hankyoreh

Links to other country sites 다른 나라 사이트 링크

New US regulations allow narrow leeway for Korean chipmakers active in China

The US government has put forth guidelines that will require Samsung Electronics and SK Hynix to limit their expansion of high-tech semiconductor production in China over the next decade to 5% if they receive subsidies for investing in the US. That plan would spare the two companies from having to close Chinese factories that cost tens of billions of dollars to build and would allow some technical upgrades to those factories, which means Korean chipmakers have avoided the worst possible outcome.

But Samsung and SK’s operations in China still face numerous obstacles, with the US expected to impose tougher controls on exports of high-tech semiconductor equipment and technology to China. Given the requirements for competing in the semiconductor market, where technology is always in flux, Samsung and SK will have to choose between sticking with the status quo or pulling out of the market if they can’t bring the latest production equipment to their semiconductor plants in China.

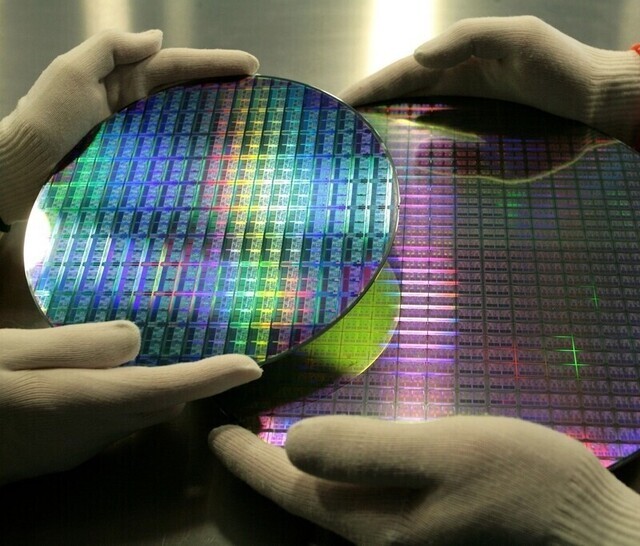

The detailed guardrails for the CHIPS and Science Act that were published on Monday by the US Commerce Department allow companies that have received semiconductor subsidies from the US government to increase production capacity at high-tech semiconductor factories in China within a range of 5%. They also allow companies to place more semiconductor chips on wafers (slices of a semiconductor like silicon) as part of technological development.

That means that chipmakers can invest in upgrading semiconductor factories or building new ones to a certain extent.

While the guardrails allow up to 10% expansion of legacy semiconductor production, the chips made by Korean companies in China are cutting-edge products whose technological specifications exceed those of the legacy semiconductors outlined by the US Commerce Department.

The CHIPS and Science Act bans subsidy recipients from substantially expanding their semiconductor production capacity in China over the next 10 years, but the Commerce Department interpreted that as referring to monthly production of wafers or chip packages.

The Commerce Department said it would permit technological upgrades as long as production capacity doesn’t increase by more than 5%. The department also indicated it would not regard an increase in chip capacity per wafer resulting from technological development as an expansion of production capacity.

That’s good news for Korean chipmakers, since a ban on that type of capacity expansion was the nightmare scenario.

The biggest challenge facing the Korean government and chipmakers is the US’ controls on exports to China. The US Commerce Department effectively banned exports of cutting-edge semiconductor production equipment to China in October 2022, but deferred the implementation of the measure by one year for Samsung and SK, both foreign companies with production facilities in China.

Chipmakers hope to get an extension on that deferment, which is set to end this October. In regard to the possibility of such an extension, US Under Secretary of Commerce Alan Estevez remarked last month that the department will likely cap the technological level of semiconductors that companies are allowed to produce.

Foreign media outlets have reported that the US plans to nearly double the types of high-tech semiconductor equipment covered by the China export ban from the current number of 17 in consultation with the Netherlands and Japan, which are both leading producers of semiconductor equipment. That’s the reason for the high degree of uncertainty in the Korean semiconductor industry about whether it will be possible to transition to cutting-edge assembly lines in Chinese factories.

“The key to technological upgrades is not merely yield improvement but also the introduction of cutting-edge semiconductor equipment, and that issue hasn’t been resolved yet,” said Kim Yang-paeng, an analyst at the Korea Institute for Industrial Economics and Trade.

If Korean companies also end up being subject to strict controls on exports to China, that would amount to “opening the front door while locking the back door,” said a source in the industry.

A transition to new manufacturing processes is critical for Samsung and SK because the products they’re currently making in China will gradually lose ground to newer products, driving down consumer demand. Without such a transition, they’ll lose their technological advantage over Chinese competitors and find it harder to sell products.

By Kim Hoe-seung, senior staff writer; Lee Bon-young, Washington correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1AI is catching up with humans at a ‘shocking’ rate

- 2The dream K-drama boyfriend stealing hearts and screens in Japan

- 3‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 4[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 5Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 6Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 7[Column] Can we finally put to bed the theory that Sewol ferry crashed into a submarine?

- 8S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 9Doubts remain over whether Yoon will get his money out of trip to Japan

- 10Up-and-coming Indonesian group StarBe spills what it learned during K-pop training in Seoul