hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea sees record foreign direct investment of US$29 billion in 2021

German pharmaceutical giant Sartorius AG invested US$300 million in the fourth quarter of last year to build a biopharmaceutical raw material production facility in Songdo International City in the Incheon Free Economic Zone. Before that, in the second quarter of last year, US chemical company DuPont invested US$30 million to develop and produce extreme ultraviolet (EUV) photoresist at its Cheonan plant in South Chungcheong Province.

EUV photoresist is the only item among Japan’s 3 key export-restricted materials that has yet to be produced locally in South Korea.

Last year, such foreign direct investment (FDI) performance, according to pledged figures, totaled US$29.51 billion — a 42.3% increase compared to the previous year. The results were released on Monday by the Ministry of Trade, Industry and Energy, based on an analysis of data from the Korea Trade-Investment Promotion Agency (KOTRA), the Foreign Direct Investment Research Center, and the foreign direct investment statistics system.

Last year's performance is the highest ever since statistics first began being compiled in 1962. In terms of actual received FDI, these figures rose by 57.5% to $18.3 billion, which is also the highest-ever recorded number. This is 9.7% and 3.3% higher than the previous records of $26.9 billion (pledged) and $17.45 billion (received) in 2018, respectively.

“Despite the COVID-19 crisis, exports and even foreign direct investment achieved their highest performance ever, contributing to economic recovery and the expansion of supply chains,” the Ministry of Trade, Industry and Energy said in a press release. The ministry also added that “robust influx factors within the supply chain, vaccine and bio-healthcare, hydrogen economy and energy policy roll-out prospects contributed to an expansion in recovery and investment.”

Based on the pledged figures, investment in the service sector increased by 64.2% while the manufacturing sector saw a decrease of 16.2% from the previous year. Other sectors — including primary industries, such as agriculture, livestock, fisheries, mining, and the electric, gas, water, and environmental cleanup sectors — rose by 122.9%.

Investment in the service industry totaled US$23.57 billion. Other industries that saw large increases in foreign investment were the information and communication sector (317.2%), the wholesale/retail sector (139.1%), and the business support/lease sector (833.0%).

FDI in the manufacturing industry was $5 billion. Particularly, semiconductor manufacturing saw a significant increase (81.8%), while paper and wood manufacturing (833.4%) and metals (77.2%) also saw increases.

Sectors that experienced declining investments included fabric, textiles, and clothing (-97.4%), food (-42.3%), and machinery and precision medicine equipment (-18.5%).

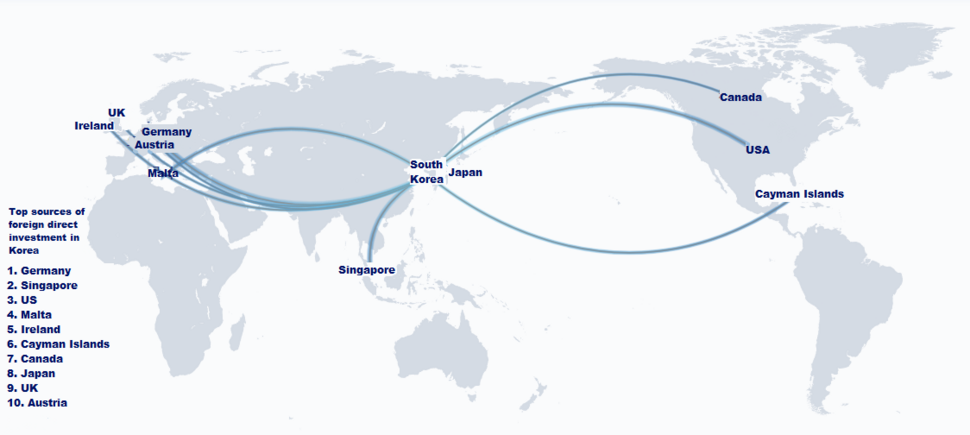

According to investment by country (based on pledged figures), investment from the US was US$5.26 billion, while investment from the European Union was recorded at US$12.8 billion. China and neighboring regions (Hong Kong, Singapore, Malaysia and Taiwan) invested US$7.54 billion, while Japan invested US$1.21 billion in Korea.

Investment from the United States saw a 0.9% drop from the previous year, while investment from the EU and Japan saw FDI increases by 169.0% and 52.8%, respectively. FDI from China and its neighbors continued its increase by 38.1%.

Based on pledged figures, greenfield investment in Korea increased by 24.7% to reach $18.09 billion, and mergers and acquisitions (M&A) investments increased by 83.2% to hit $11.42 billion. Both swapped out a decline in 2020 for an increase in 2021. Greenfield investment refers to a type of foreign direct investment in which a parent company creates a subsidiary in another country.

According to Korea’s Foreign Investment Promotion Act, in the case of owning stocks or shares, FDI refers to an “investment of 100 million won or more, which accounts for 10% or more of the total number of stocks or total investment.” Ordinary securities investments are not included.

By Kim Young-bae, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 3‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 4Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 5Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 6Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 7Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 8[Editorial] In the year since the Sewol, our national community has drowned

- 9[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent