hankyoreh

Links to other country sites 다른 나라 사이트 링크

IMF’s dim forecast for Chinese economy sounds alarm for S. Korea

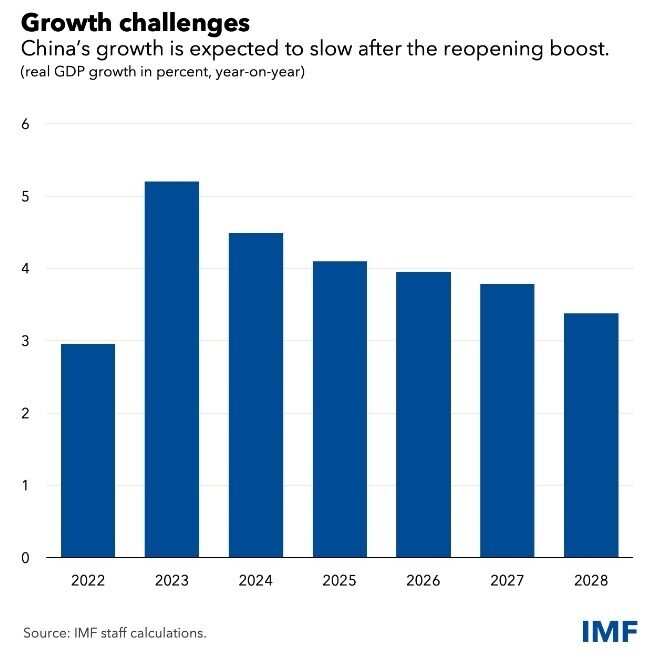

The International Monetary Fund warned that China’s economic growth rate could fall below 4% within the next five years.

While China’s growth rate will enjoy a “reopening” rebound this year as it resumes economic activity following the pandemic, the IMF’s prediction adds grist to the theory that the Chinese economy has peaked and will begin to decline as its population decreases and its productivity slows.

That prospect has disturbing implications for the South Korean economy, given its high dependence on exports to China.

“China’s economy is set to rebound this year as mobility and activity pick up after the lifting of pandemic restrictions, providing a boost to the global economy,” the IMF wrote in a report published Friday following a yearly consultation with China. China’s real economic growth rate will rise from 3% last year to 5.2% this year, making up a quarter of growth in the world economy, the IMF predicted.

The IMF believes that consumption in the Chinese private sector will pick up after last year’s contraction, exerting a positive impact not only on the domestic economy but also on the economies of neighbors such as Thailand and the Philippines through travel and tourism.

Considering that the international prices of raw materials, including energy, have been falling of late and that Chinese service-centered imports are trending upward, China’s resumption of economic activity is expected to have a limited impact on global inflation.

But China’s medium- and long-term prospects are darker.

“Even so, China still faces significant economic challenges,” the IMF said, noting that along with “the contraction in real estate,” those challenges include “a shrinking population and slowing productivity growth.”

“Without reforms, we currently estimate growth to fall below 4 percent over the next five years,” the IMF added.

The IMF expects that China’s growth rate, after hitting 5.2% this year, will decline each year until dropping below 4% in 2027.

Thomas Helbling, deputy director of the IMF’s Asia and Pacific Department, said in a press briefing on Thursday that one of the major risk factors for the Chinese economy is a hard landing in the real estate market.

“Additional action will be needed to end the real estate crisis [. . .] to promote market-based restructuring in the sector,” Helbling said.

According to Helbling, the Chinese authorities’ measures to bail out real estate developers and help homeowners with their mortgages are insufficient to deflate the real estate bubble and deal with rampant insolvency in the sector.

China pushed back against the IMF’s prescriptions. “China’s economy has strong resilience, massive potential, and strong vitality,” said Zhengxin Zhang, China’s executive director at the IMF, in a statement attached to the report. “We have confidence that the economy will maintain medium- to high-speed growth over a relatively long period.”

China’s property market has been operating smoothly in general, and is not in a ‘crisis’ situation. [. . .] It is inappropriate to overstate the difficulties in the market and potential impacts to the financial sector,” Zhang added.

The problem is that if “peak China” becomes a reality, it will have a considerable impact on the South Korean economy as well.

Korea’s exports to China have declined for eight months in a row, and Korea’s monthly trade deficit with China in January (US$3.94 billion) was the biggest on record. If China’s economic rebound this year is brief, the slump in Korean exports to China is likely to become entrenched.

David Lubin, managing director and head of emerging market economics at Citi, recently wrote in the Financial Times that China’s economic recovery will have a smaller impact on the world economy than previous recoveries. China is less able to expand investment and stimulate the economy with aggressive monetary and fiscal policy as it has in the past because of rising government debt and fears about a capital drain, Lubin argued.

By Park Jong-o, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

Most viewed articles

- 1[Column] Why Korea’s hard right is fated to lose

- 2Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 3[Column] The state is back — but is it in business?

- 4[Column] Life on our Trisolaris

- 5AI is catching up with humans at a ‘shocking’ rate

- 6[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 7[Column] Can Yoon steer diplomacy with Russia, China back on track?

- 860% of young Koreans see no need to have kids after marriage

- 9[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 10[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press