hankyoreh

Links to other country sites 다른 나라 사이트 링크

Number of foreign property owners in S. Korea on the rise

Amid the recent real estate market frenzy in the Seoul Capital Area (SCA), the number of foreign nationals purchasing apartments has risen sharply. The National Tax Service (NTS) announced on Aug. 3 that it was initiating tax audits to investigate possible tax evasion by 42 foreign nationals with histories of speculative purchasing, including multiple homeowners.

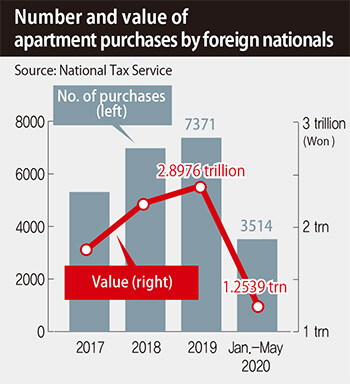

In an analysis of year-to-year acquisition of South Korean apartments by foreign nationals based on Supreme Court registration figures, the NTS found that foreign nationals had purchased a total of 23,167 apartments valued at 7.63 trillion won (US$6.39 billion) in all between 2017 and May 2020.

The number of purchases was found to have increased from year to year, with 5,308 in 2017, 6,974 in 2018, and 7,731 in 2019. The acquisition value also increased annually from 1.79 trillion won (US$1.5 billion) in 2017 to 2.23 trillion won (US$1.9 billion) in 2018 and 2.4 trillion won (US$2.01 billion) in 2019. For the year 2020, foreign nationals had acquired 3,514 apartments (1.25 trillion won, or US$1.05 billion) as of May, representing a 27% increase in the number of purchases and a 49% increase in value from the same period in 2019 (2,768 apartments, 840.7 billion won, or US$703.8 million).

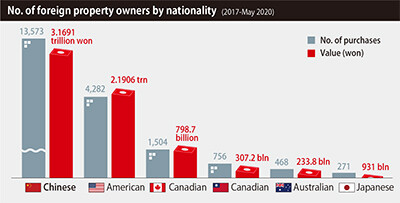

Majority of foreign property owners Chinese nationalsBy nationality, Chinese nationals led the way with 13,573 apartments acquired (3.17 trillion won, or US$2.65 billion), followed by citizens of the US (4,282 apartments, 2.19 trillion won, or US$1.83 billion) and Canada (1,504 apartments, 798.7 billion won, or US$668.7 million). A total of 1,036 foreign nationals were classified as multiple homeowners with two or more apartments. This included 866 people with two residences, 105 with three, and 65 with four or more -- accounting for 2,467 apartments in all. One individual was found to own 42 apartments, with an acquisition value of 6.7 billion won (US$5.6 million).

Of the 23,167 apartments purchased by foreign nationals over the three-year, five-month period, 7,569 (32.7%) had never been occupied by their respective owners. The NTS launched tax audits against 42 foreign nationals with multiple residences or histories of non-occupancy on suspicions of evading housing and rental income taxes. For example, an audit was initiated against a US national in their 40s identified by the initial “A,” who had acquiring 42 small apartments in the SCA and in the Chungcheong Provinces (6.7 billion won, or US$5.6 million) since 2018 through “gap investing” and is suspected of underreporting rental income. The NTS began its investigation of A due to the lack of financial transparency, with little domestic income or property recorded.

“B” is a Chinese national in their 40s who entered South Korea to study Korean and currently lives in the SCA, having found employment after the completion of their studies. B was found to have purchased eight apartments in various locations throughout South Korea, including Seoul, Gyeonggi Province, Incheon, and Busan. With seven of them currently rented out through key money and monthly rental arrangements, B is suspected of having failed to report rental income.

“C,” a foreign national who works as an executive at the South Korean branch of an overseas corporation, is suspected of having failed to report rental income for four luxury apartments they purchased in locations including the banks of the Han River and Seoul’s Gangnam neighborhood. The units in question are currently being leased for monthly rents in excess of 10 million won (US$8,376) apiece.

“Foreign nationals must comply with the same tax laws as South Koreans when acquiring, owning, and transferring apartments in South Korea,” stressed Lim Kwang-hyun, director of the NTS investigation bureau.

“We plan to conduct a thorough examination of the individuals being audited, including the possibility of rental and transfer income tax evasion, and the sources of acquired funds,” Im said.

By Lee Kyung-mi, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 346% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 8Korea sees more deaths than births for 52nd consecutive month in February

- 9“Parental care contracts” increasingly common in South Korea

- 10[Interview] Dear Korean men, It’s OK to admit you’re not always strong