hankyoreh

Links to other country sites 다른 나라 사이트 링크

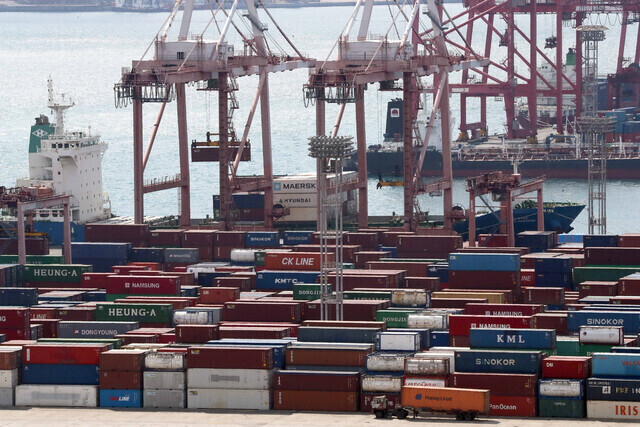

S. Korea braces for impact of low growth in China after 25T won in trade surplus goes up in smoke

A country that creates a new economy the size of Greece’s every 11.5 weeks — that’s how Jim O’Neill, then the UK commercial secretary to the treasury, described China in 2012.

Ten years later, the situation is a 180-degree turnaround.

Today, many are worried that China is going to drive the global economy into a recession. The alarm is already being raised for the South Korean economy, which is heavily dependent on China.

In a report published on Oct. 17, the Investment Institute affiliated with BlackRock, the world’s largest asset management company, noted that after recording a rapid 7.7% annual average rate of growth over the 10 years leading up to the COVID-19 pandemic, the Chinese economy is now facing serious challenges as it enters a phase of relatively slow growth. According to its analysis, the Chinese economy’s potential growth rate could drop to 3% within the next decade.

Three reasons prompt the institute to predict the long-term low growth of the Chinese economy.

First, China is seeing a decrease in exports. The report projected that China’s real export growth rate this year and next year will decrease annually by 6%, wearing down the growth rate by 1.1%.

Neither is it easy for China to boost domestic demand to substitute exports. This is due to the massive debt held by local governments, the real-estate bubble, and exacerbated income inequality.

Adding support to this analysis are predictions that Xi Jinping’s third term in office will continue to emphasize stability rather than growth. The decline of China’s productive population and the country’s slowing productivity due to the US’ checks on China’s high-tech industries are cited as reasons for decreases in China’s growth potential.

“In the past, when countries faced a slowdown [. . .] they could rely on China to continue supplying an abundance of cheap products,” said BlackRock.

“Not so anymore. Recession is looming now for the US, UK and Europe. But this time, China won’t be coming to its own, or anyone else’s, rescue.”

The latest “World Economic Outlook,” released by the International Monetary Fund, points to China’s economic slowdown as one of the three major threats to the global economy. The report projected that if China’s economy – the second largest in the world – were to slow down due to its zero-COVID policy or a sharp drop in its real estate market, it would have negative reverberations around the world on par with the outbreak of the war in Ukraine.

This problem is of particular concern to Korea, which has until now enjoyed booming demand from China. Korea, which exports intermediate goods to local production bases in China, will be significantly affected by a slowdown in China’s exports and growth.

Korea’s trade surplus with China for 2022 is US$2.7 billion as of Oct. 20, down 86% (US$17.2 billion) from the same period last year. Approximately 25 trillion won (US$17.4 billion) worth of trade surplus has evaporated in a single year. Korea’s trade surplus with China last year amounted to US$24.3 billion, accounting for 83% of Korea’s total trade surplus.

“Is there any concern that a high dependence on the public will be a structural problem for the Korean economy in the future?” asked an executive of one of the world’s top three private equity funds, at a briefing on the Korean economy held by the Korean government in New York on Oct. 11.

Yeon Won-ho, head of economic security at the Korea Institute for International Economic Policy, told the Hankyoreh over the phone, “If China is to double its 2020 gross domestic product by 2035 as President Xi Jinping declared, it will have to grow at an annual average rate of 4.73% per year.”

“This seems impossible in the current situation,” Yeon added.

“It’s commonly thought that China’s growth rate is likely to fall due to the reinforcement of the US blockade on China, opposition to dictatorship within China, decrease in local investment by overseas investors, and limitations to the government’s stimulus measures,” said Yeon.

Meanwhile, Yeon explained, “The recent deterioration in the trade balance with China is a temporary phenomenon due to rising import prices of raw materials.”

“I don’t think Korea will see a sharp decline in exports,” he added.

By Park Jong-o, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 2After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 3Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 4‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 5AI is catching up with humans at a ‘shocking’ rate

- 6Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 746% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 8Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 9Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 10Ethnic Koreans in Japan's Utoro village wait for Seoul's help