosan Heavy’s management should seriously examine global energy trends,” she advised.

By Hong Dae-sun, senior staff writer

Please direct comments or questions to [enlglish@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 6Why Israel isn’t hitting Iran with immediate retaliation

- 7[Guest essay] How Korea turned its trainee doctors into monsters

- 8Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 9[Editorial] Does Yoon think the Korean public is wrong?

- 10[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten