hankyoreh

Links to other country sites 다른 나라 사이트 링크

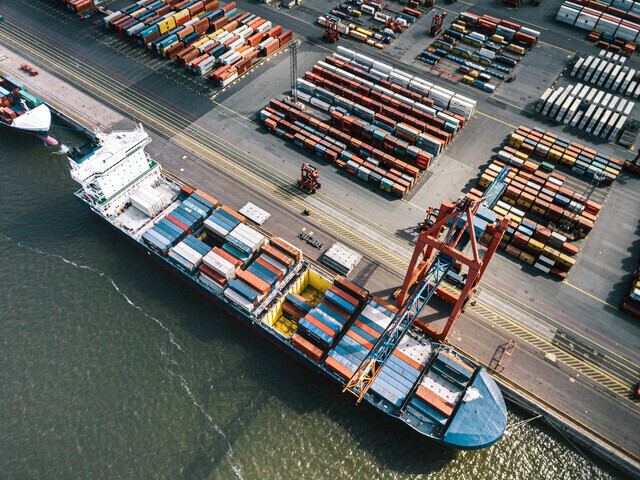

After 20 years, top importer of Korean exports is shifting from China to US

South Korea’s exports, which have long served as the engine driving the country’s economy, are facing structural challenges.

According to analysts, the recent decline in exports and the accumulation of trade deficits go beyond a simple economic downturn or a slump for certain items but are the result of changes in the global trade environment that have been ongoing for many years.

This means that the prolonged trade dispute between the US and China, clear changes in the supply chain resulting from the COVID-19 pandemic, and the appearance of blocs in the global economy are all affecting South Korean exports.

These structural changes are what are leading to South Korea’s No. 1 export market showing signs of shifting from China, which has held the top spot for the past 20 years, to the US.

According to experts, the current situation differs from past export downturns and recovery periods, which usually averaged 12 months, and that it is difficult to foresee a recovery path for the export sector in the future. The conclusion is that South Korea needs to make a major change in its export strategy.

Proportion of exports to China is 19.5%, back to 2004 levelsAccording to trade statistics from the government and the Korea International Trade Association (KITA) published on Wednesday, South Korea’s share of total exports (based on monetary value) to China from January to March this year totaled 19.5%. Although it is just the first quarter, this marks the first time since 2005 that the share of exports to China has fallen below 20%.

The total share of exports to China last year stood at 22.8%. This was largely due to a major decrease in semiconductor exports as a result of a sharp drop in DRAM prices since early last year.

For the past three years, among total exports to China, semiconductors have made up around 30%.

The turning point came in 2018. Back in 2000, exports to China made up only 10.7% of Korea’s overall exports, a proportion which then rose thanks to an export boom of intermediate goods to 21.3% in 2005 after China joined the World Trade Organization (WTO) in late 2001. The figure then rose to 26.8% in 2018.

However, as the US-China trade conflict, which touched off in the fall of 2018, expanded to high-tech sectors such as semiconductors, telecommunications, and secondary batteries, the proportion of South Korean exports to China has decreased by around 7.3 points in the past five years. In fact, the current total share of Korean exports to China is similar to that of 2004 (19.6%).

Meanwhile, the share of South Korean products in China\'s total import market was 7.5% as of 2022, the lowest since 2001. Although South Korea ranked first in the Chinese import market for eight years from 2013 to 2020, beating Japan, it has remained in second place for the past two consecutive years behind Taiwan.

It’s also worth noting that the average decline in the share of South Korean products in China’s import market over the past three years has declined more (1.9 points) than US products have (1.3 points). This is despite the ongoing trade war between the two countries.

This is yet more evidence that structural changes had already taken place in exports to the Chinese market even before August of last year, when year-over-year negative exports were recorded.

According to a recent report by the Korea Center for International Finance, the coupling of South Korean and Chinese exports has significantly weakened since China began promoting its “Made in China 2025” strategy in 2015.

“South Korea-China exports have already changed from a complementary relationship to a competitive one,” the report read.

This means that factors such as China’s technological advancement, its shift to a domestic demand-oriented growth structure, and deepening fragmentation of the global supply chain are bringing about these changes.

In fact, the margin of increase of China’s import volume has clearly declined since 2019.

Last year, China’s import growth rate (1.1% y-o-y) was the lowest among the world\'s top five trading powers (China, the US, Germany, the Netherlands and Japan).

What’s more, China’s global value chain backward linkage index, which shows the share of imports based on intermediate goods, plunged from 22.4 in 2007 to 16.5 in 2018 and 2019, and then declined further to 15.1 in 2020.

In other words, exporting mainly intermediate goods to China has now become a weakness.

Double-edged sword of increasing dependence on exports to the USSouth Korean exports to the US are helping fill the vacuum left by declining exports to China.

From January to March this year, South Korean exports to the US rose to 17.7%, reaching the same level as 20 years ago, in 2003. Among the top 10 countries to which Korea exports, the US is the only one to which exports have continuously increased over the past five years.

If the decline in semiconductor exports continues until the second half of this year and automobile exports continue to do well in the US market, it is possible that South Korean exports to the US could overtake those to China for the first time in 20 years.

In 2005, the share of South Korean exports to the US plummeted to 14.5% from 21.8% in 2000. The figure further declined to 10.1% in 2011.

But increasing the share of exports to the US is a double-edged sword. The US is a market where products (mainly final goods) from around the world, including from South Korea, Japan, Taiwan, Vietnam, and Malaysia, compete fiercely.

According to the recent KITA report, South Korean exports to the US are highly concentrated on specific items. “The export competition structure in the US market has a large ripple effect on our exports,” the report stated.

In this context, China, which is showing a strong rise in the US market, poses a great burden to South Korea. That is to say, China, armed with more advanced technology, is emerging as a strong competitor to South Korea in the US market.

In fact, China recorded a trade surplus last year in high-tech products and automobile trade, which had long been in a chronic deficit. South Korea\'s main exports to the US are automobiles (19.7% of total as of 2021), automobile parts (7.2%), semiconductors (9.4%), and computers (5.7%).

“China’s pursuit of technology in shipbuilding, steel, and semiconductors has been intense since before the US-China trade dispute of 2018, but, after that, the changed trade environment due to the US-China strategic competition and supply chain restructuring in the wake of COVID-19 has restricted China’s pursuit [of advanced technology], which has helped Korean exports buy time,” says Jeong Dae-hee, the director of the Korea Development Institute’s Office of Global Economy.

This means that changes in the Chinese and US shares of South Korean exports appeared rather late.

“Since China’s trade is undergoing structural changes, it is inevitable that Korea’s export strategy will also undergo major changes,” says Jang Sang-sik, head of trend analysis at KITA.

By Cho Kye-won, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

Most viewed articles

- 1Months and months of overdue wages are pushing migrant workers in Korea into debt

- 2At heart of West’s handwringing over Chinese ‘overcapacity,’ a battle to lead key future industries

- 3[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 4Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 5Under conservative chief, Korea’s TRC brands teenage wartime massacre victims as traitors

- 6Fruitless Yoon-Lee summit inflames partisan tensions in Korea

- 7[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 8[Column] For K-pop idols, is all love forbidden love?

- 9[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 10[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes