hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea’s financial stress index hits “caution” level, akin to early 2008

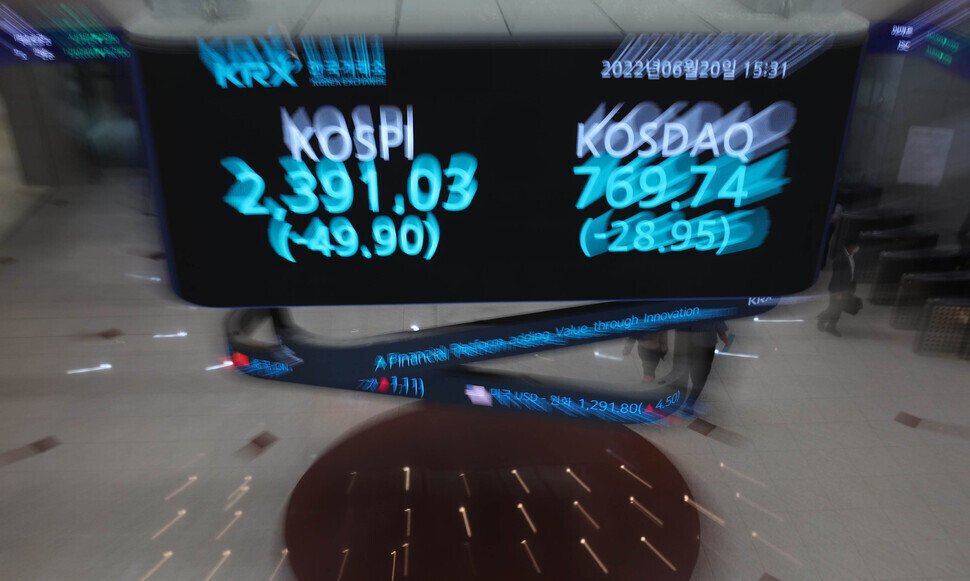

“KOSPI down 20% while won value down 7.78% against the dollar.”

Stocks, Korean treasury bond prices, and the value of the won have all been falling against their figures recorded at the beginning of the year. Major financial indicators are plunging due to strong austerity measures by the US and Korean central banks and concerns over an economic slowdown.

As a result, it’s been reported that Korea’s financial stress index (FSI) has recently reached the “caution” stage, prompting calls to keep an eye on warning signs coming from financial markets.

On Monday, South Korea’s benchmark KOSPI closed at 2,391.03, down 49.90 points (2.04%) from the previous trading day. It marked the first time since Nov. 4, 2020 (2,357.32) that it has closed below the 2,400-point level.

In the span of about six months, the index has nosedived from 2,988.77 on Jan. 3 to below 2,400.

Meanwhile, the won-dollar exchange rate closed at 1,292.4 won, up 5.1 won from the previous trading day. The won-dollar exchange rate started the year at 1,191.8 won to the dollar, but has jumped 100.6 won since. Also, the yield on the three-year treasury bonds, which was in the 1% range at the beginning of the year, finished trading at 3.675%.

According to the Bank of Korea (BOK) and financial institutions, the local FSI for last month is estimated to have reached the caution level (8 or higher). The index entered the crisis phase eight months after entering the caution stage in January 2008 during the global financial crisis. The latest figure released so far was 7.4 in February.

"It is highly likely that the [FSI] figures have risen further due to increased volatility in the financial market since February,” commented an official with the BOK.

The index briefly spiked to 24.4 in April 2020, in the early days of the COVID-19 pandemic, before later stabilizing to between 0 and 2. But it has been fluctuating again since October 2021.

The financial stress index is an indicator of financial stability that reflects a wide range of factors including the stock, foreign exchange, and bond markets; the default rate for banks; the current account balance and credit default swap spread; and the rates of growth and inflation.

Historically, the index has risen sharply during times of financial crisis, including the Asian financial crisis of the late ’90s (when it hit 100) and the global financial crisis of the late ’00s (57.5). In these cases, after passing 8, which represents the threshold level for the “caution” stage, the index continued to rise, reaching the “crisis” stage (22+) within six to eight months and remaining there for nine to 27 months. This is why many are saying the FSI requires close attention after reaching the caution stage.

Trends in the financial vulnerability index (FVI) have also been troubling.

As of the fourth quarter of 2021, the announced FVI was 54.2, which was similar to the 52.4 recorded during the second quarter of 2009 amid the global financial crisis. The level is estimated to have risen even higher during the first quarter of this year.

The FVI is an indicator of conditions of intermediate- to long-term financial stability, up to and including the response capabilities of financial institutions. The BOK is scheduled to announce new FSI and FVI figures on Wednesday.

Financial authorities are currently worried the market volatility could escalate into a crisis affecting the entire financial system. Given the complex entanglements among bonds and liabilities in the financial market, a problem in one area could end up having a cascading effect.

In particular, problems could arise with the soundness of financial institutions if the households and companies that incurred debt to invest during the COVID-19 pandemic find themselves less able to repay their liabilities.

Asset prices are currently showing extreme volatility — not only in the area of stocks and bonds but in housing, with the price of apartments in Seoul last week showing its first week-on-week decline in two years. The coverage ratio for South Korean banks, reflecting the rate of funds put in reserve for non-performing loans, stood at 181.6% in the first three months of 2022, up by 15.7 percentage points from 165.9% at the end of the preceding quarter.

Meeting with bank leaders on Monday, Financial Supervisory Service Governor Lee Bok-hyun said, “Due to fiscal and financial support for the COVID-19 response, there is a strong possibility the default ratio will be underestimated.”

He called for the leaders to “increase loss absorption capabilities, including ensuring sufficient reserve funds to reflect a more conservative future outlook.”

By Jun Seul-gi, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis![[Column] Can Yoon steer diplomacy with Russia, China back on track? [Column] Can Yoon steer diplomacy with Russia, China back on track?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/1617144616798244.jpg) [Column] Can Yoon steer diplomacy with Russia, China back on track?

[Column] Can Yoon steer diplomacy with Russia, China back on track?- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

Most viewed articles

- 1Under conservative chief, Korea’s TRC brands teenage wartime massacre victims as traitors

- 2[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 3Months and months of overdue wages are pushing migrant workers in Korea into debt

- 4[Column] Can Yoon steer diplomacy with Russia, China back on track?

- 5Value of Korean won down 7.3% in 2024, a steeper plunge than during 2008 crisis

- 6After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 7Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 8First meeting between Yoon, Lee in 2 years ends without compromise or agreement

- 9[Editorial] Japan’s removal of forced labor memorial tramples on remembrance, reflection and friends

- 10Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range