hankyoreh

Links to other country sites 다른 나라 사이트 링크

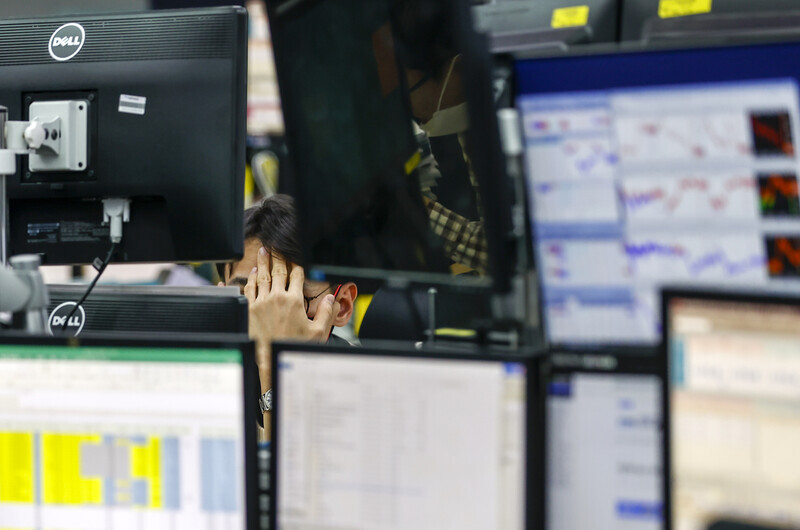

KOSPI dips below 3,000 as won’s value falls against the dollar

The market was rattled by growing concerns about the Omicron variant of COVID-19 over the weekend, along with the US Federal Reserve signaling it would raise its policy rate in March 2022. The won-dollar exchange rate rose nearly 10 won to top 1,190 won, and South Korea’s benchmark stock index fell below 3,000.

The won-dollar exchange rate ended on Monday at 1,190.8 won on the Seoul foreign exchange market, up 9.9 won from the previous day of trading as the won lost value. The last time the won-dollar rate was above 1,190 was on Nov. 29 (1,193 won). It was also the first time the rate has increased by close to 10 won from the previous day of trading in half a year, following a 13.2 won jump on June 17.

The benchmark Korea Composite Stock Price Index, known as KOSPI, closed Monday at 2,963.00 points, a decline of 1.81% (54.73 points) from the previous day of trading. The last time the index closed below 3,000 was three trading days ago, on Dec. 15. The tech-heavy KOSDAQ index was also down 1.07% (10.75 points) from the previous day of trading, dropping to 990.51 at the close.

The factor behind the sharp rise in the won-dollar exchange rate was the proliferation of the Omicron variant. Preferences for safe assets have increased as concerns about Omicron have grown around the world, analysts explained. That drove up the US dollar, the leading safe-haven currency, depressing the value of the won.

“One thing that’s clear is [Omicron’s] extraordinary capability of spreading, its transmissibility capability,” said Anthony Fauci, the US’ top infectious disease expert, on Sunday.

“With the Omicron that we’re dealing with it is going to be a tough few weeks to months as we get deeper into the winter,” Fauci noted.

On top of that, financial markets seemed jittery about growing indications that the Fed will raise its policy rate next March. In a meeting of the Federal Open Market Committee on Dec. 14-15, Fed officials hinted that there may be three rate hikes next year.

On Dec. 17, Christopher Waller, a member of the Federal Reserve Board of Governors, mentioned that the Fed could begin raising its policy rate as soon as tapering (reducing asset purchases) ends next March.

“Assuming this new pace of reductions in our monthly asset purchases continues, the FOMC will end purchases in March,” Waller said in a speech at the Forecasters Club of New York. “I believe an increase in the target range for the federal funds rate will be warranted shortly after our asset purchases end.”

“The KOSPI declined on uncertainty about US policy and concerns about the spread of Omicron, and the won fell sharply against the dollar as preferences for safe assets gained strength,” said Park Su-jin, an analyst at Mirae Asset Securities.

By Jun Seul-gi, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Tariffs on China: Trump was dumb, Biden dumber [Column] Tariffs on China: Trump was dumb, Biden dumber](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0520/191716191153918.jpg) [Column] Tariffs on China: Trump was dumb, Biden dumber

[Column] Tariffs on China: Trump was dumb, Biden dumber![[Column] What if Seoul took reunification by force off the table? [Column] What if Seoul took reunification by force off the table?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0520/3017161928630494.jpg) [Column] What if Seoul took reunification by force off the table?

[Column] What if Seoul took reunification by force off the table?- [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later

- [Column] When ‘fairness’ means hate and violence

- [Editorial] Yoon must stop abusing authority to shield himself from investigation

- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

Most viewed articles

- 1Xi, Putin ‘oppose acts of military intimidation’ against N. Korea by US in joint statement

- 2Kim Jong-un wanted to meet with residents of shelled Yeonpyeong Island in South, Moon recalls in mem

- 3[Column] What if Seoul took reunification by force off the table?

- 4To weigh costs and benefits, Korea must stop treating US troop presence as a sacred cow

- 5Berlin mayor hints at tearing down ‘comfort women’ memorial in city

- 6[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- 7[Column] Tariffs on China: Trump was dumb, Biden dumber

- 8[Exclusive] Truth commission to seek additional murder charges for figures behind 1980 Gwangju massa

- 9[Column] In Germany, Japan is waging a war over its history with Korea

- 10KEPCO undergoes repairs for cracks in nuclear reactor containment buildings in UAE