hankyoreh

Links to other country sites 다른 나라 사이트 링크

How big of an impact will China’s economic downturn have on Korea? It depends

The Chinese economy is on shaky ground. With China’s standing as Korea’s biggest export market, the shock of an economic downturn there could have major negative repercussions on the South Korean economy as well.

Leading financial analysts say the shock to the Korean economy will depend on which area the crisis occurs in. The three major risks to the Chinese economy are real estate debt, a slump in the domestic market and an export slowdown. Crises arising in the real estate sector and the domestic market are expected to have less of an impact on the Korean economy than a crisis triggered by an export slowdown.

“China achieved a truly remarkable recovery [from COVID-19], but its growth momentum has been slowing notably,” warned Kristalina Georgieva, managing director of the International Monetary Fund, on Monday.

The Chinese Academy of Social Sciences, the leading think tank affiliated with the State Council of China, recently predicted that the Chinese economy would grow by 5.3% next year — representing the lowest level in the past 30 years.

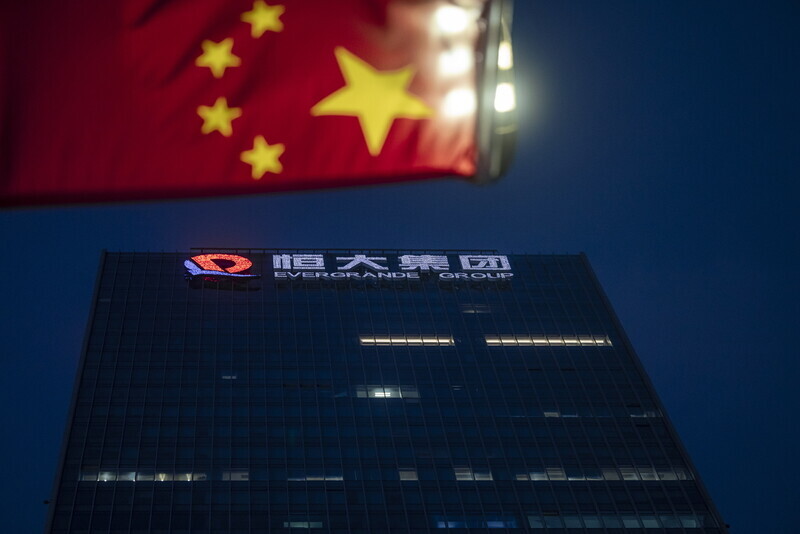

Economic growth in China is slowing dramatically because of the debt crisis at property developers including the Evergrande Group, an electricity shortfall, and the Chinese government’s insistence on maintaining extremely rigid pandemic restrictions. That economic slowdown could also inflict serious damage on the Korean economy, given its close ties with China.

While Korean financial analysts are worried about the situation in China, they’re also paying close attention to what might trigger an economic recession.

“When China’s economic growth rate falls by about 1 point, Korea’s economic growth rate falls by an average of 0.1-0.15 points as well,” said Kim Woong, head of the Bank of Korea’s research department, while announcing revised economic projections on Nov. 25.

“The factor behind the decrease in China’s growth rate is important, and the impact depends on which area is declining — consumption, real estate investment or exports. If it’s a matter of real estate or consumption, the impact on Korea could be limited,” he added.

Kim’s comments suggest that a Chinese economic downturn triggered by sluggish consumption or other factors in the domestic market might have a relatively small impact on the Korean economy.

That projection makes sense when we examine the structure of Korean exports to China, which are organized around semiconductors and other areas in which Korea has a competitive advantage. China also imports high-tech parts from Korea and uses them to make finished products for export.

So long as Chinese exports hold steady, therefore, Korean exports to China might not be majorly disrupted even if there is a slowdown in the Chinese domestic market.

Analysts also say the Chinese government still has the option of intervening in the real estate debt crisis.

“The Chinese government has begun to intervene in the Evergrande Group instead of simply watching it go through a disorderly bankruptcy. The growing likelihood that China will change its policy approach will have a positive influence not only on the Chinese economy but on Korea as well,” Hi Investment & Securities said in a report on Wednesday.

Therefore, exports appear to pose the greatest risk for Korea among China’s three potential crises. China is showing indications of an export slowdown: China’s exports last month were up 22% year over year, but the pace of growth declined from September (28.1%) and October (27.1%).

Fortunately, Korea’s exports to China are still strong, exceeding US$15 billion in value for the first time last month.

“The intensity of the shock a downturn in Chinese growth would have on Korean exports to China may depend on the sector in which that downturn originates,” the Bank of Korea said last month in an issue note on the structural characteristics and implications of exports to China.

By Jun Seul-gi, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0517/8117159322045222.jpg) [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later

[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence- [Editorial] Yoon must stop abusing authority to shield himself from investigation

- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

Most viewed articles

- 1For new generation of Chinese artists, discontent is disobedience

- 2[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 3[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- 4[Exclusive] Unearthed memo suggests Gwangju Uprising missing may have been cremated

- 5[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner t

- 6Xi, Putin ‘oppose acts of military intimidation’ against N. Korea by US in joint statement

- 7China calls US tariffs ‘madness,’ warns of full-on trade conflict

- 8Could Korea’s Naver lose control of Line to Japan?

- 9China, Russia put foot down on US moves in Asia, ratchet up solidarity with N. Korea

- 10For Korea’s Justice Ministry, no place is sacred from immigration raids