hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea’s public debt to rise to 43.5% after 3rd supplementary budget

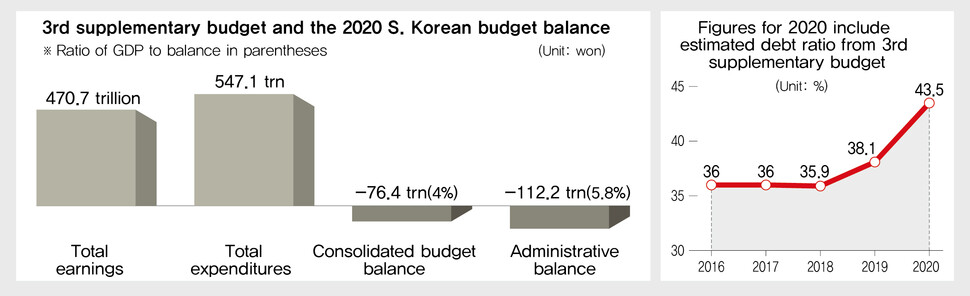

The South Korean government’s plan for a historically large 35.3 trillion-won (US$28.99 billion) third supplementary budget of the year on June 3 means that a large rise in the fiscal deficit and public debt ratio for 2020 is inevitable. If the National Assembly passes the budget plan in its current form, the operational fiscal balance -- a representation of the government’s finances -- will grow to 112.2 trillion won (US$92.17 billion), or around 5.8% of the predicted nominal gross domestic product (GDP) for the year. It’s the highest level ever, even exceeding the 4.6% recorded in 1998 in the immediate wake of the foreign exchange crisis. Public debt is predicted to reach 840.2 trillion won (US$690.12 billion), an increase of 21.2 trillion won (US$17.4 billion) from the second supplementary budget.

As a result, the ratio of public debt to GDP is projected to increase to 43.5%, or 2.1 percentage points more than the 41.4% based on the second supplementary budget. The increase is even larger when compared with last year. Public debt is up by over 100 trillion won (US$82.14 billion) from the 728.8 trillion won (US$598.6 billion) recorded last year, while the public debt ratio is 5.4 percentage points higher than last year’s 38.1%. Like other countries, the South Korean government has been spending massive amounts to protect vulnerable demographics, stimulate the economy, and revise industry structures amid the novel coronavirus pandemic.

The International Monetary Fund (IMF) similarly predicted a rise in the public debt ratio as a result of the pandemic. In the April edition of its Fiscal Monitor, the IMF projected that the global public debt ratio would increase by 13.1 percentage points from last year amid the coronavirus response, with a 17.2-percentage point rise predicted for advanced economies, including South Korea. In a Cabinet meeting on June 3, Prime Minister Chung Sye-kyun noted that there had been “concerns about fiscal soundness with three supplementary budgets being developed in a single year.”

At the same time, he also stressed that it was a “wartime situation” and observed that South Korea’s public debt ratio was “lower than the OECD average.” According to the OECD, the average general government debt (D2) ratio for member countries -- reflecting the sum of debt for central and local governments and non-profit public institutions -- stood at 109.2% as of 2018, with levels of 106.9% for the US, 122.5% for France, and 224.1% for Japan. In contrast, South Korea’s ratio was 40.1%.

Experts said that with South Korea possessing more available fiscal means than other major economies, it should focus more on helping the economy recover through swift fiscal allocation without worrying too much about fiscal soundness. Indeed, IMF figures on the scale of fiscal outlays and financial support relative to GDP showed rates of 34.0% for Germany, 20.5% for Japan, 18.8% for the United Kingdom, and 11.1% for the US as of April. South Korea’s rate was 12.8%. Even with the third supplementary budget added in, the proportion rises only by around one to two percentage points.

“The reason we maintain fiscal soundness is to respond to crises like the present one,” explained Choi Han-soo, a professor of economics at Kyungpook National University.

“Even in places like the US where the public debt ratio exceeds 100%, the top priority is to respond to the crisis, and there aren’t people worrying about fiscal soundness,” he noted.

Hwang Sung-hyun, a professor of economics at Incheon National University, said, “The second supplementary budget should have been even larger, but now that we have a third supplementary budget drawn up, its swift passage by the National Assembly and swift allocation are advisable both for the sake of overcoming the crisis and to enable a swift economic recovery in the future.”

By Lee Jeong-hun, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1Behind-the-times gender change regulations leave trans Koreans in the lurch

- 2South Korean ambassador attends Putin’s inauguration as US and others boycott

- 3Yoon’s revival of civil affairs senior secretary criticized as shield against judicial scrutiny

- 4Family that exposed military cover-up of loved one’s death reflect on Marine’s death

- 5AI is catching up with humans at a ‘shocking’ rate

- 6Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 7[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 8Japan says its directives were aimed at increasing Line’s security, not pushing Naver buyout

- 91 in 10 marriages in Korea last year was with a foreign national

- 10[Column] The nuclear umbrella and the afterlife