hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea to raise tax rate on highest income bracket from 42% to 45%

Stock transactions will be taxed at 20% starting at profits of US$41,000

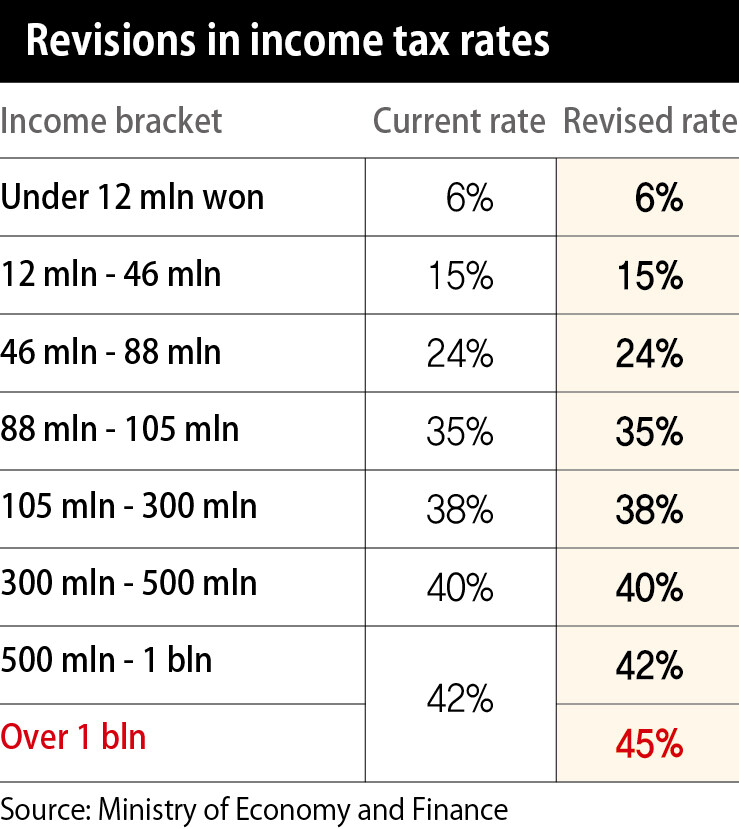

The South Korean government is raising the tax rate on the highest bracket of income earners (above 1 billion won, or US$834,397, in annual income) by 3 percentage points, from 42% to 45%. As of 2023, investors will be charged between 20-25% of tax if they make more than 50 million won (US$41,720) from selling stock.

These and other changes appear in the revised 2020 tax code, which was given final approval by a tax review board at the Ministry of Economy and Finance on July 22. Presuming that the revised code, which seeks to revitalize the economy and help overcome the COVID-19 crisis, is passed by the National Assembly in December, its measures will take effect, in phases, starting next year.

Under the current income tax regime, the first 12 million won (US$10,014) in the tax base is assessed at the lowest tax rate of 6%, with the tax rate increasing in each bracket. The highest bracket had a taxed income of 500 million won (US$417,233) and above at the rate of 42%. Under the revised plan, the government creates a new bracket of 1 billion won (US$834,439) and above, bumping up the maximum tax rate by 3 percentage points to 45%. This tax rate will take effect with income earned in January 2021.

“The polarization of wealth distribution has been exacerbated recently by the COVID-19 pandemic. We are raising the tax burden on high-income earners who can afford it, namely the top 0.05% of taxpayers [11,000 individuals in terms of wage and salary income and aggregate income], in the interest of social solidarity,” explained the Ministry of Economy and Finance.

Facing public opposition, the government backpedaled on a plan to impose a capital gains tax on trading stocks from publicly listed companies. The revised tax code states that, starting in 2023, those who make more than 50 million won (US$41,718) in stock transactions will pay a 20% tax on profit between 50 million and 300 million won (US$41,718-250,302) and 25% on profit above 300 million won.

The government’s initial plan, as announced last month, was to assess tax on stock profits above 20 million won (US$16,687), but pushback from individual stockowners prompted President Moon Jae-in to order a revision of the plan, ultimately exempting the first 50 million won in profit. The government’s original plan would only have applied to the top 5% of stockholders, but the revision brings that percentage down to the top 2.5%.

The government is also fast-tracking its plan to cut the financial transaction tax (currently 0.25%) by one year, from 2022 to 2021. The transaction tax rate will be lowered by 0.02 points to 0.23% next year and then by 0.08 points to 0.15% in the following year.

The July 10 real estate measures, which ratcheted up a range of taxes on multiple home owners (including the comprehensive real estate holding tax, capital gains tax, and acquisition tax) were also included in the revised tax code. Bitcoin and other cryptocurrencies had been a blind spot in the tax code, but starting in Octover 2021, profits on cryptocurrency transactions will be subject to a 20% income tax.

Starting in July 2021, the government will broaden eligibility for the simplified VAT (value-added tax) reporting system by increasing the maximum yearly revenue from 48 million won (US$40,056) to 80 million won (US$66,760). At the same time, the government will raise the VAT exemption limit from 30 million won (US$25,035) to 48 million won (US$40,056) in yearly revenue. Both measures are designed to ease the tax burden on the working class and small business owners.

“Over the next five years, these adjustments will increase the tax burden of high-income earners and large corporations by 1.88 trillion won [US$1.57 billion] while lowering the burden on the working class, the middle class, and small and medium-sized enterprises by 1.77 trillion won [US$1.48 billion],” the government predicted.

By Lee Kyung-mi, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1Samsung subcontractor worker commits suicide from work stress

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 4Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 5[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 6No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 7US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 10[Column] Season 2 of special prosecutor probe may be coming to Korea soon