hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Why semiconductor prices are dropping despite a supply crunch

After a previous forecast in excess of 100,000 won, Samsung Electronics' share prices closed below 70,000 won on Tuesday, Oct. 12.

This happened at a time when the company had recorded its highest-ever quarterly sales during the third quarter from July to September. Analysts read the trend as reflecting market predictions that the price of dynamic random access memory (DRAM) semiconductors — which make up a large part of Samsung Electronics’ sales — will drop in the future.

Many have been taken aback by the predictions of semiconductor prices falling at a time when automobile and smartphone production have been experiencing setbacks due to a shortage of semiconductor materials.

This confusion stems in part from misconceptions about semiconductors.

Semiconductors come in two main types. One consists of non-memory (system) semiconductors, which have been the subject of global shortages this year. The other type is memory semiconductors, which are expected to experience a price drop.

While both are indeed semiconductors, they differ in nature.

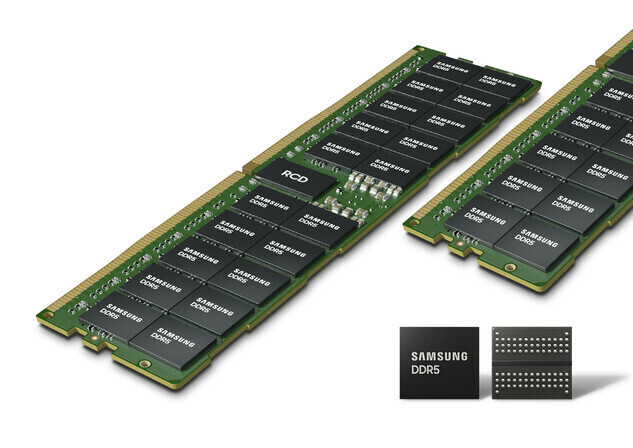

DRAM is one of the main types of memory semiconductors, alongside NAND flash. This is the market dominated by South Korean companies such as Samsung Electronics and SK Hynix. The predictions of a price drop are rooted in concerns about a memory semiconductor supply glut.

To be sure, the two different categories of semiconductors are not entirely unrelated. Indeed, they could be seen as having a close interrelationship, especially under the current conditions.

DRAM goes into a wide variety of devices, including personal computers, smartphones, and servers. Non-memory semiconductors are also needed to produce the same devices.

In other words, demand for memory semiconductors decreases as a matter of course when finished products cannot be produced on time due to a lack of non-memory semiconductors. When demand drops, that increases the potential for prices to drop as well.

According to a recent report by Bloomberg, Apple may cut its production of the iPhone 13 by as many as 10 million units from its original 2021 target of more than 90 million units due to the semiconductor chip crunch.

Similarly, Samsung Electronics has yet to unveil its Galaxy S21 Fan Edition (FE), which was expected to be launched in August. This means that unused DRAM semiconductors are piling up in warehouses.

In a recent report, KB Securities analyst Kim Dong-won said, “The down cycle for memory semiconductors appears to be less about a drop in final demand and more about production setbacks for set companies due to the IT component supply crunch.”

“The set companies with memory stockpiles beyond what is appropriate appear to be demanding lower prices and conservative memory stockpiling policies,” he observed.

In a report published on Tuesday, the Taiwanese market research company TrendForce projected the average selling price for all DRAM products next year would be 15–20% lower than this year. According to this analysis, demand will fail to meet supply even if the “big three” of Samsung Electronics, SK Hynix and Micron are conservative in their production plans.

Market experts also noted that DRAM prices have been in a holding pattern for the past two months (August and September) and appear very likely to decline during this month.

Some analysts suggested that if memory semiconductor prices do fall, it will be for a shorter period than in the past — a result of the memory semiconductor cycle shortening to one year from a roughly two-year cycle in the past.

The DRAM market would experience longer down cycles in the past as companies competed to build their supply capabilities during boom times for multiple manufacturers. These days, however, the only “survivors” left are the big three, which account for more than 90% of the total market.

“A short-term decline in quarterly operating profits appears inevitable [for Samsung Electronics] with the reversal of the DRAM price drop in the fourth quarter and an increase in the decline of DRAM price’s during the slow season in the first quarter of next year,” predicted Eo Kyu-jin, an analyst at DB Financial Investment.

“I expect DRAM prices will begin rapidly rising again [based on the shortened down cycle] once we reach the third quarter of next year,” Eo added.

By Sun Dam-eun, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 2Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 360% of young Koreans see no need to have kids after marriage

- 4[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 5After 2 years in office, Yoon’s promises of fairness, common sense ring hollow

- 6S. Korean first lady likely to face questioning by prosecutors over Dior handbag scandal

- 7[Column] Why Korea’s hard right is fated to lose

- 8AI is catching up with humans at a ‘shocking’ rate

- 9[Column] The first year of war in Ukraine

- 10‘Weddingflation’ breaks the bank for Korean couples-to-be