hankyoreh

Links to other country sites 다른 나라 사이트 링크

Apple’s move into India’s smartphone market sounds alarm for Samsung

Apple is making a full-scale entry into the rapidly growing Indian market that has been buoyed by the global move away from China, leading to dark clouds on the horizon for Samsung Electronics, the current front-runner in the Indian smartphone market.

Apple’s targeting of the local market is accelerating with the opening of the company’s first Apple store in India last month and the purchase of a large factory site in India by Foxconn, the Taiwanese firm that produces Apple products including the iPhone.

A series of reports from AFP and other international outlets on Wednesday stated that Foxconn, which is responsible for up to 70% of iPhone production, had recently bought up 120,000 square meters of land on the outskirts of Bengaluru.

Foxconn has invested some US$700 million in this endeavor since the start of the year, solidifying the plan to build a large-scale iPhone component factory near the Bengaluru International Airport, where a cluster of high-tech research institutes is located. Although Foxconn has been running an iPhone factory in the southern Indian state of Tamil Nadu since 2019, this facility only accounts for around 5% of total production.

The background of Apple’s partners seeking to enter India is part of the “China plus one” strategy of securing additional production bases outside of China. The US government has imposed sanctions on China including tariffs on Chinese-made products in the wake of rising bilateral tensions, and trade hitches with China caused by the COVID-19 pandemic have further accelerated this trend.

Apple’s revenue was dealt a blow last year when the company reduced the production volume of the iPhone 14 at the Foxconn factory in Zhengzhou, the largest iPhone production facility in the world, over the spread of COVID-19 and labor protests.

Apple is also working hard to win over the Indian market, with CEO Tim Cook personally visiting the first Apple store to open in Mumbai on April 18. Cook even met with Indian Prime Minister Narendra Modi to convey that Apple is “committed to growing and investing across the country.”

After the March earnings announcement, Cook stated the company had “set a quarterly record” in India and registered “very strong double digits year-over-year.” India’s Ministry of Commerce and Industry also believes the proportion of iPhones produced in India could reach as high as 25% by 2025, and plans to provide support such as tax benefits.

The reason behind Apple’s advance in India is the potential that lies in the country’s smartphone market. Although India is projected to surpass China to become the most populous nation in the world this year, India’s smartphone penetration rate stands at just 54%. A survey by market research firm Counterpoint found that India’s smartphone market lags behind that of China, with 152 million to China’s 286 million in terms of units shipped. By 2027, the figure for India is set to reach 253 million units.

This is cause for concern at Samsung Electronics.

In July 2018, Samsung completed a new smartphone factory in the Noida region of India at a cost of 800 billion won (US$605 million). The company is touting India as a market to replace China and has been ramping up local marketing alongside the construction of the new Noida production facility.

Starting from the new Galaxy S23 model set to be released in the second half of this year, products for sale in India will be produced at the Noida factory. This move is aimed at gaining a preemptive advantage in the premium smartphone market.

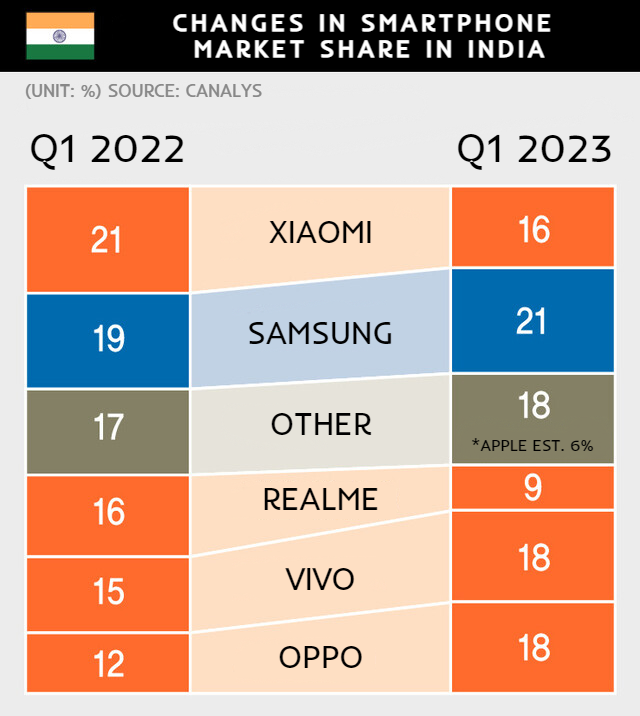

According to market research firm Canalys, Samsung held the lion’s share of the Indian smartphone market with 21% in the first quarter of this year. But Chinese brands such as Xiaomi, Vivo and Oppo that compete at lower prices are right on Samsung’s tail. The market share of the iPhone is believed to be approximately 6%.

By Ock Kee-won, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence![[Editorial] Yoon must stop abusing authority to shield himself from investigation [Editorial] Yoon must stop abusing authority to shield himself from investigation](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/4417158464854198.jpg) [Editorial] Yoon must stop abusing authority to shield himself from investigation

[Editorial] Yoon must stop abusing authority to shield himself from investigation- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

- [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

Most viewed articles

- 1China calls US tariffs ‘madness,’ warns of full-on trade conflict

- 2[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 3[Editorial] Yoon must stop abusing authority to shield himself from investigation

- 4[Column] When ‘fairness’ means hate and violence

- 5[Column] How to win back readers who’ve turned to YouTube for news

- 6US has always pulled troops from Korea unilaterally — is Yoon prepared for it to happen again?

- 7[Book review] Who said Asians can’t make some good trouble?

- 8Naver’s union calls for action from government over possible Japanese buyout of Line

- 9Could Korea’s Naver lose control of Line to Japan?

- 10[Editorial] Korea must respond firmly to Japan’s attempt to usurp Line